August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

April 28th, 2016 by Elma Jane

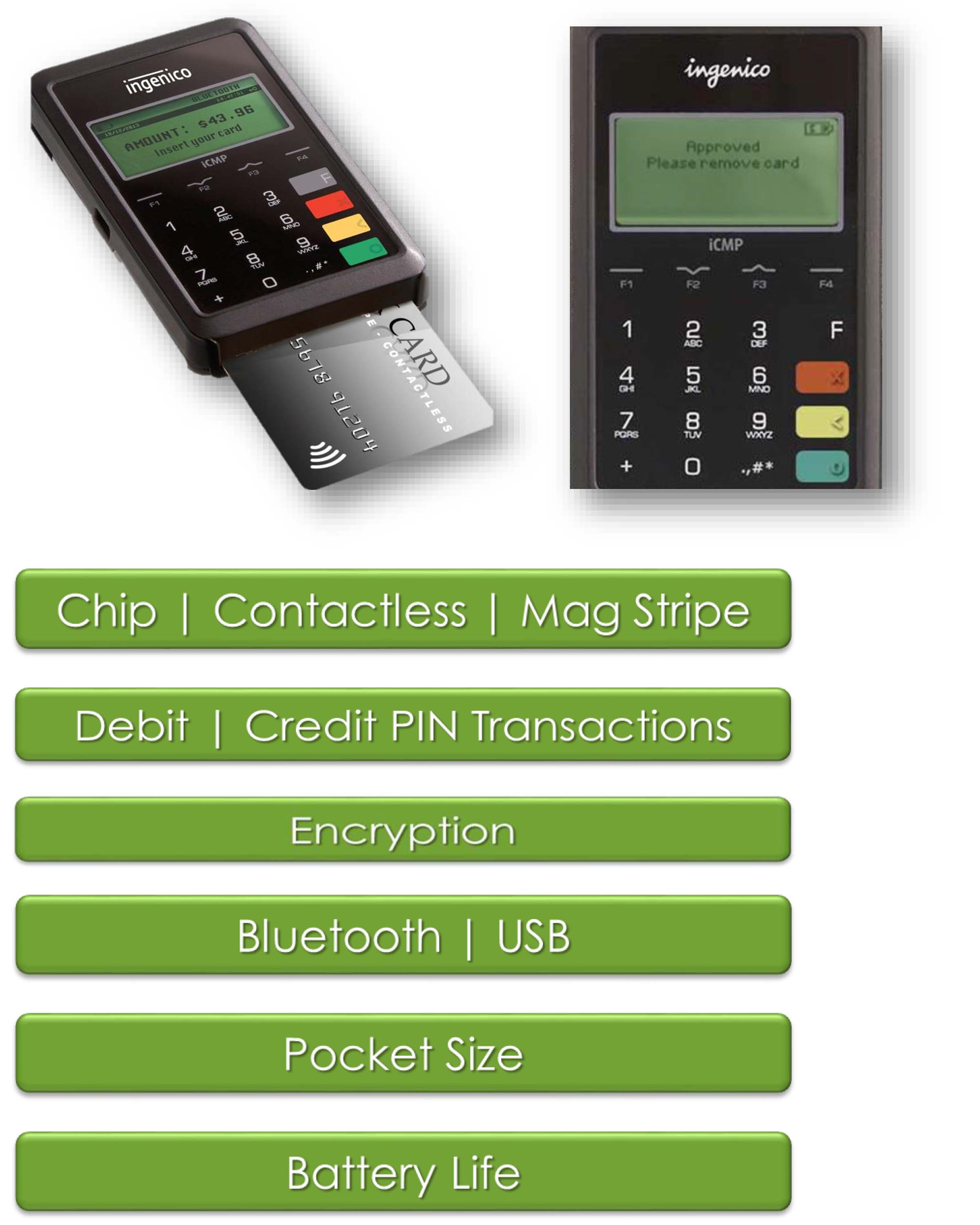

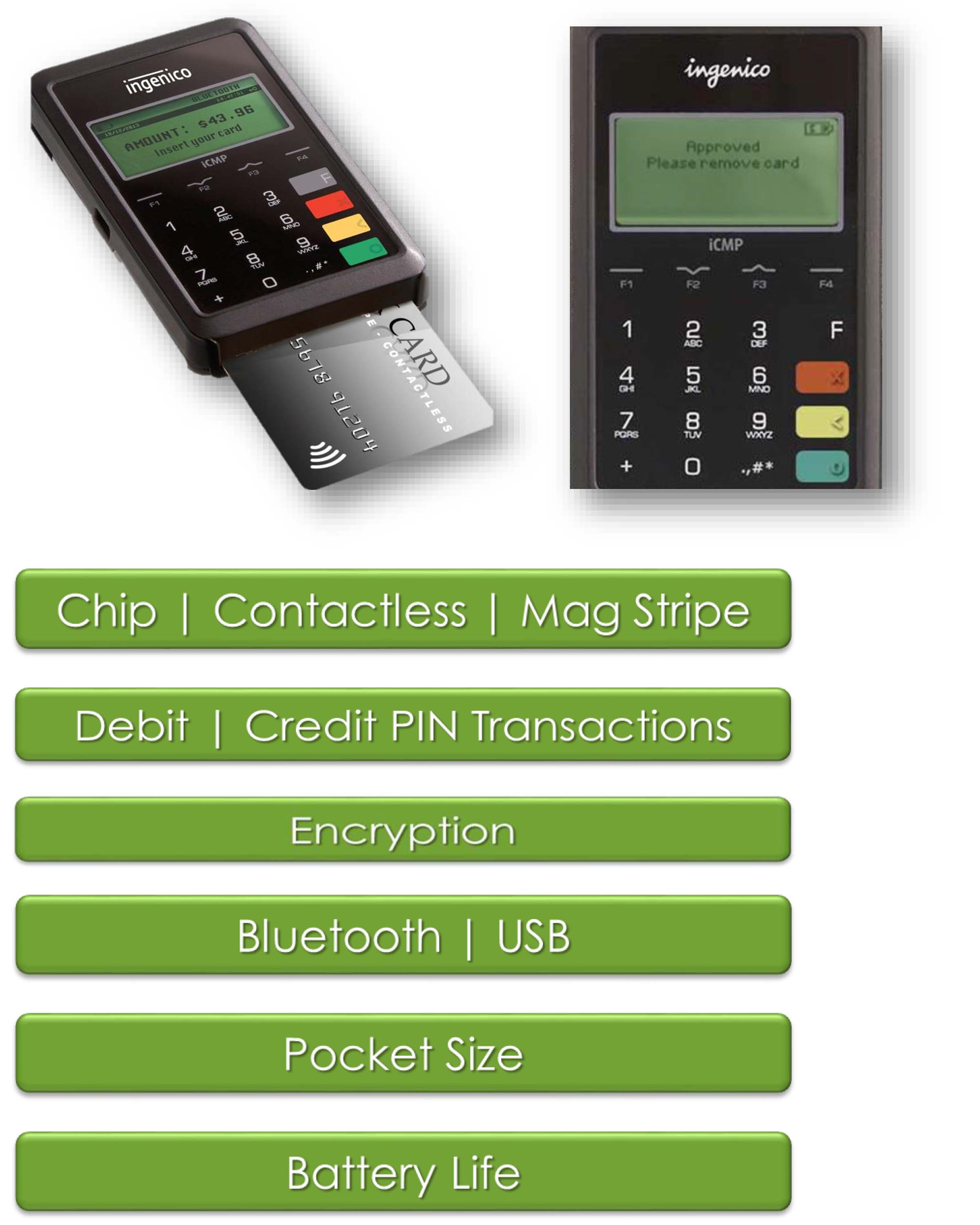

You can offer your customers preferred payment method with the next generation point-of-sales terminals, an all-in-one credit card processing experience: which not only support Near Field Communication (NFC) contactless payment transactions such as Apple Pay but chip cards and the traditional magnetic stripe cards; and manual entry transactions as well.

Contactless payment transactions are happening now. NTC are here to help.

