September 18th, 2017 by Elma Jane

Smart Security for Smart Businesses:

Safe-T for SMB streamlines the PCI process while providing the layered security needed to protect card data

EMV – Fraud protection at the point of sale

EMV chip technology keeps the consumer’s card in their hand. It also helps protect the business from card-present fraud related chargebacks.

Encryption – Protection of payment card data in-transit

Safe-T scrambles cardholder data using advanced encryption technology, so data is protected at the point of entry, and throughout the authorization process.

Tokenization – Token ID protection of stored payment card data

Safe-T returns a token ID or an alias, consisting of a random sequence of numbers to the point-of-sale so the actual card number is never stored. Token IDs can be used for follow up transactions (i.e. recurring payments, voids, etc.).

Reduced PCI – Protection from complex PCI compliance

Maintaining PCI Compliance can be intimidating – second only, perhaps, to completing your taxes. Safe-T eases this process for customers by reducing the number of PCI Self-Assessment questions by more than 60% from 80 questions to 31.

Financial Reimbursement – Financial protection from a card data breach

Recovering from a card data breach can be costly for a small business. Safe-T offers Card Data Breach Reimbursement to financially protect your customer’s business in the event of a card data breach – regardless of the type of card data breach.

For Electronic Payment Set up with this feature call now! 888-996-2273

Posted in Best Practices for Merchants Tagged with: card data, card present, chargebacks, chip, data, data breach, EMV, encryption, fraud, payment, PCI, point of sale, Security, tokenization

September 14th, 2017 by Elma Jane

Payments standards body EMVCo has updated its Payment Tokenisation Technical Framework to introduce the new roles of token programme and token user, refine the roles of token service provider and token requestor and detail their interrelationships within the global payments environment.

EMV Payment Tokenisation Specification — also includes expanded ecommerce use cases and operational management enhancements to support global interoperability and facilitate transaction security.

This latest version offers significant updates and use cases that reflect payment industry input to define how EMV payment tokens are generated, deployed and managed. The level of detail assists in establishing a stable payment environment and delivering a common set of tools to facilitate transaction security.

The technical framework needs to capture these industry requirements and be flexible enough to interoperate with the existing payment ecosystem while supporting ecommerce, new payment methods and regional variations.

EMVCo is calling on the payments community to get involved and provide feedback.

EMVCo was formed by Europay International, MasterCard International, and Visa International to manage, maintain and enhance the EMV specifications for payment systems.

Posted in Best Practices for Merchants Tagged with: ecommerce, EMV, payments, Security, service provider, token, Tokenisation

