Travel Agents prefer NTC ePay because they get paid faster with their very own “Buy Now” button or simply by requesting payments by email!

Last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTC ePay helps your travel agency.

Last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTC ePay helps your travel agency.

NTC ePay offers travel agents the most innovative technology because it is fast, mobile friendly and easy to use.

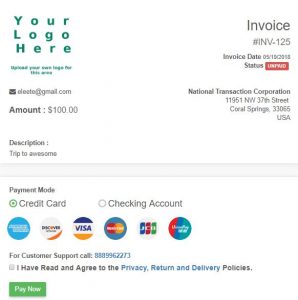

Whether you use Quickbooks, Peachtree or any other accounting application, you can enter the invoice number into the ePay application for reconciliation, and you can customize your pricing to any amount you choose. Your agency can create invoice and payment links that can be posted to your website or any social media website for payment.

Don’t you like it when everything seems to work together, making your day a lot easier? Technology is something that can get your daily workflow to go smoothly, and NTC ePay works for you. If you need a customized solution to go with your workflow, NTC can make most anything a reality for your business workflow.

National Transaction Corporation is one of the few travel payment processing companies that can directly integrate with both TRAMS and SABRE. You can perform your bookings like you always have but have the payment flow the way you need it to. We also integrate with many booking engines and shopping carts allowing you many options that are not available by host agencies.

NTC ePay is simple, secure and sets up in just minutes. It’s a web application, so you can use it on any device you already own: your desktop, laptop, tablet or phone. It lets you add inventory items or use the quick send feature for simplified invoicing.

Our ePay product was designed from the ground up with your security in mind. Even though we encrypt data back and forth to the payment gateway, we also use the gateway to handle the cardholder’s input. NTC’s cutting-edge technology doesn’t store credit card data, nor does it transmit that data. What that means to you is that the liability is 100% on the bank and not you – the merchant – as is typically the case. The application is written and hosted on our own servers, so you can set up and be in the ecommerce business within minutes.

By the way, there are also many customizations available to you with NTC ePay which can be set up very easily by your users. Inquire with your specific process and we will meet your specific needs in the travel payment scope.

Now when you run a social media campaign you can leverage our NTC ePay technology to help you increase sales. Use our ePay links to post vacation packages or special sales and have customers pay by two clicks.

Next week we will share the third reason in this series why National Transaction Corporation is the preferred choice for travel agents like you.

Remember, when you need a safe and technologically advanced gateway to manage all your travel agency payments, look no further than NTC.

Feel free to call us now at 888-996-2273, if you are ready to start using NTC ePay today.

Posted in Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, nationaltransaction.com, Travel Agency Agents Tagged with: card-not-present, credit card, customers, e-commerce, electronic payment, merchant account, Mobile Payments, payments, Security, transactions, travel

