November 1st, 2018 by Admin

We are officially 55 days until Christmas, time to take all of the tricks out of your hat to promote your business. Since we know you will be using social media, here are 30 random holidays you can use to promote your business with their Hashtag.

November 1st:

#ExtraMileDay: Show your customers how you will go the extra mile for them.

November 2nd

#LoveYourLawyerDay: Need we say more? This one is perfect for lawyers or anyone working with them.

#FountainPenDay: If you sell promotional items, this one is for you. It can also work if you want to post the latest contract signed.

#SandwichDay: Even if you don’t own a sandwich shop, Sandwich day can be used to share a more laid back look of your company. Maybe sharing a picture of your last company picnic or lunch will do. Remember to have a good looking picture!

First Sunday of November

#ZeroTaskingDay If you work for a spa or anything that promotes relaxation, this one would be a good one for you!

November 5th

#LoveYourRedHairDay Hairdressers, time to get those finished looks and share them on social media!

#NachosDay Any day is a good day for Nachos, but on Nachos day you can show some humor as a way to connect to your customers. This one is great for restaurants.

November 8th

Guinness World Record Day: #GWRDay: Sharing a fun fact comes a long way in Social Media. Sharing a Guinness World Record that might relate to your industry can attract a new crowd online.

#CappuccinoDay: People love coffee, (search #CoffeeLover, and you’ll see) so why not share Cappuccino Day with your coffee loving crowd. Perfect for the coffee shop owner to the savvy consultant on the go.

November 10th

#SesameStreetDay: If you are in an industry that deals with children, this one is for you. Make the posts funny or just cute but remember you are targeting the parents at the end. Nostalgic posts work well too with this.

#VanillaCupcakeDay: Cupcake lovers beware, this hashtag might be for you. Perfect for the bakery owner and the all-time cupcake lover, there is no need to be a pastry chef to use this one.

November 11th

#origamiday This one might require some skill and imagination, but it can delight your online community and attract them more to what you do. If you use this one, be sure to send us a picture.

#SundaeDay Who doesn’t love Ice Cream Sundaes!

November 12th

#HappyHourDay Geared more for restaurants and bars, but with a bit of creativity, many can use this hashtag.

November 13th

#KindnessDay Show your kindness to others.

November 15th

#AmericaRecyclesDay We all need to take care for our planet. Show your support by sharing this with some facts and information about recycling.

November 18th

#PrincessDay: Pamper the princesses in your business or show appreciation of your customer.

#MickeyMouseDay Need we say more?

November 19th

International Men’s Day #MensDay: Men’s day is great to share information about current men’s health issues. Perfect for those in the healthcare industry

#PlayMonopolyDay: This one we feel is perfect for finance. “Don’t get caught in monopoly games and get your money safe” what do you think?

November 20th

#EntrepreneursDay Completely self-explanatory.

#NameYourPCDay Give some love to those PC users in your industry and have fun too.

November 21st

#HelloDay A great hashtag to introduce yourself and the team.

November 22nd

#GoForARideDay Whether it is a ride on a car or bike ride, many can use this hashtag if you are creative enough.

November 23rd

#FlossingDay perfect for those in the dental industry.

#EspressoDay Just like #CapuccinoDay, this hashtag can help greatly any account.

November 25th

#ShoppingReminderDay If you sell goods, this one is for you.

November 30th

#ComputerSecurityDay Technology always changes, this one can be an excellent reminder to keep online info safe.

All Month Long:

#PeanutButterLoversMonth When you ran out of ideas or inspiration this month, this hashtag can be a lifesaver. Remember that social media should entertain or educate and this one can help with that.

Bonus Holidays:

These might not be random but are always useful to add.

#Movember

#ThanksGiving

#CyberMonday

We hope these hashtags can help boost your business online presence and bring a little more creativity to your social media game. As always, have fun and use your to see if any of these can help your business.