Posted in Best Practices for Merchants Tagged with: chip cards, contactless payment, credit card processing, customers, magnetic stripe cards, Near Field Communication, nfc, payment, point-of-sales, terminals, transactions

April 14th, 2016 by Elma Jane

Accepting credit card payments is a must if you’re planning to start a business. It’s good to know what is out there and how it applies to your situation. So you need to learn about credit card processing machines, depending on your business.

Here are some of the different types of credit card processing machines:

Dial-Up Terminal – the grandfather of credit card processing machines. Dial-up terminals use a phone line to connect with a credit card processing company. The advantage is that they are normally inexpensive than some higher-end options. The disadvantage is slower processor speed.

IP Terminal – connect the merchant over a high-speed internet connection. The advantage of IP terminal over dial-up terminal is speed. IP machines can process transactions as fast as 3 seconds as opposed the 10 to 25 seconds that a dedicated dial-up machine might take. IP terminals now cost about the same as dial-up units and that a single DSL link can accommodate more than one credit card terminal.

Wireless Terminals – the priciest yet most convenient type is a wireless machine that runs on a wireless network, much like your mobile phone.

Virtual Terminal – virtual terminals are computers running credit card processing software connected to a credit card reader. Virtual terminals are a great addition to an office because they don’t require a standalone credit card processing terminal.