July 26th, 2017 by Elma Jane

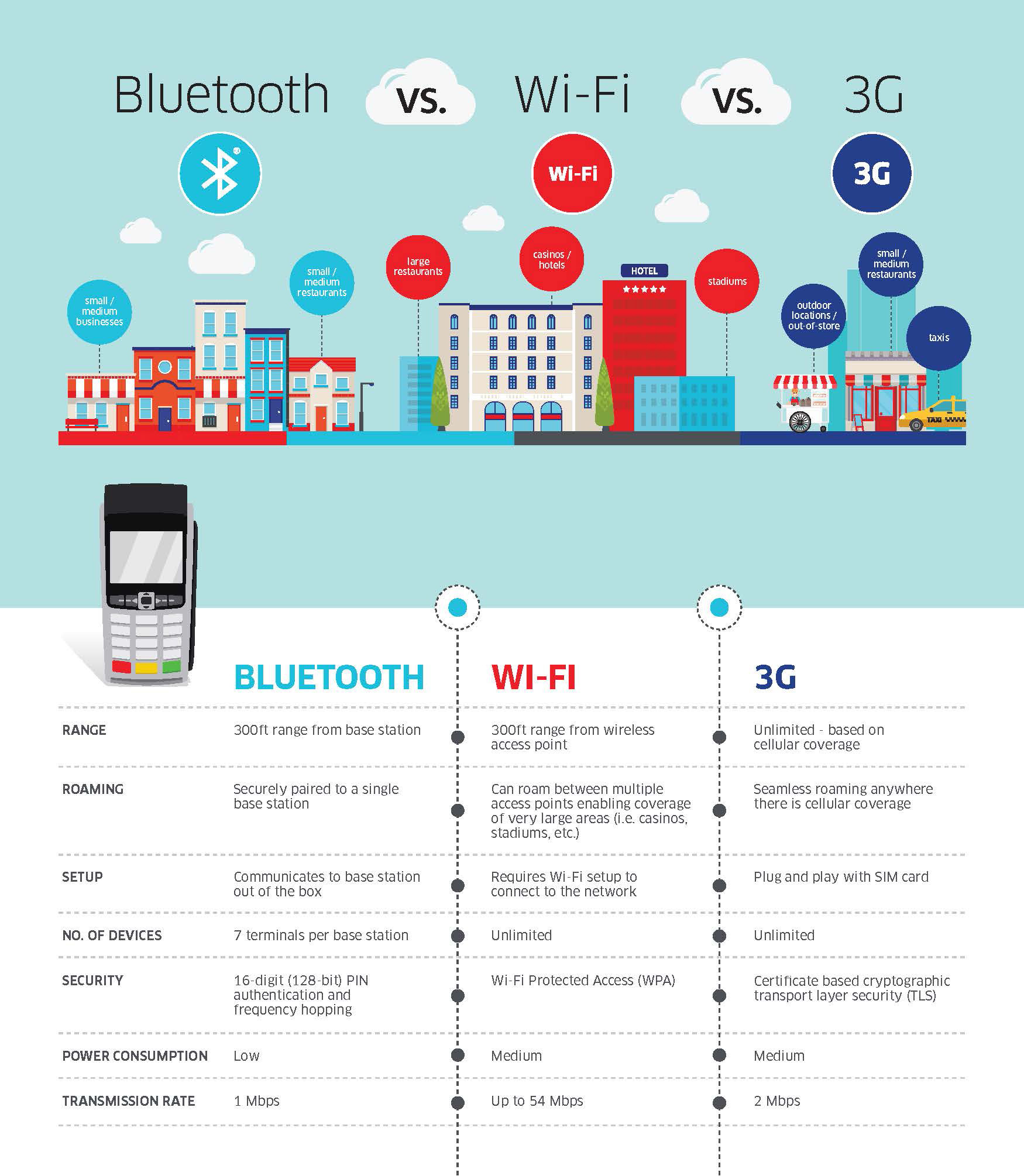

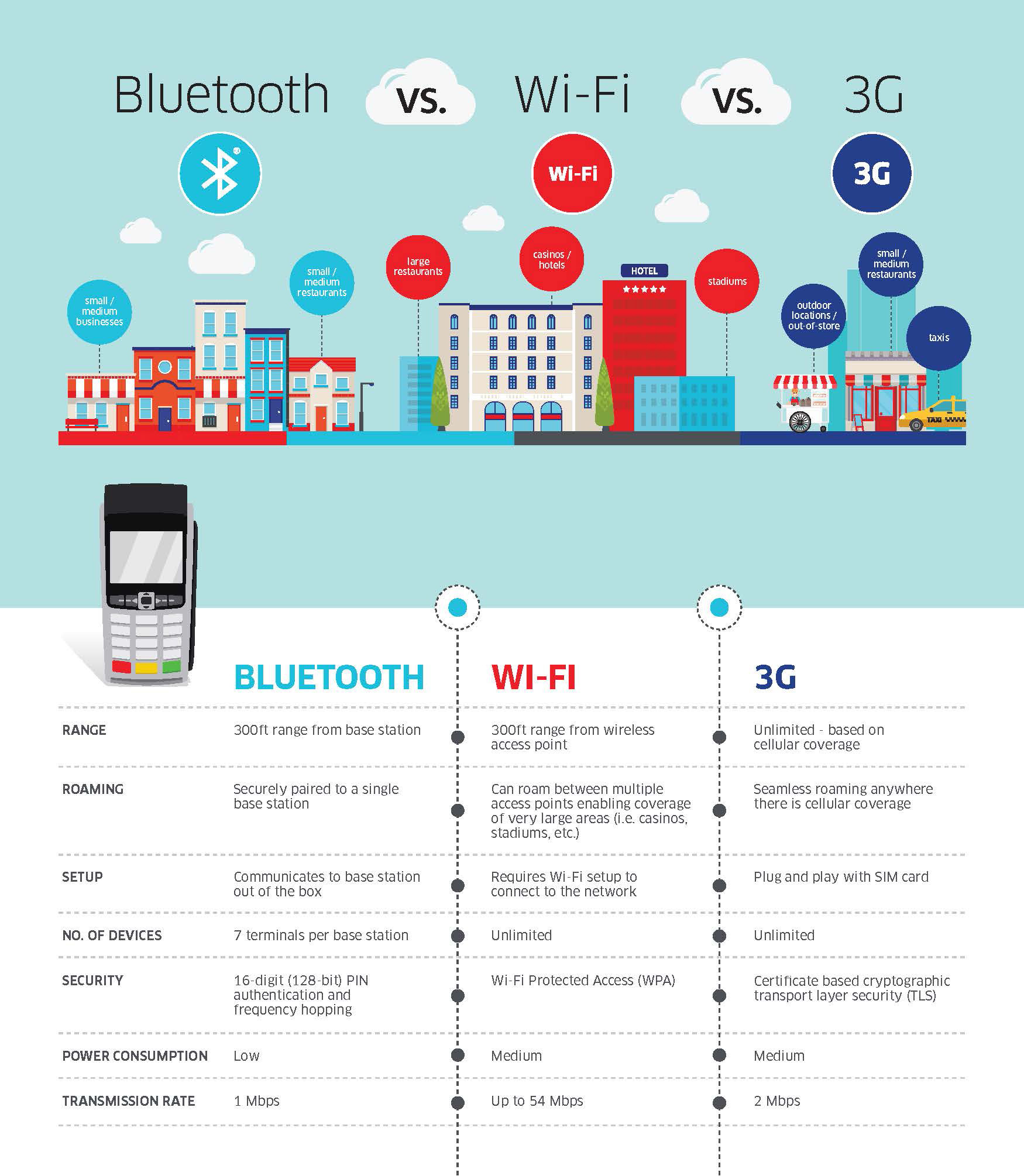

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

July 18th, 2017 by Elma Jane

1979 was a turning point in the credit card processing industry. Point of sale terminals emerged that year when Visa introduced a bulky electronic data capturing terminal which was the first payment credit card terminal.

In the same year, magnetic information stripe was added to the credit card which allowed card information to be captured electronically. Now Mag stripe was replaced by EMV (Europay, MasterCard and Visa) .

In 1994, the first version of the EMV was released and it became stable in 1998.

The United States started using the EMV Technology in 2014.

The future of payment will see Mobile payments, Electronic payments and Contactless payments like NFC (Near Field Communication) and smart cards, and is now taking over the traditional payment. Electronic Payment Technology will continue to evolve.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Lodging industry customers that will benefit from this smart terminals:

