November 1st, 2018 by Admin

We are officially 55 days until Christmas, time to take all of the tricks out of your hat to promote your business. Since we know you will be using social media, here are 30 random holidays you can use to promote your business with their Hashtag.

November 1st:

#ExtraMileDay: Show your customers how you will go the extra mile for them.

November 2nd

#LoveYourLawyerDay: Need we say more? This one is perfect for lawyers or anyone working with them.

#FountainPenDay: If you sell promotional items, this one is for you. It can also work if you want to post the latest contract signed.

#SandwichDay: Even if you don’t own a sandwich shop, Sandwich day can be used to share a more laid back look of your company. Maybe sharing a picture of your last company picnic or lunch will do. Remember to have a good looking picture!

First Sunday of November

#ZeroTaskingDay If you work for a spa or anything that promotes relaxation, this one would be a good one for you!

November 5th

#LoveYourRedHairDay Hairdressers, time to get those finished looks and share them on social media!

#NachosDay Any day is a good day for Nachos, but on Nachos day you can show some humor as a way to connect to your customers. This one is great for restaurants.

November 8th

Guinness World Record Day: #GWRDay: Sharing a fun fact comes a long way in Social Media. Sharing a Guinness World Record that might relate to your industry can attract a new crowd online.

#CappuccinoDay: People love coffee, (search #CoffeeLover, and you’ll see) so why not share Cappuccino Day with your coffee loving crowd. Perfect for the coffee shop owner to the savvy consultant on the go.

November 10th

#SesameStreetDay: If you are in an industry that deals with children, this one is for you. Make the posts funny or just cute but remember you are targeting the parents at the end. Nostalgic posts work well too with this.

#VanillaCupcakeDay: Cupcake lovers beware, this hashtag might be for you. Perfect for the bakery owner and the all-time cupcake lover, there is no need to be a pastry chef to use this one.

November 11th

#origamiday This one might require some skill and imagination, but it can delight your online community and attract them more to what you do. If you use this one, be sure to send us a picture.

#SundaeDay Who doesn’t love Ice Cream Sundaes!

November 12th

#HappyHourDay Geared more for restaurants and bars, but with a bit of creativity, many can use this hashtag.

November 13th

#KindnessDay Show your kindness to others.

November 15th

#AmericaRecyclesDay We all need to take care for our planet. Show your support by sharing this with some facts and information about recycling.

November 18th

#PrincessDay: Pamper the princesses in your business or show appreciation of your customer.

#MickeyMouseDay Need we say more?

November 19th

International Men’s Day #MensDay: Men’s day is great to share information about current men’s health issues. Perfect for those in the healthcare industry

#PlayMonopolyDay: This one we feel is perfect for finance. “Don’t get caught in monopoly games and get your money safe” what do you think?

November 20th

#EntrepreneursDay Completely self-explanatory.

#NameYourPCDay Give some love to those PC users in your industry and have fun too.

November 21st

#HelloDay A great hashtag to introduce yourself and the team.

November 22nd

#GoForARideDay Whether it is a ride on a car or bike ride, many can use this hashtag if you are creative enough.

November 23rd

#FlossingDay perfect for those in the dental industry.

#EspressoDay Just like #CapuccinoDay, this hashtag can help greatly any account.

November 25th

#ShoppingReminderDay If you sell goods, this one is for you.

November 30th

#ComputerSecurityDay Technology always changes, this one can be an excellent reminder to keep online info safe.

All Month Long:

#PeanutButterLoversMonth When you ran out of ideas or inspiration this month, this hashtag can be a lifesaver. Remember that social media should entertain or educate and this one can help with that.

Bonus Holidays:

These might not be random but are always useful to add.

#Movember

#ThanksGiving

#CyberMonday

We hope these hashtags can help boost your business online presence and bring a little more creativity to your social media game. As always, have fun and use your to see if any of these can help your business.

Posted in Small Business Improvement Tagged with: account, business, capuccino, christmass, coffee, consumers, credit card, customer, customers, data, disney, e-commerce, Facebook, finance, fun, hairdressers, hashtags, holidays, Instagram, lawyers, merchants, payments, photography, restautrant, retail, Security, social media, transactions, twiter

August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

May 27th, 2016 by Elma Jane

Refunds – transfers funds from your merchant account to the customer’s account.

Refunds are always associated with a transaction that has settled.

A settled transaction – is funds that have already transferred from the customer to the merchant. You can only refund a transaction with a Settling or Settled status.

The refunded transaction goes through the typical settlement process. As the refund settles, the funds are sent back to the customer’s bank account. It is normal for your customer to experience a delay because the customer’s bank may take a couple of days to deposit these funds.

Voids – will cancel the transfer of funds from the customer to the merchant and can be issued if the transaction is either Submitted for Settlement or Authorized. The original authorization should disappear from the customer’s statement within 24 to 48 hours.

Posted in Best Practices for Merchants Tagged with: account, bank, customer, funds, merchant, merchant account, refunds, transaction

April 20th, 2016 by Elma Jane

ECS: An Electronic Mode Of Funds Transfer From One Bank Account To Another

- Paper check conversion

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- Image

ACH E-CHECK: Uses Bank Routing and Account Number In a CNP Environment.

- Card-Not-Present e-Processing of ACH Debit

- Known Relationship B/Consumer and Business

- NOT for Ecommerce “Sale of Goods and Services”

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- No Image

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: account, ACS, bank, card-not-present, cnp, consumer, debit, ecommerce, ECS, merchant, risk, services

April 19th, 2016 by Elma Jane

Electronic Benefit Transfer (EBT) is an electronic system that allows a recipient to authorize a transfer of their government benefits from a Federal account to a retailer account to pay for products received. Very much similar to purchasing something using a credit card.

Posted in Best Practices for Merchants Tagged with: account, credit card, EBT, electronic, Electronic Benefit Transfer

March 4th, 2016 by Elma Jane

A number of financial institutions are beginning to implement biometric authentication. They started to replace traditional knowledge-based passwords with biometric authentication.

A British multinational banking is introducing biometric tests for its customers in U.K., letting account holders access online banking using their fingerprint or voice. If you’re using phone-banking services you can register your voiceprint with the company instead of using a regular password. A special voice biometrics technology will analyze a customer’s voice when they call the bank.

Customers using Apple’s Touch ID will be able to access their accounts on their mobile phones using their fingerprint.

Customers in the U.S., Canada, Mexico, Hong Kong, and France will have the technology by the end of the year. Other markets will follow in 2017 and 2018. The British multinational banking and financial services company have nearly 50 million retail banking customers around the world.

Posted in Best Practices for Merchants, Financial Services Tagged with: account, bank, banking, biometric, customers, financial, financial institutions, financial services, mobile, online, retail

January 26th, 2016 by Elma Jane

The convenience, simplicity and security of Apple Pay are now available to customers who use U.S. Bank FlexPerks American Express Cards.

U.S. Bank which is the fifth-largest bank in the nation will add TouchID biometric capabilities to its mobile app in March.

The company made the disclosure as part of a notable iOS app update released last Friday. Release appears to include, among other enhancements, improvements such as easier navigation, quicker accessibility to account information, and the ability to search transactions from previous months.

U.S. Bank Minneapolis did not give many details about how TouchID will be used within its iOS app, other than to say for fingerprint authentication for enabled devices.

Many major banks already have TouchID implemented in their mobile apps, including Citibank, Wells Fargo and Bank of America. Citibank, for example, implemented TouchID last July. Apple introduced TouchID in mid-2013.

Last week, U.S. Bank enabled for Apple Pay use the last of its debit and credit cards that had not been Apple Pay-capable. Apple Pay relies on TouchID for security and authentication.

Apple Pay is now available with the:

- U.S. Bank FlexPerks Reserve American Express Card.

- U.S. Bank FlexPerks Travel Rewards American Express Card.

- U.S. Bank FlexPerks Select+ American Express Card.

Posted in Best Practices for Merchants Tagged with: account, bank, biometric, cards, credit cards, customers, debit, mobile, mobile app, Security, transactions

January 21st, 2016 by Elma Jane

Merchant accounts are as varied as the merchants themselves and the goods being sold.

What kind of account would you fall under:

High Risk Merchant Accounts – Finding a processor who is willing to take your account can be more challenging. High risk merchants range from travel agencies to multi-level marketing companies, credit restoration merchants, casinos, online pharmaceutical companies, adult/dating merchants and many other.

Internet based merchant account (Ecommerce/Website order processing) – E-Commerce is a booming market, with so many people buying and selling goods online due to the wide reach and easy access to the internet.

Mobile or Wireless merchant account – This merchant is specifically designed for small businesses, solo professionals, and mobile services (including lawyers, landscapers, contractors, consultants, repair tradesmen, etc), who are constantly on the move and require a payment to processed on the spot.

MOTO (Mail or Telephone order) – This enables phone based or direct mail orders processing for customers who can buy your product or service from the comfort of their home. Since there is no card present there is no need for traditional equipment.

Multiple Merchant Accounts – Some businesses can have merchant accounts of a couple or all different types. Merchants who fall into this category are called multi-channel merchants as they sell their goods through a number of different channels. Most commonly this is related to retail stores who also have an online presence to sell their goods. This is very common in today’s competitive market where constant contact with customers is critical to success.

Traditional Account with Equipment – Most commonly used for retail businesses (grocery, departmental stores etc) where the transactions are processed in a face to face interaction also known as Point of Sale (PoS).

Interested to setup an account give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Travel Agency Agents Tagged with: account, card, card present, credit, customers, e-commerce, high risk merchant, internet, merchant accounts, merchants, mobile, mobile services, moto, multi-channel merchants, payment, point of sale, POS, processor, transactions, travel, travel agencies

May 12th, 2015 by Elma Jane

Our company’s goal is to make our customer happy. Our Merchant is very important with us. At National Transaction it’s all about our customer service. Yet many customers would rather than not contact a company for support, and this is especially true in the tech world. Customer finds the support experience as frustrating and time-wasting exercise.

We know this is true because we are customers ourselves. We’ve all felt that palpable sense of dread when we have to call a toll-free support number, expecting a massive, circular phone tree followed by a seemingly endless wait, and possibly a clueless rep when (if!) we finally do reach a human being.

It doesn’t have to be that way, at National Transaction we manage customer support delivery because we know we have an obligation to make it work. NTC’s teamwork-focused strategy and effective application of technology and data, can help our customer service do their jobs better.

How it works:

Apply lessons learned to continuously improve service – Some issues customers raise are a one-off, but many times, patterns emerge that can deliver insights on how the company could improve service for everyone.

It can be difficult for a single agent or manager to identify patterns, which is why a customer support platform with robust reporting capabilities is crucial to enable continuous service improvement.

In a crowded marketplace, excellence in customer support can be a key differentiator for a business. When customers reach out for support, they’re usually already stressed out about something that’s not working as expected. Far too often, their stress level increases while they’re attempting to get help, due to poorly designed business processes.

If your customers are stressed out, you can change that by taking a new approach. Make sure you know who they are when they reach out, and allow them to contact you on their own terms. Access your company’s collective expertise to quickly resolve the customer’s problems.

Be honest with the customer – A good customer support agent really does want to make things right for the customer, and that’s admirable. However, it’s important to avoid making commitments you can’t keep, which will serve only to increase the customer’s dissatisfaction in the long run.

Always be honest with your customers. If you can’t solve their problem immediately, give them an accurate time frame for a resolution, and let them know what steps you’re taking to address the issue. Record the commitment on a customer database so colleagues are up-to-date on your activities.

Be honest about what you can and cannot do, and take a look at the big picture, so you can improve service not only for the customer on the line but for everyone else.

Give customers multiple channels to access help – Customers have unique needs and individual preferences, Give them choices.

Know who your customers are – There are few among us who haven’t experienced the frustration of a poorly designed phone tree and the indignity of being shuffled from agent to agent and asked for our name, account number, product type and current service issue over and over again. Stop doing that to your customers.

Deploy a technology platform that incorporates a customer database with product and inventory information. That way, you’ll know who your customers are and what products they use when they call, and if you have to transfer them to another agent for help, the next agent will have that information too.

Use teamwork to solve customer issues – Chances are, someone in your company is capable of solving any problem a customer brings to the support team, but that person might not be on the phone. That’s why collaboration is so important.

There are software solutions that make collaborating across business units simple, and enable agents to view notes about past customer issues for clues to solving current problems. This not only helps your company solve the problem at hand, but also allows you to manage the entire relationship.

By following these steps, you can reduce your customers’ stress level and your own.

Posted in Best Practices for Merchants, nationaltransaction.com Tagged with: account, customer service, customer support, data, database, merchant, software, transaction

September 22nd, 2014 by Elma Jane

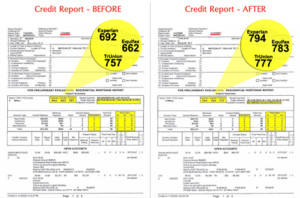

Consumers know how hard it is to obtain a credit card, if your credit score isn’t up to par. A bad credit score can prevent you from getting credit and make it hard to purchase your day to day necessities. People with poor credit don’t know their options. There are a number of ways to get a credit card if you have a poor credit score. There will likely be road blocks and limitations in your search. You won’t have the same options available as someone with pristine credit. But you will be able to get a line of credit if you look in the right place.

COSIGNED CREDIT CARDS If you get a cosigner, you will be able to obtain a card that would not be available to you otherwise. The cosigner has to have good credit, and they are responsible for your debt if you can’t pay. Make sure your cosigner fully recognizes their obligations and what will happen if you are unable to pay.

GIVE AN EXPLANATION FOR POOR CREDIT Explain the circumstances behind your poor credit. You can add a 100-word statement to your credit report such as the loss of a job. If you can tell your story and convince creditors you are on the road to increasing your credit score, they may believe you are more likely to pay back your debts. Divorce and illness are two other instances where individuals may see a drop in their credit score. Make sure whatever you list is true.

IMPROVE YOUR CREDIT One of the most difficult options. Poor credit can seem extremely hard to repair. But there are choices, it is just a process that will take a significant period of time. If you have poor credit, you can open bank accounts and pay off your loans and credit cards on time. If you pay off your debt in a timely manner, your credit score will improve over time and you will gain access to more credit card options.

RETAIL STORE CARDS Retail stores often have store credit cards they offer customers. Retail stores are generally more willing to approve applicants without a stellar credit score. But these cards usually come with extremely high interest rates and relatively low credit limits, so make sure you fully understand the terms of the card before applying.

SECURED CREDIT CARDS You deposit some money into an account, and then a creditor will provide you with a line of credit equal to your deposit. It is essentially a down payment, and if you don’t pay your credit card bill, your creditor is entitled to the money in the account. This might not sound like a favorable position, but remember that secured credit cards can be used as a valuable tool to rebuild your credit. Make sure the card you apply for reports to a credit reporting agency. This will help you start building a credit history. SELECT A CREDIT

CARD DESIGNED FOR THOSE WITH POOR CREDIT There are a number of credit cards offered by Visa and MasterCard designed for people with poor credit. These cards have low limits, a significant number of fees and high interest rates. But for some people, it may be their best option. Talk to your bank’s administrators or with your current credit card company to see if they offer a credit card that fits your personal needs.

SUBPRIME CREDIT CARDS Another option for those with poor credit, but they are ripe with fees that many people who are already short on cash may not be able to handle. Interest rates can be dangerously high for those with poor credit, so beware of these cards. They are often a last resort for individuals who need access to credit. However, like secured credit cards, they can be used to rebuild credit. Make sure you read the fine print and understand the applicable fees before you apply for a subprime credit card. Again, make sure the card reports to a credit reporting agency so you start building a credit history. Finding a line of credit doesn’t have to be a difficult endeavor. If you know what you are looking for, you can find a line of credit that fits your personal needs without breaking the bank. There are limitations, as well as pros and cons, to many of the forms of credit available to those with poor credit scores, such as secured credit cards or subprime credit cards. But those options do give people choices they otherwise may not have, and they help you build credit, so that eventually you will have a greater number of options.

Posted in Best Practices for Merchants Tagged with: account, applicants, card, consumers, COSIGNED CREDIT CARDS, credit, credit card bill, credit history, credit limits, credit report, credit score, credit-card, creditor, customers, deposit, down payment, good credit, interest rates, low credit limits, MasterCard, payment, poor credit, RETAIL STORE CARDS, retail stores, SECURED CREDIT CARDS, store credit cards, SUBPRIME CREDIT CARDS, visa, Visa and MasterCard