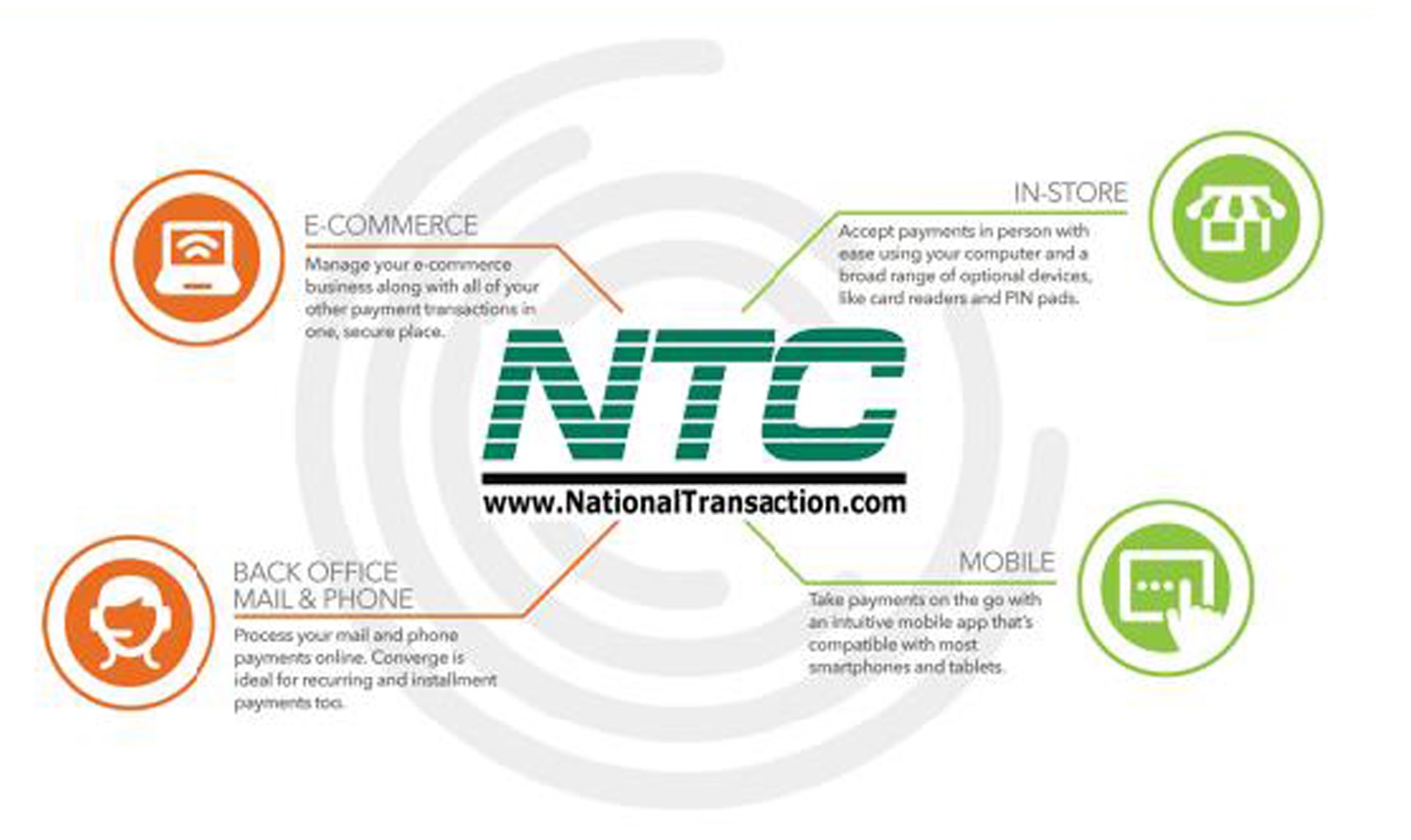

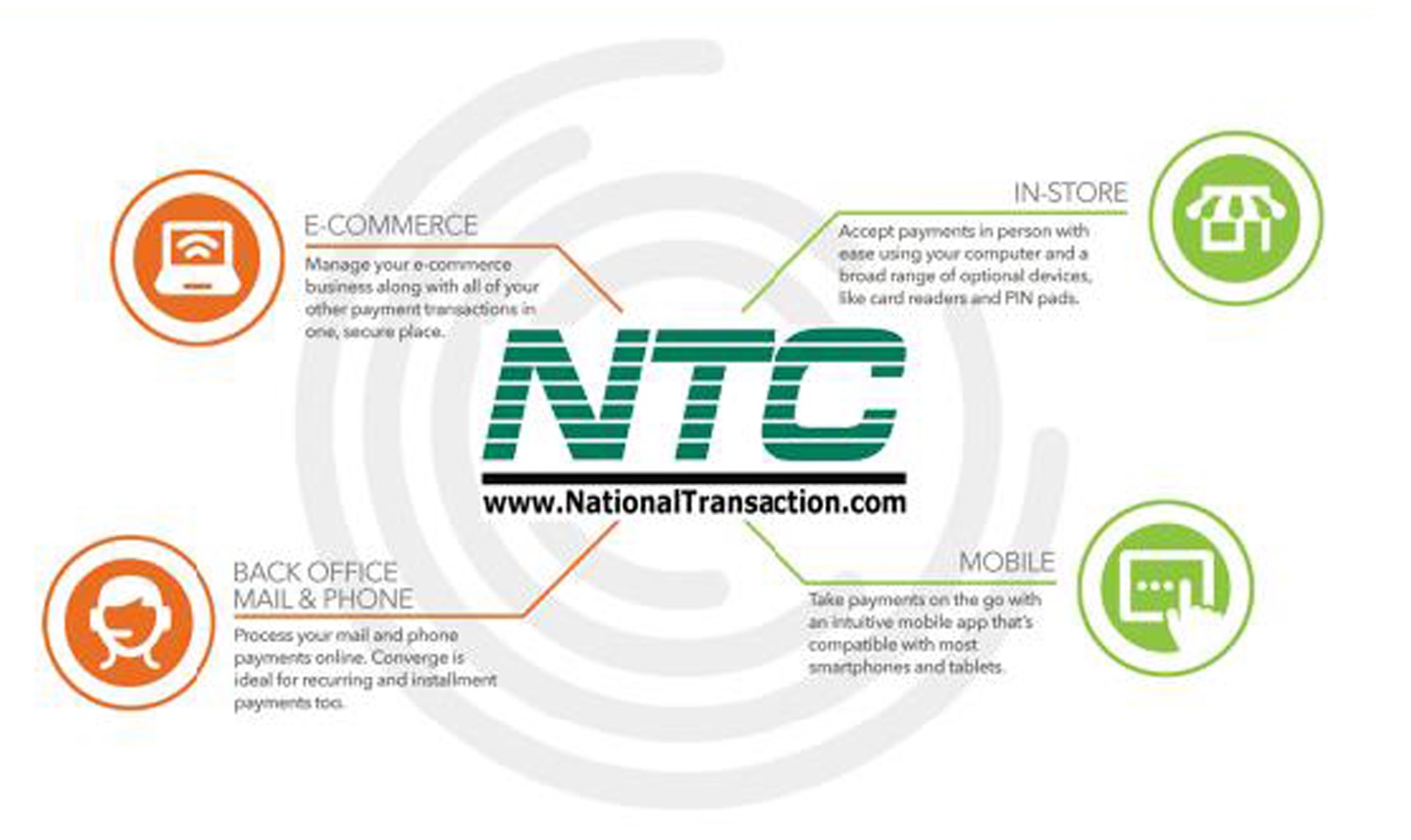

There are many options available for your business, whether you’re e-Commerce, MOTO, In-Store or Mobile there’s a credit card processing machine and platform out there that will fit your business.

Give us a call to know more at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce Tagged with: card reader, credit card, credit card processing, e-commerce, merchant, mobile, moto, payments, terminal, virtual terminal

February 19th, 2016 by Elma Jane

This company is the best. If anyone, especially Travel Agents need to obtain a Credit Card Processing Company, this is the one to go with, ask for Megan. She is the Best!!!! Thank you for all your help….

Travel Agents,Travel,Credit Card Processing,Credit Card,Card

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments, Merchant Account Services News Articles, Travel Agency Agents Tagged with: card, credit card, credit card processing, travel, travel agents

October 30th, 2015 by Elma Jane

National Transaction Corporation is the preferred Credit Card Processing Agent for many National Travel Agencies & Associations. We are the preferred merchant account service provider for ASTA, OSSN, ARTA, HBTA,Vacation.com, Travel Leaders, Trams and many more. We are also affiliated with JaxFax, Travel weekly, TRO / Travel Research Online and other travel agency associations in the travel agent industry.

Benefits of our Merchant Account Services for Travel Agencies.

Competitive credit card processing rates & fees for travel agents

Faster deposits (as quick as 24 hrs from transaction)

No holds on funding

Trams Credit Card Merchant Account Integration

Sabre Red Merchant Account Integration

Booking Software Processing Integration

Lower Processing Rates & Fees

Swiped Rates for face to face credit card processing

ecommerce for shopping cart credit card processing

National Transaction Corporation has a proven track record with many of the Largest Travel Agency Associations in the U.S. and Canada. In fact for several of those, we are the preferred credit card processing merchant account services provider for their members. We can take your business to the next level with integration into Trams, Sabre, Sabre Red or off the shelf accounting programs like QuickBooks and Peachtree Accounting.

We are more than happy to provide you with a free merchant account rate review and go over your current credit card processing details and show you how we can save you money and get deposits even faster. We also offer industry leading technical support around the clock, you call, we answer. Simple as that. We can assist errant transactions, chargebacks, terminal messages and much more. Find out why National Transaction Corporation is the preferred merchant account services provider for travel agents & agencies.

Call us now and put us to the test. 888-472-7112

American Society of Travel Agents, Vacation.com, ASTA, Trams, Virtuoso, Travel Leaders, Association of Retail Travel Agents, Specialty Travel Agent Association, Cruise Holidays Credit Card Processing.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: chargebacks, credit card, credit card processing, ecommerce, merchant account, Merchant Account Services, National Travel Agencies, shopping cart, travel agencies, travel agency, travel agent

August 13th, 2015 by Elma Jane

The credit card processing industry, have been working towards including EMV technology in all of the point of sale systems.

Many processors have sent out EMV capable devices that will need to be adjusted before they can start accepting EMV card transactions.

See which category you fall into so you are prepared when October 1 rolls around.

First, check and see if your credit card machine has the slot to accept EMV cards (it’s either a slot in front, or on the top of, the unit). If you don’t, you need to contact your processors or sales agent to update your equipment .

If you do have the slot for EMV cards, you’ll need to contact National Transaction to see if your EMV capable machine has been enabled to accept EMV cards.

What is the difference between EMV capable and EMV enabled?

- EMV Capable – EMV capable means that your credit card machine is equipped with the hardware (i.e. the slot) and has the capability to do a transaction, but first you’ll have to update the application to enable you to process the cards. At National Transaction, we have a support specialist to assist you with step-by-step instructions to switch your credit card Point-of-Sale System, from EMV capable to EMV enabled.