- Smaller, independent hotels

- Hotels without property management systems

- Existing lodging customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

April 10th, 2017 by Elma Jane

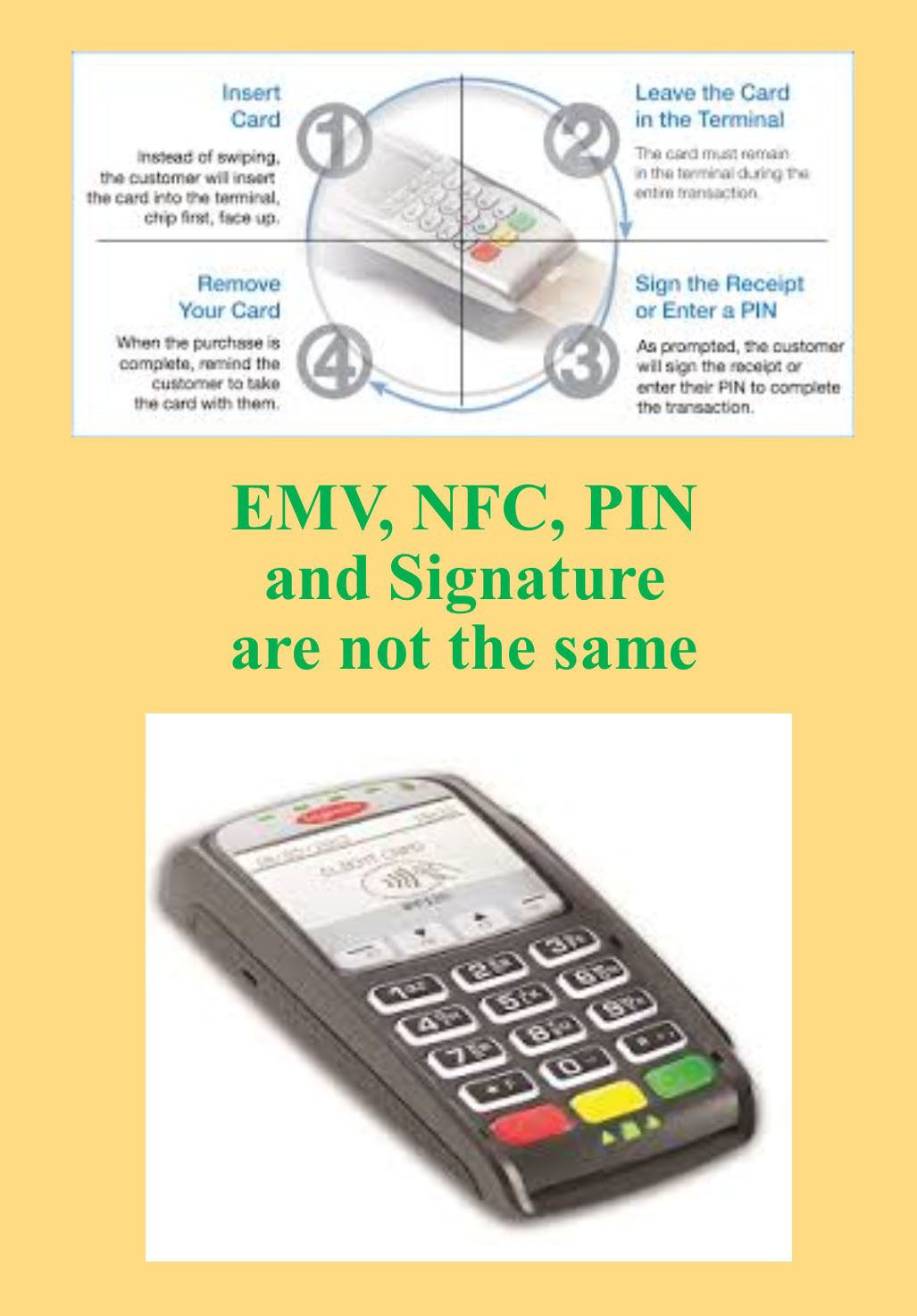

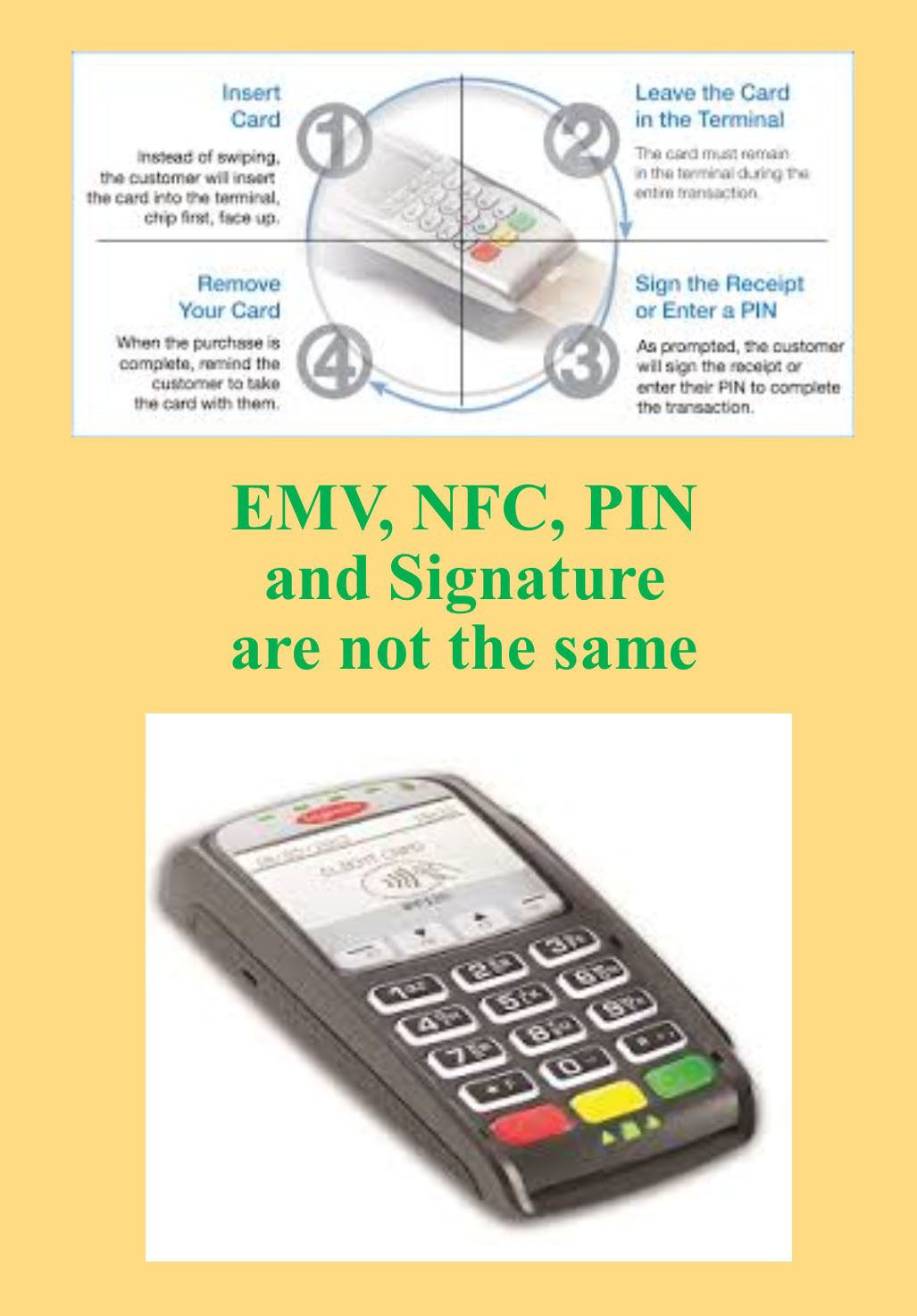