Posted in Small Business Improvement Tagged with: account, business, capuccino, christmass, coffee, consumers, credit card, customer, customers, data, disney, e-commerce, Facebook, finance, fun, hairdressers, hashtags, holidays, Instagram, lawyers, merchants, payments, photography, restautrant, retail, Security, social media, transactions, twiter

October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

August 24th, 2017 by Elma Jane

Travel agencies are viewed as high-risk merchants. As such, you need a merchant solution that best suits a travel merchant needs.

You want an account that eliminates the complexities of a typical shopping cart. Ideally, it allows you to request payment from clients without the need of setting up booking engines and carts.

This post is going to guide you on how to use a payment solution e-Pay and other merchant solutions to ensure a seamless operation of your business.

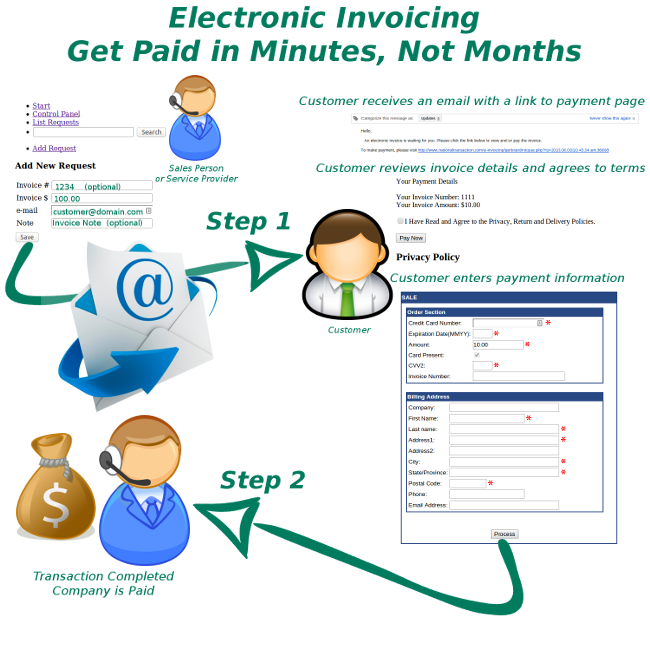

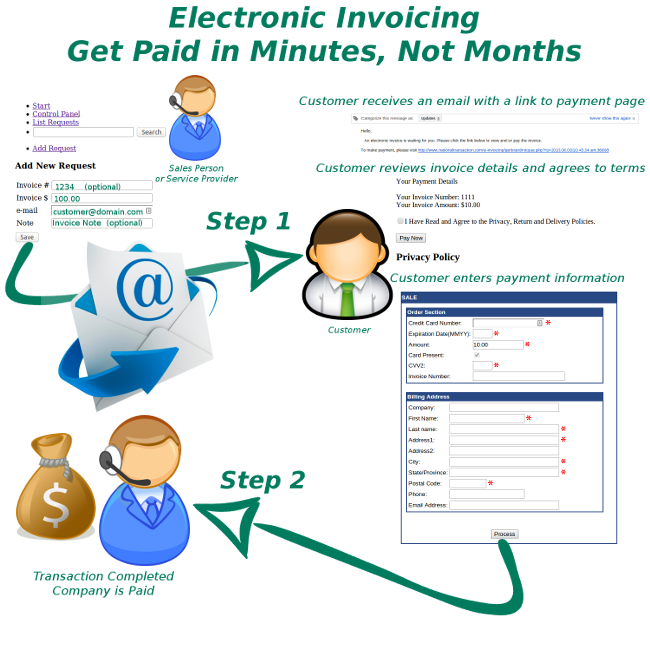

Leveraging the NTC e-Pay Service

Payment solution e-Pay allows you to eliminate the complexities of integrating payment processing into your point-of-sale or an accounting system.

With this payment method, you only need to send a payment request to your customers via email. You don’t need to send invoices via snail mail or fax any forms to your customers. Plus, NTC e-Pay doesn’t need you to take orders over the phone.

With this service, you can create a “BUY” button for any transaction amount in seconds. You also don’t need a website to you use this service. NTC e-Pay allows you to generate a digital link that you can email to clients.

The service allows you to customize the process to make everything simple for your customers. After the customer pays the specified amount, a receipt is generated, and the amount is sent to your account.

Tomorrow we are going to discuss on how to understand your Travel Merchant Account….So standby to learn more.

For NTC e-Pay Set Up call Now 888-996-2273

Posted in Best Practices for Merchants Tagged with: customers, merchants, payment, transaction, travel, travel agencies

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

June 27th, 2017 by Elma Jane

E-commerce has been growing, and now the overall market is starting to take notice; thanks to advances in online payment processing and electronic payment technology, as well as the willingness of almost all merchants to accept credit cards online.

E-commerce ecosystem are set to double and will account for a rising share of overall card payments. In addition to increased internet and smartphone penetration; more e-commerce merchants and an increase in the use of digital wallets.

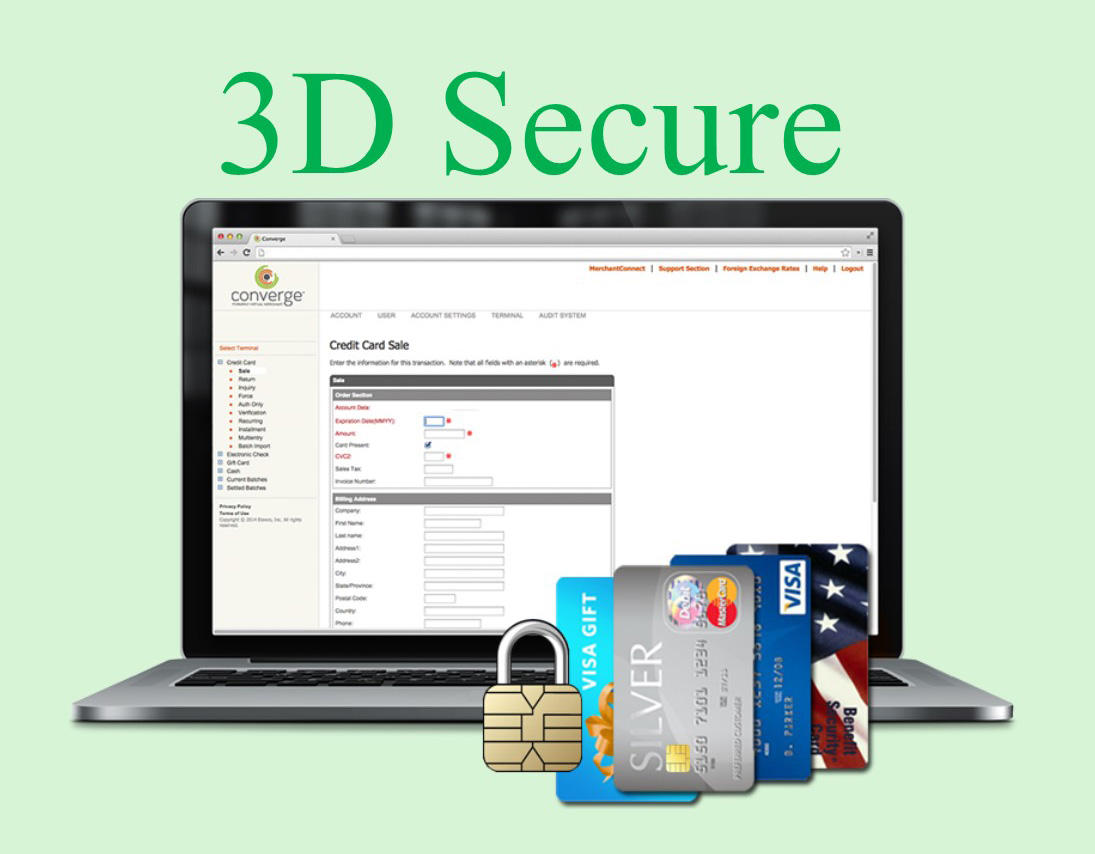

Cardholders globally are becoming more confident in the security of the e-commerce channel, with the expected implementation of 3D-Secure 2.0 and increased use of sophisticated anti-fraud systems in many markets it gives consumer assurance that payment cards are safe to use for e-commerce purchases.

Trends indicate that e-commerce is the wave of the future for shoppers. But digital shopping is just one piece of the broader payments ecosystem.

For Electronic Payment Set Up Call Now! 888-996-2273

Let’s Get Started National Transaction.Com

Posted in Best Practices for Merchants Tagged with: card payments, credit cards, Digital wallets, e-commerce, electronic payment, merchants, online, payment, Security, smartphone

May 31st, 2017 by Elma Jane

If you’re a retail business you’re going to need a credit card terminal to accept credit cards, and if you have multiple locations; you might need more than one terminal.

Obtaining terminals for your business with multiple locations can be expensive. Because of this, some merchants used leasing arrangements which they think that monthly leasing fee might seem like a bargain compared to the cost of buying a terminal.

One provision of the lease is: Non-Cancelable Lease

Leases commonly have a 48-month (four-year) term, and a clause that makes the lease completely non-cancelable.

They also have a purchase option at the end of the lease. You must exercise your option to end the lease.

In a non-cancelable provision, they’ll keep deducting monthly leasing fees from your account regardless of anything, or an immediate payment of all remaining months of your contract if you break your lease.

In addition to monthly leasing fee, you’ll also pay sales tax and a monthly equipment insurance fee; while you can purchase it for as low as $150-$200.

Beware of free terminal offers, other providers will offer a free terminal, but they also charge higher monthly fees if you elect the free terminal. So the terminal isn’t really FREE.

For Electronic Payment Set Up Call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants, Electronic Payments Tagged with: credit card, electronic payment, merchants, payment, terminal

May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

May 2nd, 2017 by Elma Jane

Automated Account Updater

Avoid declined recurring payments with automated Account Updater.

Target Market: Merchants that accept regular recurring monthly donations like church, or recurring monthly tuition payments for schools or any regular customer you need to invoice.

Account updater advantage – Increased Sales and Retention, Reduce Customer Costs and Reduced Operating and Processing Costs.

Convenient and Transparent Account Updates

Account updater – is a service to automatically update the cards on file. These tools are used to ensure the success of recurring payments. This makes the account update process convenient with little effort by the cardholder to maintain a seamless and transparent update of card account information.

For Electronic Payments Set up and account Updater call now 888-996-2273

Or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: card, electronic payments, merchants, payments

April 26th, 2017 by Elma Jane

Best Practices For Merchants!

Recurring and Installment Payments:

Recurring Payments – allows merchant to set up payment amounts and billing cycles in which the payments occur.

Installment Payment – allows merchant to set up payment amounts, the number of payments and the billing cycle in which the payments occur.

Recurring is a useful feature with multiple applications: Donations, Memberships, Subscriptions and Utility Payments.

For Electronic Payments Set up call now 888-996-2273!

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: electronic payment, merchants, payments, recurring