- EMV Enabled – When your machine is EMV enabled, your terminal is ready to accept EMV transactions. According to MasterCard, 73 percent of consumers say owning a chip card would encourage them to use their card more often. In addition, 75 percent of consumers expect to use their chip card at the merchants where they shop today. Keeping these numbers in mind, it only makes sense to equip your business with an EMV enabled credit card POS system.

What makes EMV technology so important?

EMV is a global payment system that adds a microprocessor chip into credit cards and debit cards, and reduces the chance a transaction is being made with a stolen or copied credit card. Unlike traditional magnetic-stripe cards, anytime you use an EMV card, the chip in the card creates a unique transaction sequence that can’t be replicated. Because the number will never be valid again, it makes it hard for hackers to fake these cards. If they attempt to use the copied EMV card, the transaction would be denied.

The rollout of EMV technology is ongoing, but even with the October 1 deadline, it’s estimated that only 70 percent of credit cards and 40 percent of debit cards in the U.S. will support EMV. Despite these numbers, that doesn’t mean you shouldn’t update your equipment.

Following the deadline, card present fraud liability will shift to whoever is the least EMV compliant party in a fraudulent transaction.

Make sure that’s not you!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: card present, card transactions, chip, chip card, credit card, credit card processing, debit cards, EMV, EMV capable, EMV enabled, emv technology, magnetic stripe cards, merchants, payment system, point of sale, POS, processors, terminal

July 14th, 2015 by Elma Jane

If you own a business, you should consider opening a merchant account. If you accept credit cards for transactions, you will take your business to a higher level, increase your revenue, and gain new customers. Most people nowadays use credit cards and debit cards to pay for their purchases, so no business should go without processing card payments. Electronic, Credit card processing payments are a must-have for any kind of business including Internet businesses.

If you accept several forms of payments, you will provide your customers with multiple options and you will enhance their experiences. If you do not accept credit cards, the people who prefer to pay for their purchases with credit cards and debit cards will go somewhere else, and you will lose the transaction. So many benefits are attached with merchant accounts and millions of small business owners have found success with them. If you have a merchant account, you will be able to accept Discover, MasterCard, Visa, and American Express from your customers.

With National Transaction, securing Electronic, Credit card payment processing service instore, online and on the go are easy to acquire. It will boost your income, so it is worth the investment. You can apply online for a merchant account, the applications will only take you a few minutes to complete, and you will find out if you have been approved for a merchant account in a day or so.

A credit card processing service will also protect your business and valued customers against fraud. Customers feel safe using credit cards because they know that if their cards get stolen, they can cancel them, dispute the purchases, and get their money back. Your customers will feel safe when they make purchases. Some consumers will not purchase from a company that does not accept credit/debit card.

National Transaction offers advanced payment processing solutions like Currency Conversion, EBT and Debit Cards Processing, E-commerce Gateways, Electronic Check and ACH Transfers, Gift Loyalty Card Programs, Loans and Advances, Mobile Processing and MediPaid, you will definitely benefit from opening a merchant account. National Transaction offers Free CRM and we can even help promote your business through Social Media Sites. We offer a very competitive rate and Customer/Technical Support to our Partners because we answer our phone.

Merchant accounts are a necessity for any kind of business, so don’t wait. Sign up for a merchant account right now and discover what your business can gain from accepting credit cards! With 73 percent of American households owning a credit card, it’s easy to think that everyday credit card usage is a way of life.

Give us a call 888-996-2273 or check our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: ACH Transfers, Advances, card payments, credit card processing, credit cards, crm, Currency Conversion, debit cards, Debit Cards Processing, e-commerce, EBT, Electronic Check, gateways, Gift Loyalty Card, loans, MediPaid, merchant account, Mobile Processing, payments, transactions

April 6th, 2015 by Elma Jane

Merchant Cash Advance – A lump-sum payment to a business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 24 months) and small regular payments (typically paid each business day) as opposed to the larger monthly payments and longer payment terms associated with traditional bank loans.