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

March 30th, 2017 by Elma Jane

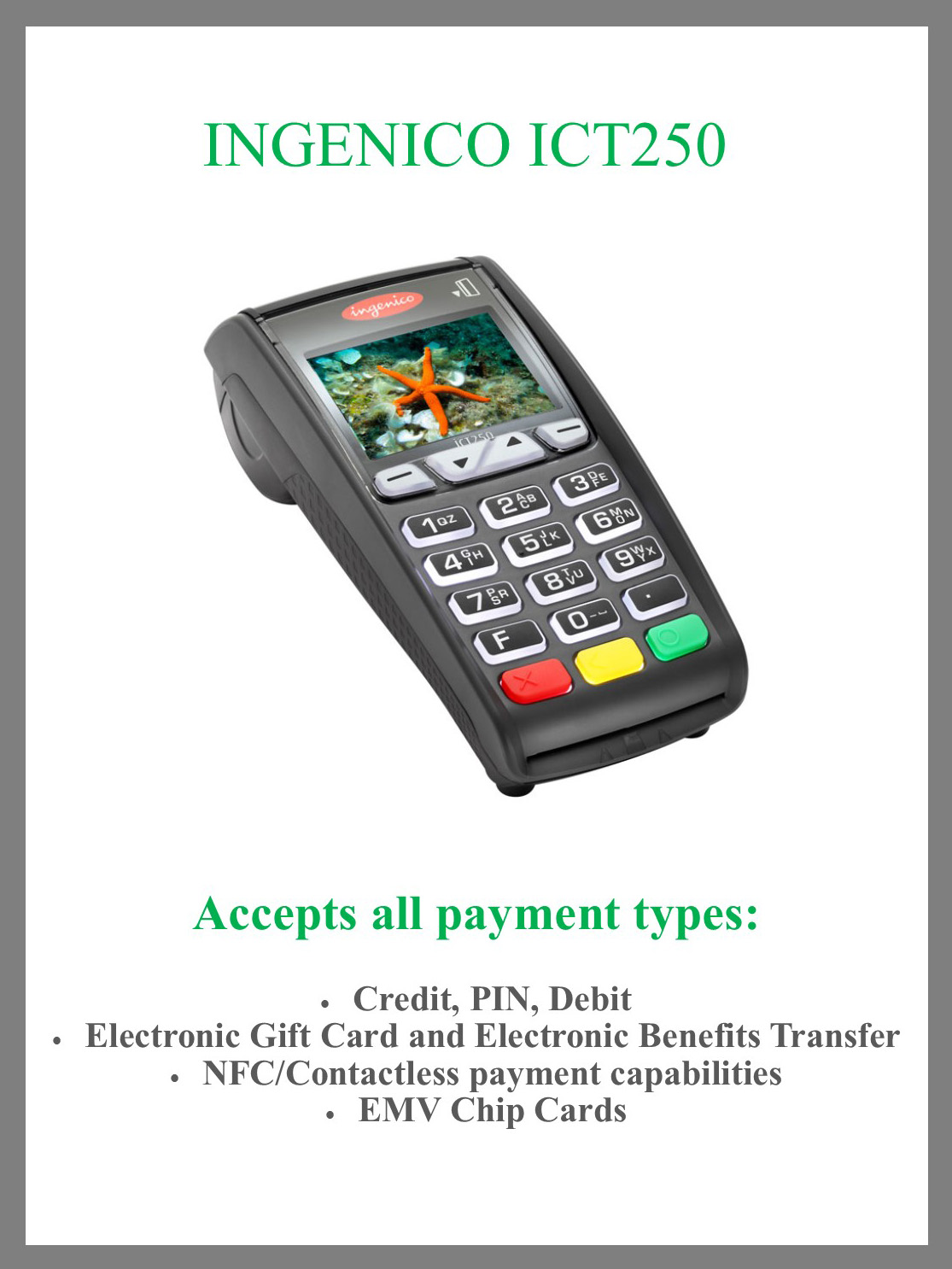

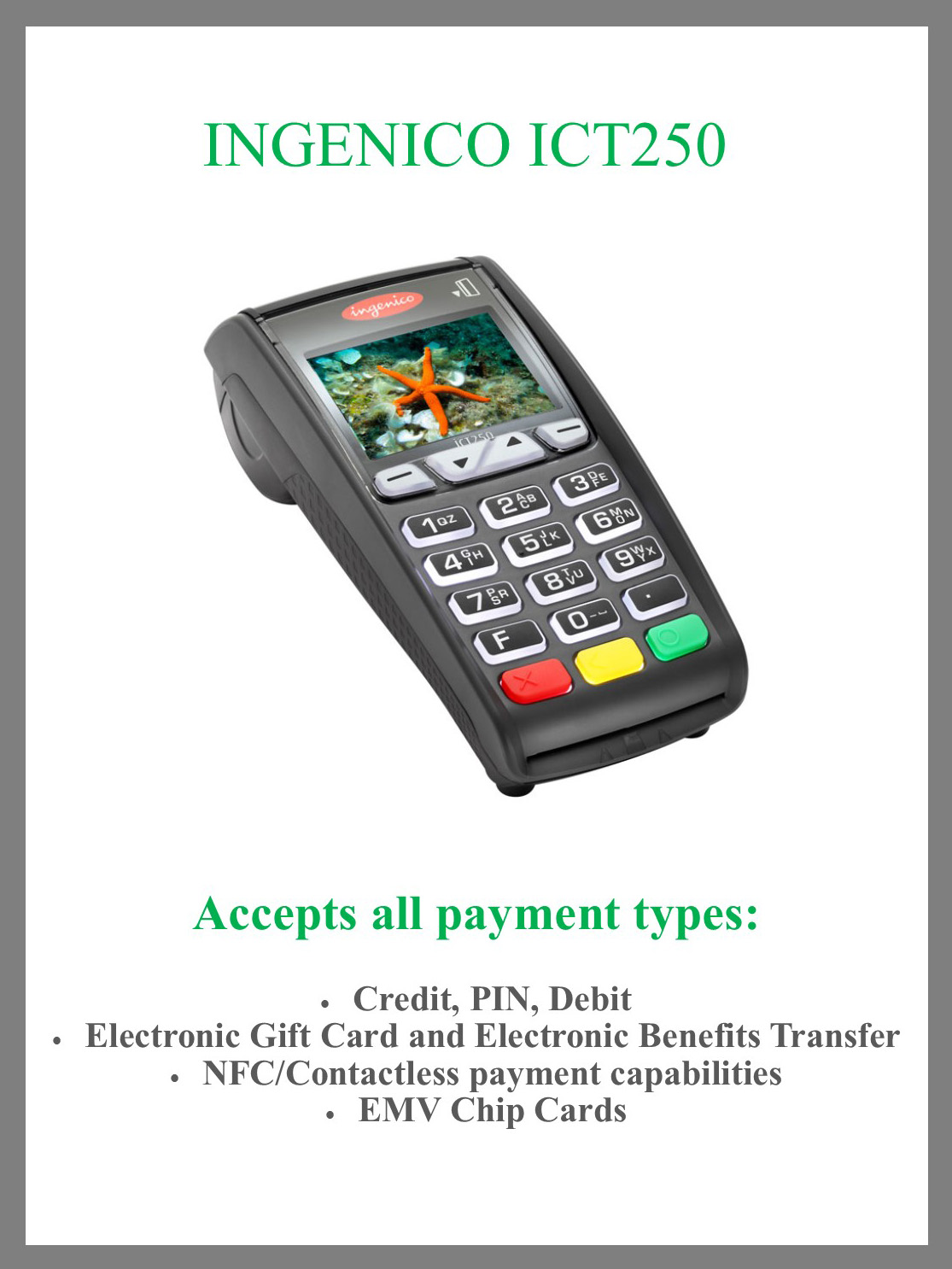