April 17th, 2017 by Elma Jane

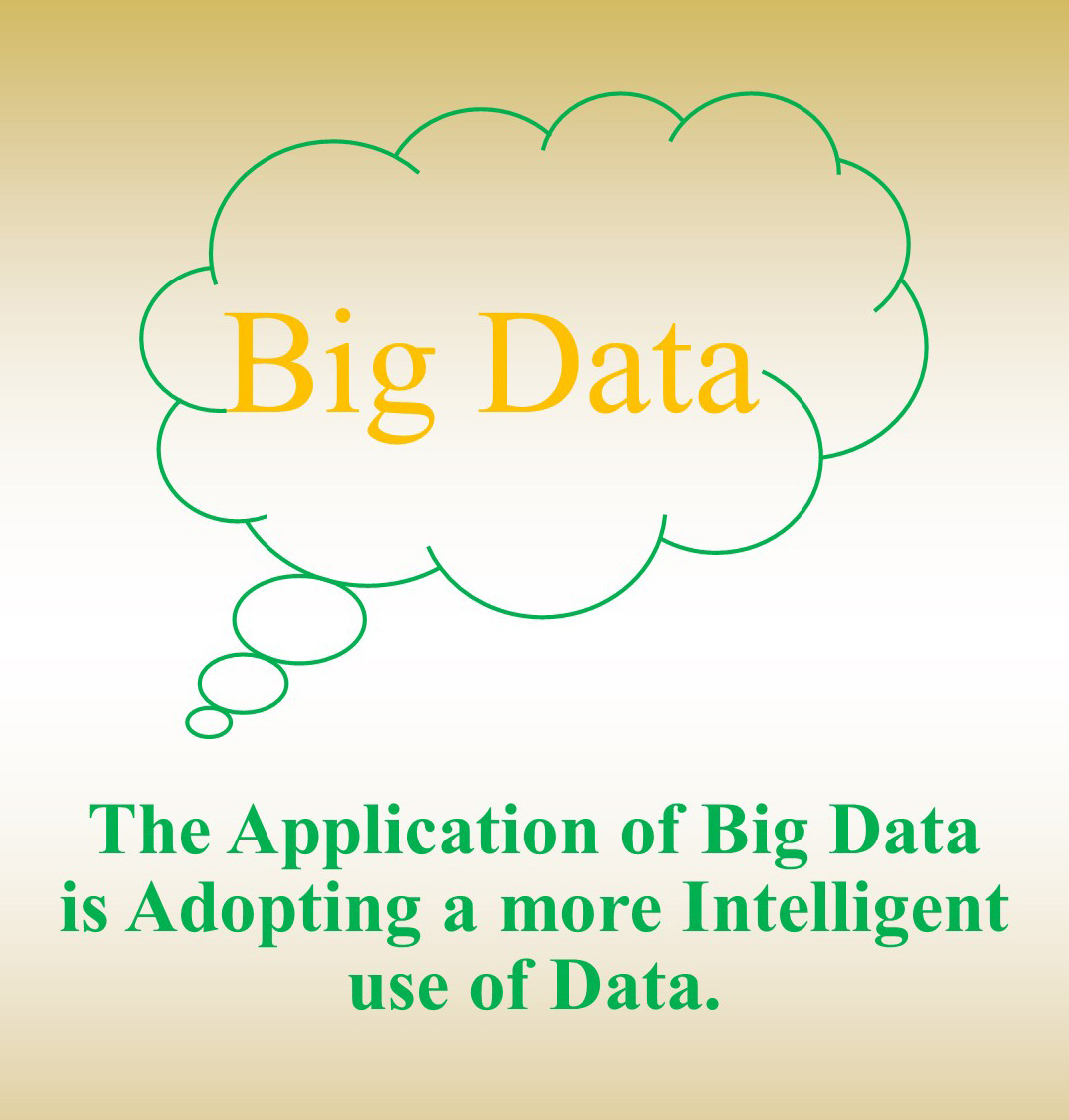

Intelligent Use Of Big Data

In understanding Big Data for Merchants, NTC provided a general overview of how online merchants can use Big Data. Think about this application of big data as adopting a more intelligent use of data.

Keeping customers happy is the key to the travel industry, but customer satisfaction can be hard to gauge in a timely manner. Big data analytics gives these businesses the ability to collect customer data, apply analytics and immediately identify potential problems before it’s too late.

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex.

One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as a CRM and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter.

A business could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions.

In a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

A Virtual Merchant can capture email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected.

As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants. Application of big data is a more intelligent use of data.

You know WHO, WHAT, WHEN, AND WHERE a purchase took place.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: data, database, merchants, mobile, online, point of sale, virtual merchant, website