Category: Travel Agency Agents

Cash When You Need it by Not Holding Funds

In our second installment, we talked about NTC’s newest solution, NTC ePay. This third and final reason in this series will go over how NTC keeps your cash flow going.

Due to the history of travel businesses, many travel agencies are given a travel merchant account with monthly credit card processing volume caps. This means merchants are only permitted to handle a specific number of credit card transactions per month. Once that limit amount is reached, the merchant can no longer take credit cards for purchases that month. This keeps a business, especially an e-commerce merchant that relies on credit card payments, from operating effectively.

Imagine the impact on your travel agency when you no longer have to worry about having your cash flow stopped. We work very hard to eliminate holds and reserves on all our travel accounts.

Now imagine you getting approved for large volume.

You will agree that those two factors will have a huge positive impact on your business growth.

Most merchant providers usually hold funds from travel agents, because historical data shows that consumers are much more likely to dispute and chargeback travel agency transactions because of a change in their travel plans.

You may be wondering, why do we not hold your funds?

Well simply said, because we understand your business. NTC has been doing business with travel professionals like you for over 20 years and we understand that holding funds creates a huge hassle for your operation. We understand that cash flow is essential to your continued success.

With NTC travel agents can feel confident that they will maintain cash flow to help their business operate smoothly and efficiently without interruptions.

Why do travel merchants flag large transactions?

Many travel merchants many times run thousands of dollars worth of transactions and their processor tells them they’re going to simply hold the transaction and not pay the merchant.

We understand how critical it is to have funds available because many agents have shared how with other merchant providers, their cash flow has come to a complete halt at times.

Remember that when you choose a travel payment processor, you must be sure to choose one with experience in working with travel agencies like NTC.

At NTC, we assist you in developing and implementing your fraud prevention procedures, so that you can be proactive in identifying and correcting potential weak spots in your processing cycle.

Over these past three blog articles, we have shared the three main reasons why travel agents like you prefer National Transaction Corporation. Now we want to hear from you as to which of these three reasons is most important for your travel agency business. We’d love to read your comments below.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Merchant Services Account, nationaltransaction.com, Travel Agency Agents Tagged with: credit cards, e-commerce, electronic payment, merchant account, travel

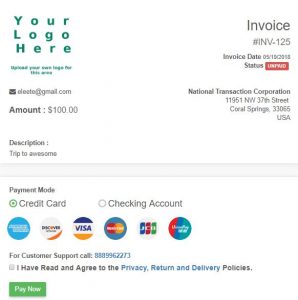

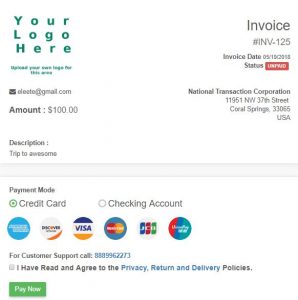

Travel Agents prefer NTC ePay because they get paid faster with their very own “Buy Now” button or simply by requesting payments by email!

Last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTC ePay helps your travel agency.

Last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTC ePay helps your travel agency.

NTC ePay offers travel agents the most innovative technology because it is fast, mobile friendly and easy to use.

Whether you use Quickbooks, Peachtree or any other accounting application, you can enter the invoice number into the ePay application for reconciliation, and you can customize your pricing to any amount you choose. Your agency can create invoice and payment links that can be posted to your website or any social media website for payment.

Don’t you like it when everything seems to work together, making your day a lot easier? Technology is something that can get your daily workflow to go smoothly, and NTC ePay works for you. If you need a customized solution to go with your workflow, NTC can make most anything a reality for your business workflow.

National Transaction Corporation is one of the few travel payment processing companies that can directly integrate with both TRAMS and SABRE. You can perform your bookings like you always have but have the payment flow the way you need it to. We also integrate with many booking engines and shopping carts allowing you many options that are not available by host agencies.

NTC ePay is simple, secure and sets up in just minutes. It’s a web application, so you can use it on any device you already own: your desktop, laptop, tablet or phone. It lets you add inventory items or use the quick send feature for simplified invoicing.

Our ePay product was designed from the ground up with your security in mind. Even though we encrypt data back and forth to the payment gateway, we also use the gateway to handle the cardholder’s input. NTC’s cutting-edge technology doesn’t store credit card data, nor does it transmit that data. What that means to you is that the liability is 100% on the bank and not you – the merchant – as is typically the case. The application is written and hosted on our own servers, so you can set up and be in the ecommerce business within minutes.

By the way, there are also many customizations available to you with NTC ePay which can be set up very easily by your users. Inquire with your specific process and we will meet your specific needs in the travel payment scope.

Now when you run a social media campaign you can leverage our NTC ePay technology to help you increase sales. Use our ePay links to post vacation packages or special sales and have customers pay by two clicks.

Next week we will share the third reason in this series why National Transaction Corporation is the preferred choice for travel agents like you.

Remember, when you need a safe and technologically advanced gateway to manage all your travel agency payments, look no further than NTC.

Feel free to call us now at 888-996-2273, if you are ready to start using NTC ePay today.

Posted in Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, nationaltransaction.com, Travel Agency Agents Tagged with: card-not-present, credit card, customers, e-commerce, electronic payment, merchant account, Mobile Payments, payments, Security, transactions, travel

Mark Fravel is the Founder and CEO of National Transaction Corporation. Founded in 1997, NTC has over 20 years of transaction processing experience, specializing in card not present and e-commerce solutions for the hospitality, tourism and medical industries, charitable institutions and franchises. NTC is an electronic payment expert, currently serving over 4,000 merchant accounts across Canada and the US.

He will be speaking at the ASTA Convention in Washington D.C. on Thursday August 23rd about PCI Compliance in regards to Travel Credit Card Processing.

For more information visit ASTA’s Global Convention Site.

ASTA is the American Society of Travel Agents

Mark Fravel, CEO of National Transaction.

Posted in Credit card Processing, Travel Agency Agents

Over the next three weeks we will explore on this blog some of the reasons why National Transaction Corporation is the preferred choice for travel agents.

The Travel industry is one of the world’s largest industries with a global economic contribution of over 7.6 trillion U.S. dollars in 2016. (Statista)

At NTC we recognize that travel agency payment processing has some unique hurdles to overcome, but we are leveraging our innovation because we want our travel agency partners to explore how our solutions transcend the challenges that travel agents face.

Secure processing is one of the reasons why National Transaction is the preferred choice for travel agents

National Transaction Corporation has Secure Merchant Payment Processing – Because when your customers know their data is safe, they keep coming back!

You’ve heard of the many data breaches within major corporations that have occurred in just the last few years, when customers’ confidential credit card information is stolen and businesses lose a small fortune in repairing the problem. The cost of such a security breach goes far beyond that, however; once a business has lost the trust of its customers, 60% of those cardholders will go elsewhere for their purchases and services, according to studies on the problem.

Imagine if this happened to your travel agency merchant account? It could be disastrous, especially because agencies tend to deal with high-dollar sales from a moderately-sized pool of customers – so every client counts.

NTC knows that you, like us, care about your customers, and we want your travel agency to be seen as a trustworthy place to book a dream vacation. The first step is for your business to be PCI-DSS compliant.

PCI-DSS (Payment Card Industry-Digital Security Standards) requirements were put in place by the credit card associations to deal with the increasing problem of identity theft and data loss. The requirements vary according to the types and the number of payment transactions your agency goes through, but you can be sure that NTC will help you stay compliant with the latest security standards.

In the event of a data breach, we are here to eliminate the negative impact it can have on your company. NTC may be able to help you with the fines, assessments, and other costs from the networks, and we will consult with you on how to proceed to protect your agency and your reputation.

As you know, data security is as much a concern for the business owner as it is for the cardholder – your customer. When your clients know that their data is safe with you, they will keep coming back to your agency to book their next great trip!

If you cannot wait to read blog number two out of this three part series, feel free to call NTC now at 888-996-2273 to find out the best options for your travel agency!

Posted in Credit card Processing, Credit Card Security, Travel Agency Agents Tagged with: cardholder, data, fraud, merchant account, payments, Security, transaction, travel, visa

May 15th, 2017 by Elma Jane

Process Your Travel Agency Payments For Less. Get 100% Funding The Next Day!

Call now 888-996-2273 or sign up here NationalTransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchant, payments, travel, travel agency

March 20th, 2017 by Elma Jane

Process Your Travel Agency Payments For Less. Get 100% Funding The Next Day!

Call now 888-996-2273 or Sign Up now!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: payments, travel agency

March 10th, 2017 by Elma Jane

Qualified vs Non-Qualified credit card rates

The most common forms of rate structures for credit card rates are:

2-Tiered: Qualified and Non-Qualified

3-Tiered: Qualified, Mid-qualified, or Non-qualified

Each and every transaction you accept is classified into one of the above and is the basis for the credit card rate you see on your statement.

As a general rule, qualified transactions are going to be “standard” cards; without any consumer or corporate rewards associated with them. Accepted in the “standard” method expressed in your merchant processing agreement, this is where Card-Not-Present (CNP) setup comes into play.

Mid and Non-Qualified transactions include:

Rewards cards, keyed-in payments (for swipe accounts), AVS (Address Verification Service) does not match or is not performed, not all required fields are entered, or the payment was entered in a late batch. Ex. the payment was sent to the processor 48 hours or more past the time of the authorization.

Posted in Best Practices for Merchants, Travel Agency Agents

March 1st, 2017 by Elma Jane

ELECTRONIC PAYMENTS

When it comes to electronic payments, certain types of businesses are considered high risk.

Most merchants do not realize that electronic payment processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank.

Essentially, a merchant account is an unsecured loan.

Different factors used to determine when a business is a high risk are:

- Types of products

- Services they sell how

- How they sell them

Online transactions are considered high risk because there are increased risks of fraud.

A key factor used to determine the risk of a business is chargebacks.

Chargebacks include customer refunds and fraudulent transactions.

Payment providers assess this risk to determine the percentage of chargebacks your business is likely to experience.

Businesses that are considered high risk where they take advanced payments:

- Travel agencies

- Ticketing services

Electronic payments provider is necessary if you want to accept debit and credit card transactions.

For high-risk electronic payments please feel free to call us at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, credit card, debit, electronic payments, fraud, loan, merchant accounts, merchants, online, payment processors, transactions, travel agencies

February 21st, 2017 by Elma Jane

The Travel Payment Expert

No Setup or Cancellation Fees

100% Next day Funding

Lowest price Guarantee

24/7 US Based Support

#1 Preferred Payment Processor among Travel Associations

NTC ePay, our exclusive electronic invoicing platform. (Email customers invoices and get paid even faster, eliminating paperwork and saving time).

For Electronic Payment Setup or FREE Rate review, call us now 888-996-2273

or visit www.nationaltransaction.com/travel/ and use our contact form.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: Electronic invoicing, electronic payment, payment, processor, travel

January 19th, 2017 by Elma Jane

Card-Present vs Card-Not-Present – It’s important for a merchant to know what types of credit card payments their business will be taking.

If you rely on mailed, over-the-phone, or online payments a Card-Not-Present merchant account is what you need.

With this type of account, you don’t need the physical card. You are set up to accept credit cards where card information is being keyed into a credit card terminal or online.

A card-not-present merchant accounts base rate is higher than if you signed up for a Card-Present or swipe merchant account.

Why are card-not-present rates higher? There is less risk associated with a business swiping a credit card than keying it in. Why? When a card is swiped, a person is present; where the merchant can check ID and signature. When a person is not present, it’s open for consumer fraud.

However, when you’re setting up a Card-Not-Present merchant account, these factors are taken into consideration during the underwriting process, which leads to a lower base rate for keyed-in payments

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card present, card-not-present, credit card, merchant, online, payments, terminal