May 11th, 2017 by Elma Jane

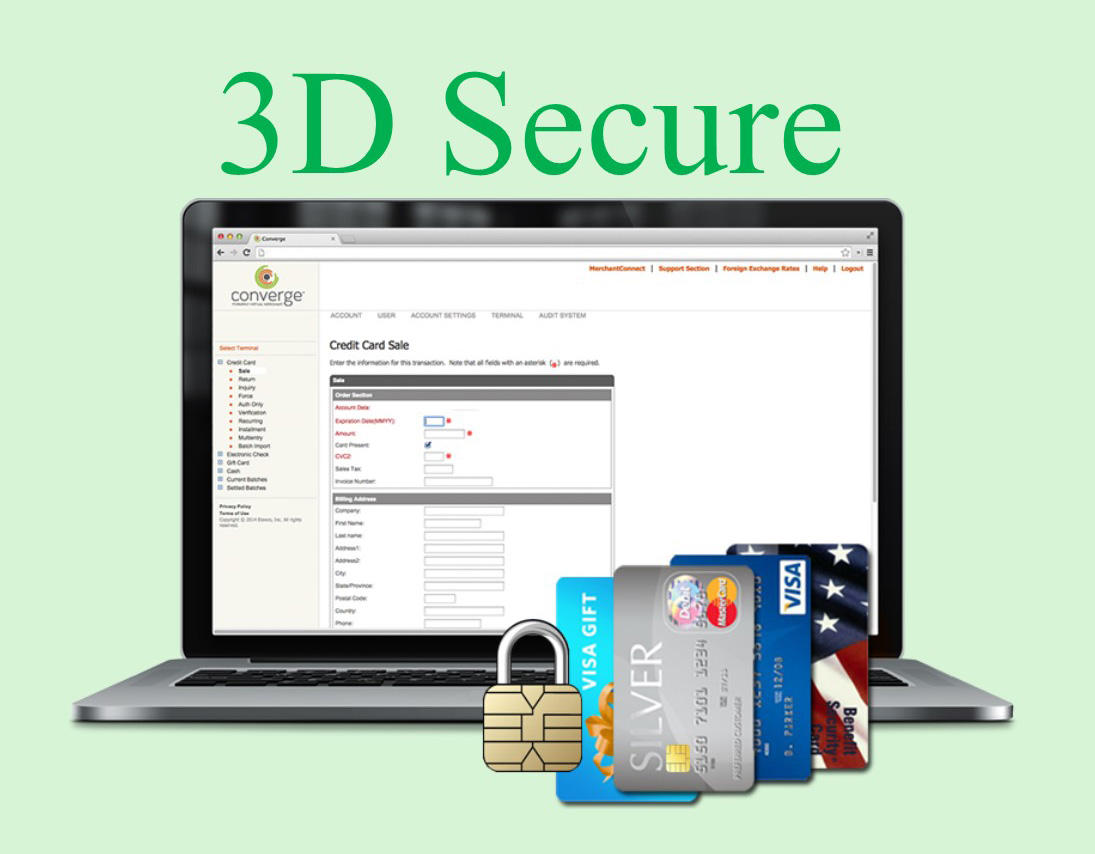

Three Domain Secure (3-D Secure)

Visa is announcing a global plan to support 3-D Secure 2.0 to help protect e-commerce transactions.

3-D Secure (3DS) – stands for Three-Domain Secure. A messaging protocol to enable consumers to authenticate themselves with their card issuer when making card-not-present (CNP) e-commerce purchases. 3DS is an additional security layer that will help prevent unauthorized CNP transactions and protects the merchant from CNP exposure to fraud.

The three domains consist of:

The merchant/acquirer domain

Issuer domain

the interoperability domain (payment systems)

The purpose of the 3DS protocol within the payments community is to facilitate the exchange of data between the merchant, cardholder and card issuer. The objective is to benefit each of these parties by providing the ability to authenticate cardholders during a CNP e-commerce purchase, reducing fraud.

Visa currently offers its 3-D Secure service through the Verified by Visa program, which supports the existing 3-D Secure 1.0 specifications for consumer authentication.

Visa anticipates that early adoption of 3-D Secure 2.0 will begin in the second half of 2017.

Merchants that authenticate transactions using 3-D Secure are generally protected from issuer card-not-present fraud-related chargeback claims,1 and this rule will extend to merchant-attempted 3-D Secure 2.0 transactions after 12 April 2019, the global program activation date.

For Electronic Payment Set Up go to NationalTransaction.Com or call now 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card, card-not-present, cnp, data, e-commerce, electronic payment, merchant, payment, Security, transactions

April 27th, 2017 by Elma Jane

Adding Tokenization Service

Important notes when adding tokenization:

– Tokens replace credit or gift card numbers.

– The terminal must be enabled to accept tokenization.

– Tokens are unique for each merchant, for example:

The same card will produce a different token for each merchant.

– Merchants with multiple terminals sharing tokenization domains will receive the same token for a unique card and the token can be used across their stores if they wish to do so.

– Merchants may supply the token in place of card information in any subsequent transaction.

– Tokenization is supported for both credit cards and gift cards.

Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions. This eliminates the possibility of having card data stolen because it no longer exists within your environment.

Tokens can be used in card not present environments such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments.

Tokens can reside on your POS/PMS or within your e-commerce infrastructure “at rest” and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions “in use”.

For Electronic Payment Set up with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit, e-commerce, electronic payment, encryption, gift Card, merchant, moto, POS, terminals, tokenization, tokens, transaction