Merchant Cash Advance companies, provide funds to businesses in exchange for a percentage of the businesses daily credit card income, directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed variable percentage of a merchant’s future credit card sales.

The Term Merchant Cash Advance – may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring or short-term business loans.

This structure has some advantage over the structure of a conventional loan. Most importantly, payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital. Also, because MCA providers like typically give more weight to the underlying performance of a business who may not qualify for a conventional loan.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans, and are generally more expensive than bank loans. Competition and innovation led to downward pressure on rates and terms are now more closely correlated with an applicant’s FICO score.

There are generally three different repayment methods:

Split withholding – when the credit card processing company automatically splits the credit card sales between the business and the finance company per the agreed portion. The most common preferred method of collecting funds for both the clients and finance companies since it is seamless.

Lock box or trust bank account withholding – all of the business’s credit card sales are deposited into bank account controlled by the finance company and then the agreed upon portion is forwarded onto the business via ACH, EFT or wire. The least preferred method since it results in a one-day delay in the business receiving the proceeds of their credit card sales.

ACH withholding – when structured as a sale, the finance company receives the credit card processing information and deducts its portion directly from the business’s checking account via ACH. When structured as a loan, the finance company debits a fixed amount daily regardless of business sales.

Posted in Best Practices for Merchants, Financial Services, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account Tagged with: ach, bank loans, business loans, checking account, conventional loan, credit card processing, credit card sales, credit-card, debit card, finance company, loan, MCA providers, merchant, merchant cash advance, payments

March 17th, 2015 by Elma Jane

Merchant Cash Advance – A lump-sum payment to a business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 24 months) and small regular payments (typically paid each business day) as opposed to the larger monthly payments and longer payment terms associated with traditional bank loans. The term Merchant Cash Advance may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring or short-term business loans.

Merchant Cash Advance companies, provide funds to businesses in exchange for a percentage of the businesses daily credit card income, directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed variable percentage of a merchant’s future credit card sales.

These Merchant Cash Advances are not loans – rather, they are a sale of a portion of future credit and/or debit card sales.

This structure has some advantage over the structure of a conventional loan. Most importantly, payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital. Also, because MCA providers like typically give more weight to the underlying performance of a business who may not qualify for a conventional loan.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans, and are generally more expensive than bank loans. Competition and innovation led to downward pressure on rates and terms are now more closely correlated with an applicant’s FICO score.

There are generally three different repayment methods:

Split withholding – when the credit card processing company automatically splits the credit card sales between the business and the finance company per the agreed portion. The most common preferred method of collecting funds for both the clients and finance companies since it is seamless.

Lock box or trust bank account withholding – all of the business’s credit card sales are deposited into bank account controlled by the finance company and then the agreed upon portion is forwarded onto the business via ACH, EFT or wire. The least preferred method since it results in a one-day delay in the business receiving the proceeds of their credit card sales.

ACH withholding – when structured as a sale, the finance company receives the credit card processing information and deducts its portion directly from the business’s checking account via ACH. When structured as a loan, the finance company debits a fixed amount daily regardless of business sales.

Posted in Best Practices for Merchants, Merchant Account Services News Articles, Merchant Cash Advance Tagged with: ach, bank loans, business loans, checking account, conventional loan, credit card processing, credit card sales, credit-card, debit card, finance company, loan, MCA providers, merchant, merchant cash advance, payments

November 4th, 2014 by Elma Jane

“Healthcare’s Unique, Robust MEDIPAID Rolls Out”

Delivering paperless, next-day deposits for Medical Billers

National Transaction Corporation (NTC) in Coral Springs, Florida announced today that, by the first of December 2014, their paperless medical insurance electronic funds capturing suite: MEDIPAID will be fully functional nationwide. NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance billing. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

NTC’s agents help merchants standardize their Electronic Remittance Advice (ERA) and distribution options to automate posting which further reduces paper and time burdens. At a rate far less than credit card processing or third party billing companies, MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

For more information, Contact us anytime.

National Transaction Corporation

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: billing, check payments, credit card processing, credit-card, electronic funds, electronic payments, Electronic Remittance, health insurance, Medical Billers, merchant accounts, Merchant's, paperless medical insurance, secure electronic payments