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

February 13th, 2017 by Elma Jane

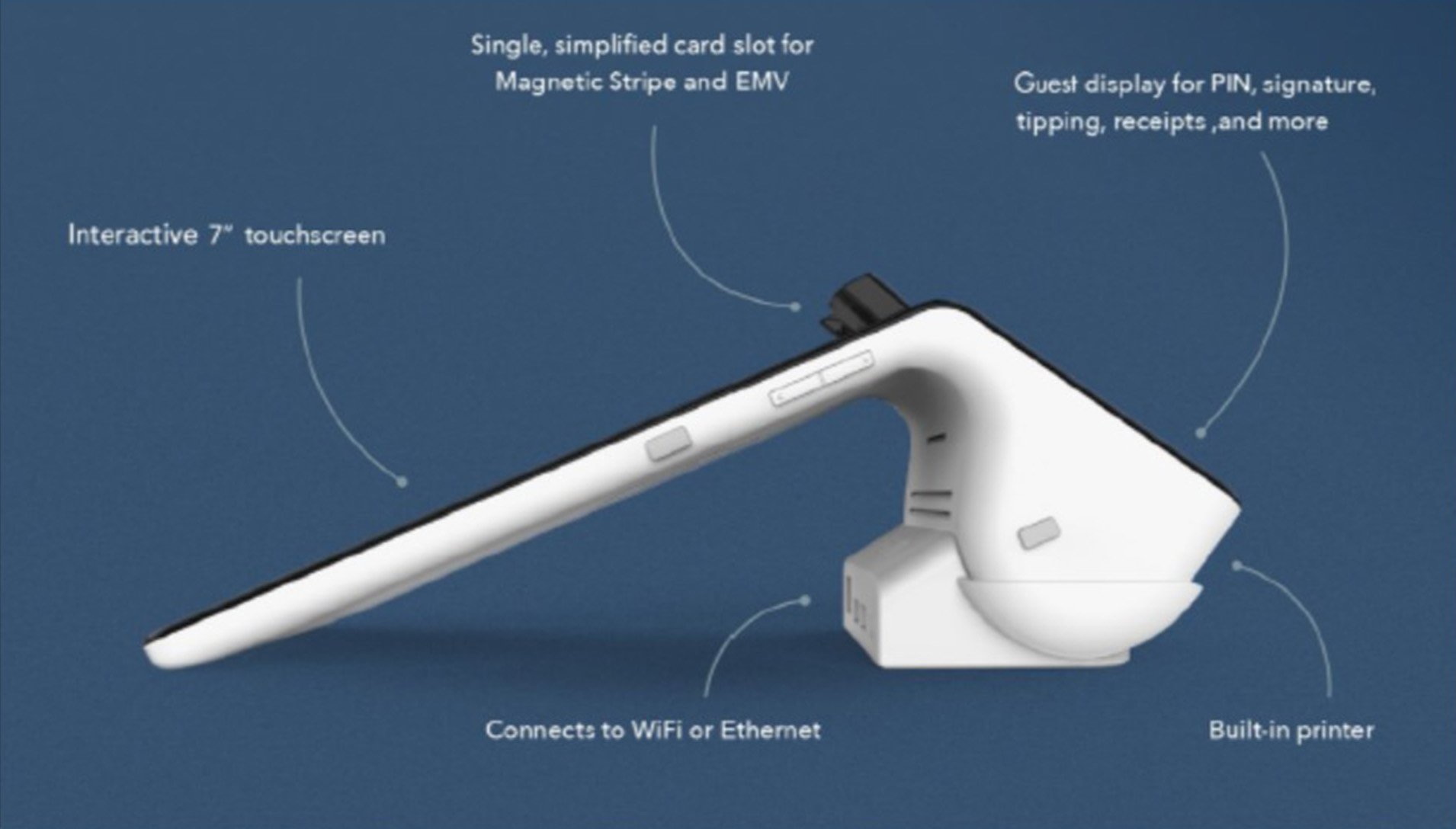