April 10th, 2017 by Elma Jane

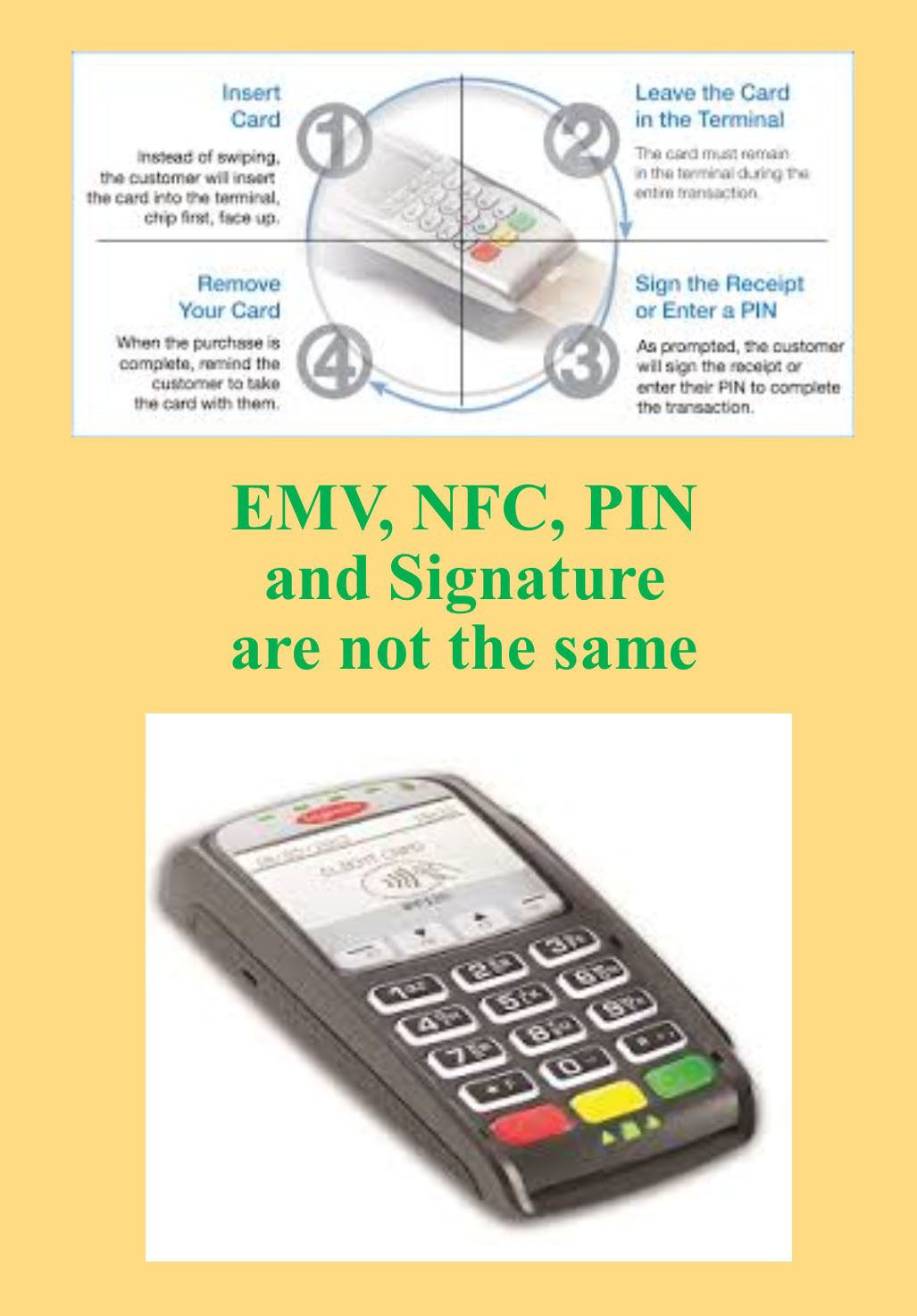

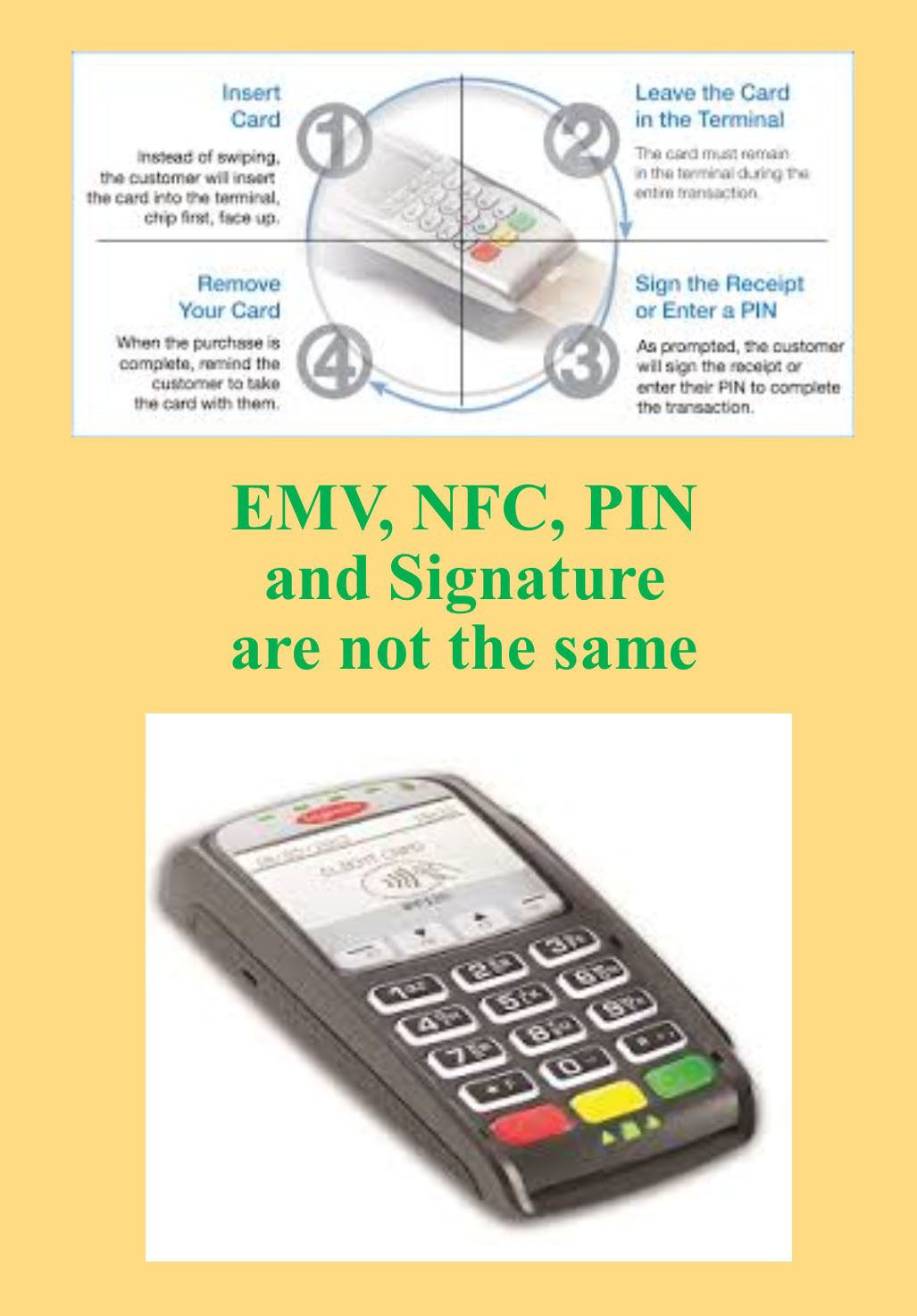

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

April 6th, 2017 by Elma Jane

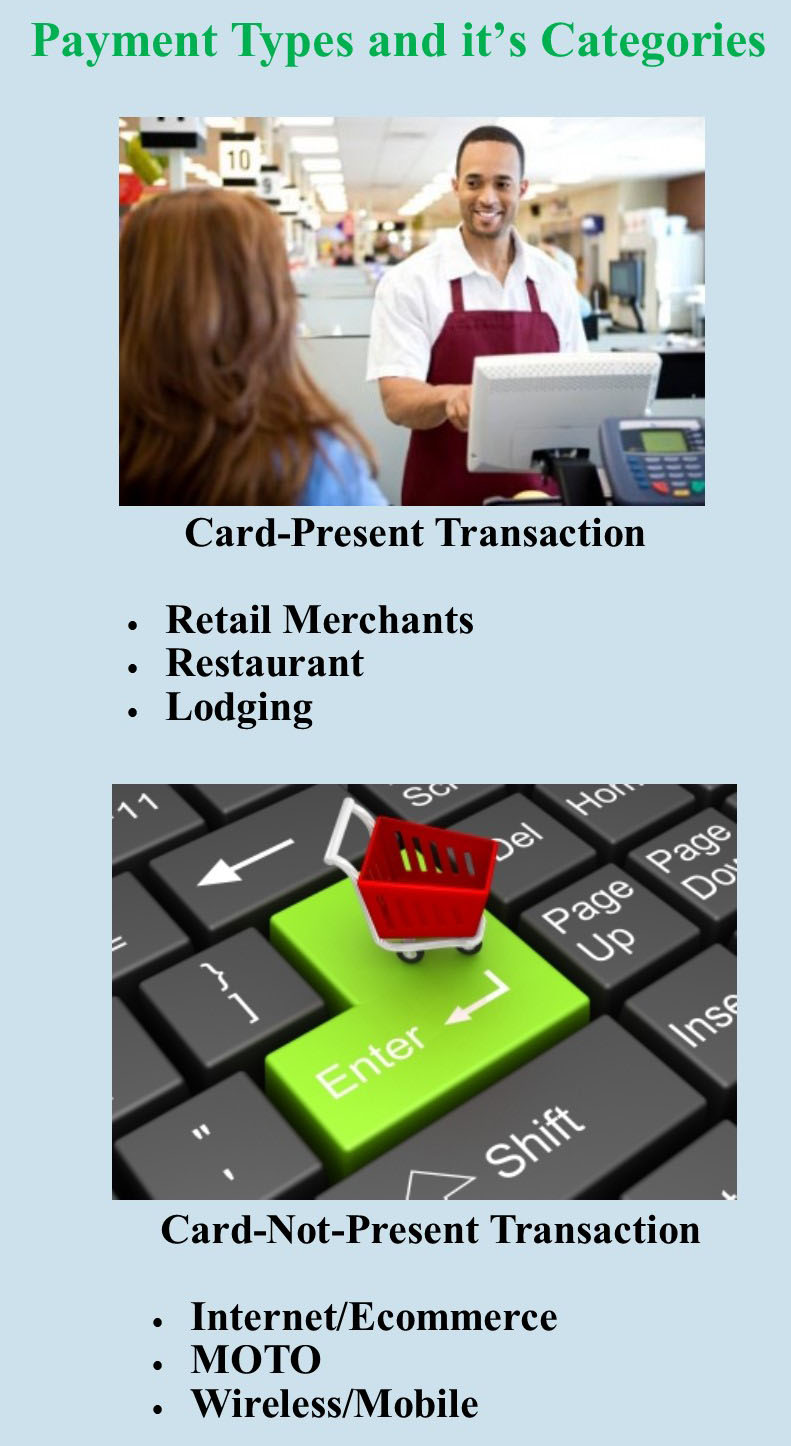

Payment types and it’s categories

The two main category types when it comes to credit card processing are swiped and keyed. Card present or card-not-present.

Swiped or card present transaction – merchants do a face-to-face transaction. A merchant can capture card information by dipping the chip or swiping the card in the terminal or POS. Merchants directly interact with a customer so the risk is low.

Card-Present Sub Categories:

Retail Merchants – conduct transactions face to face in a retail environment.

Face to Face (mobile) – this type of merchant is typically on the go, such as a vendor at a trade show. You can use a service like converge mobile that allows you to take the information in person.

Restaurant – the same as retail merchants, the difference is they may require the ability to add tips to their charges.

Lodging – processes their transactions like retail merchants except they may adjust the settlement amount depending on the customer’s length of stay.

Keyed or card-not-present are high risk, because merchants indirectly collect customers card information, and can process transactions in various ways.

Card-Not-Present Sub categories:

Internet/Ecommerce – conducts business through a web site by utilizing a shopping cart and an Internet payment gateway service. The payment gateway then collects the credit card information and processes it in real time.

Mail & Telephone Order (MOTO) – typically take the customer’s credit card information over the phone, by mail or through the Internet. They then manually process the transaction by keying it into either a credit card machine or through a virtual terminal such as Converge.

Talk to our payment consultant to know the best solution for your business.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit card, customer, ecommerce, merchants, payment, payment gateway, POS, swiped and keyed, terminal, virtual terminal

February 14th, 2017 by Elma Jane

Prevent Freeze, Holds, and Terminations

Common ways to prevent freezing; holds and termination to your account.

Minimize Chargebacks – chargeback should always be limited. An excessive number of chargeback whether won or lost is a red flag.

Minimize Fraud – if fraud is suspected, your account will be frozen pending an investigation.

One account per business type – if you have multiple businesses, you must have a separate account. If one account is being used for a different business altogether, that’s the quickest way for an account to be fully terminated.

Sell only the services or products you said you’d sell – selling other product or services could violate your Marketing Services Agreements.

Stay within your average monthly volume and ticket – an unusually high processing volume or average ticket is one of the fastest ways to get your funds held. To avoid this, notify your provider of an expected busy month. Call your provider for a large transaction before running it.

Use appropriate payment account types – card present (retail) and card-not-present accounts (internet). Card present means both customer and their credit card are present in the store. Card-not-present means card nor the person are not physically present at the time of the transaction. A large number of card present transactions on a card-not-present account or vice versa can result in a hold or termination of an account.

For Electronic Payments call now 888-996-2273 or got to www.nationaltransaction.com and click on get started

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargeback, electronic payments, fraud, provider

January 20th, 2017 by Elma Jane

Qualified vs Non-Qualified credit card rates

The most common forms of rate structures for credit card rates are:

2-Tiered: Qualified and Non-Qualified

3-Tiered: Qualified, Mid-qualified, or Non-qualified

Each and every transaction you accept is classified into one of the above and is the basis for the credit card rate you see on your statement.

As a general rule, qualified transactions are going to be “standard” cards; without any consumer or corporate rewards associated with them. Accepted in the “standard” method expressed in your merchant processing agreement, this is where Card-Not-Present (CNP) setup comes into play.

Mid and Non-Qualified transactions include:

Rewards cards, keyed-in payments (for swipe accounts), AVS (Address Verification Service) does not match or is not performed, not all required fields are entered, or the payment was entered in a late batch. Ex. the payment was sent to the processor 48 hours or more past the time of the authorization.

Posted in Uncategorized Tagged with: card-not-present, consumer, credit card, merchant, payment, processor, transaction

January 19th, 2017 by Elma Jane

Card-Present vs Card-Not-Present – It’s important for a merchant to know what types of credit card payments their business will be taking.

If you rely on mailed, over-the-phone, or online payments a Card-Not-Present merchant account is what you need.

With this type of account, you don’t need the physical card. You are set up to accept credit cards where card information is being keyed into a credit card terminal or online.

A card-not-present merchant accounts base rate is higher than if you signed up for a Card-Present or swipe merchant account.

Why are card-not-present rates higher? There is less risk associated with a business swiping a credit card than keying it in. Why? When a card is swiped, a person is present; where the merchant can check ID and signature. When a person is not present, it’s open for consumer fraud.

However, when you’re setting up a Card-Not-Present merchant account, these factors are taken into consideration during the underwriting process, which leads to a lower base rate for keyed-in payments

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card present, card-not-present, credit card, merchant, online, payments, terminal

January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions

December 19th, 2016 by Elma Jane

Surcharges and Convenience Fees:

A surcharge is a fee that is added to a card transaction, either as a set amount or a percentage of a transaction. Typically, used to cover the cost of the merchant service charge.

There are rules, exceptions and state laws to observe to ensure you are compliant.

At present there are surcharge bans in the following states:

California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas. (Appeals are pending for California and Florida)

Surcharge Rules:

- Applicable only to credit card transactions, not debit or prepaid card transactions.

- The surcharge cannot be greater than the merchant’s average discount rate for that brand’s credit card transactions.

- Maximum surcharge allowed is 4%.

- Cardholder must be notified of the surcharge.

- Surcharge must be listed on the receipt as a line item and the primary payment amount must be processed together as one transaction.

A convenience fee is a fee charged for the “convenience” of being able to pay using an alternative payment channel outside the merchant’s customary payment channel.

Any merchant can charge a convenience fee IF the fee charged is for the legitimate convenience of being able to pay using a different payment channel than the merchant’s usual payment channel.

Example: Your business customary payment channel is face-to-face or card present and you provide an alternative payment channel, such as the option to pay by phone using a credit card, that could then charge a convenience fee along with the payment.

Mail Order/Telephone Order (MOTO) merchants and ecommerce merchants, whose customary payment channel is exclusively non face-to-face or card-not-present, are NOT permitted to charge convenience fees.

Convenience Fee Rules:

- Customer must be notified of the convenience fee prior to finalizing payment and given the opportunity to cancel.

- Payment must take place through an alternative payment channel.

- The fee can only be added to a non face-to-face transaction. Must be flat or fixed, regardless of the value of the payment due.

- The fee must be applied to all means of payment accepted through the alternative payment channel. Must be included in the total transaction amount.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order Tagged with: card-not-present, Convenience Fees, credit card, debit, ecommerce, merchant, moto, payment, prepaid card, Surcharges, transaction