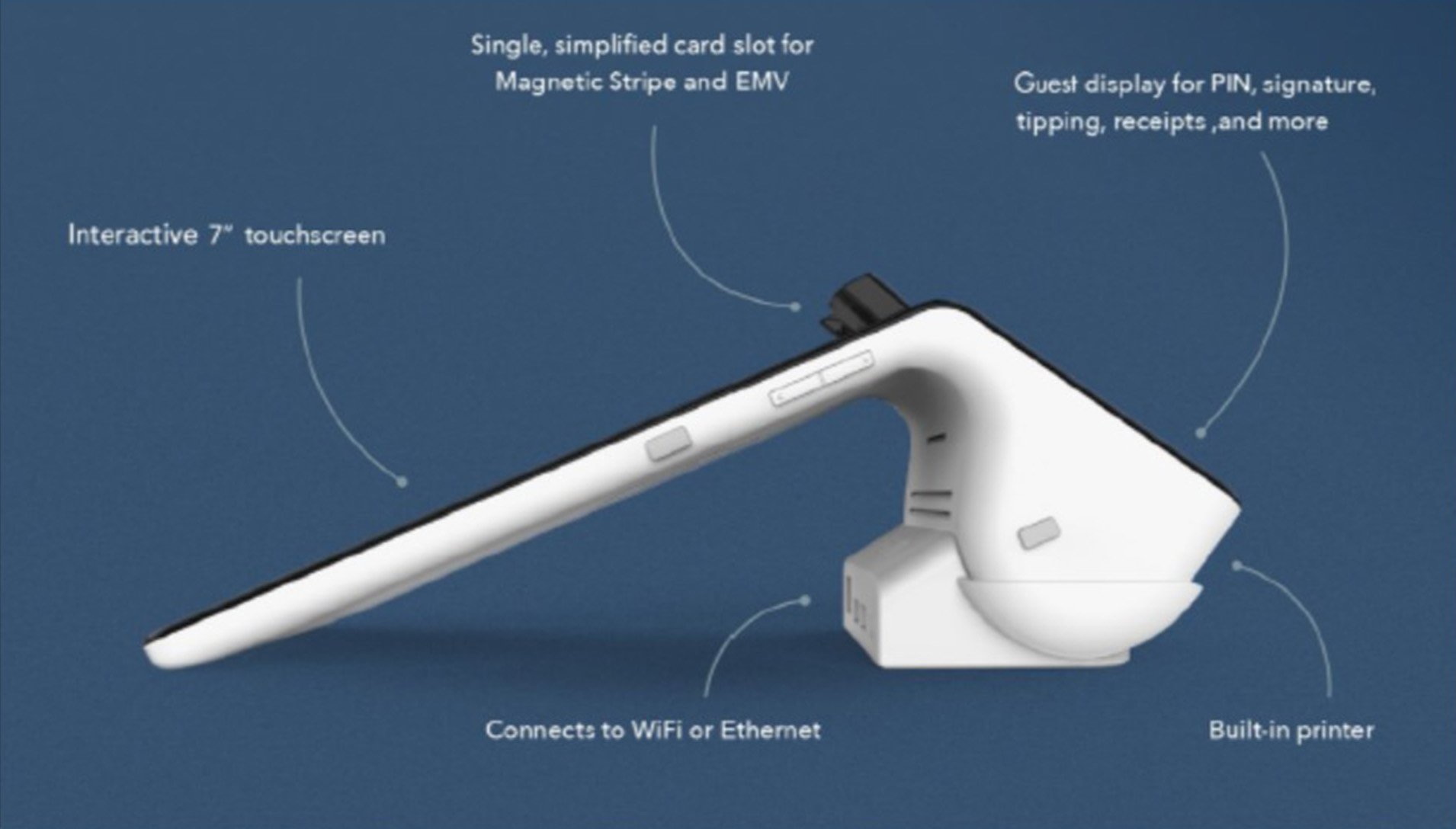

Smart Device for Lodging Transactions

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions