May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

July 26th, 2016 by Elma Jane

Mobile payment space is growing yet, many small businesses and retailers are choosing to overlook the idea of mobile payment acceptance.

Here are stats that prove the importance of mobile payments:

About 45% of consumers use mobile payments out of convenience.

1 billion users will use in-store mobile payments by 2019.

An increase from $3.2 billion in 2014 to $487 billion by 2020 in US in-store mobile payments is predicted.

Millenials use contactless payments on a regular basis.

Over the next five years, mobile payments will reach about $3 trillion in volume.

There are 16 million Starbucks mobile app active users that make 8 million mobile payments per week.

Transactions globally are on mobile devices.

It is a great investment for a merchant to upgrade your point-of-sale (POS) to have near field communication (NFC) capabilities. If you’re not currently accepting mobile payments, you should start now, your customers who are already using mobile payments will thank you and your business will be ahead of the game as more businesses onboard mobile payment acceptance.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, Mobile Payments, Near Field Communication, Point of Sale Tagged with: contactless payments, customers, merchant, mobile payment, Near Field Communication, nfc, point of sale, POS, transactions

June 8th, 2016 by Elma Jane

Near field communication technology (NFC) is on the rise, and consumers can use NFC not just for making payments.

Top ways consumers can use NFC (Near field communications):

NFC Access Keys – can also be used as your access to certain buildings or hotels.

NFC Boarding Pass – are used in airports to expedite the boarding process. No more keeping track of that printed boarding pass!

File Sharing – on certain Android phones, consumers can share songs, contacts and files from phone to phone with a simple tap.

Retail – Paying in stores simply requires a wave of the customer’s smartphone. This provides speedier transactions, but also provides merchants the opportunity to offer their customers loyalty points and rewards.

NFC Ticketing – speeds up subway boarding time by allowing consumers to use their phones at the reader.

Vending Machines – NFC-enabled vending machines will allow customers to simply tap and go.

With the growing list of NFC technology uses, merchants should be prepared for the adoption. Upgrade your terminal to be NFC-enabled give us a call at 888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: consumers, customer’s smartphone, merchants, Near Field Communication, nfc, payments, retail, rewards, technology, terminal, transactions

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction

April 28th, 2016 by Elma Jane

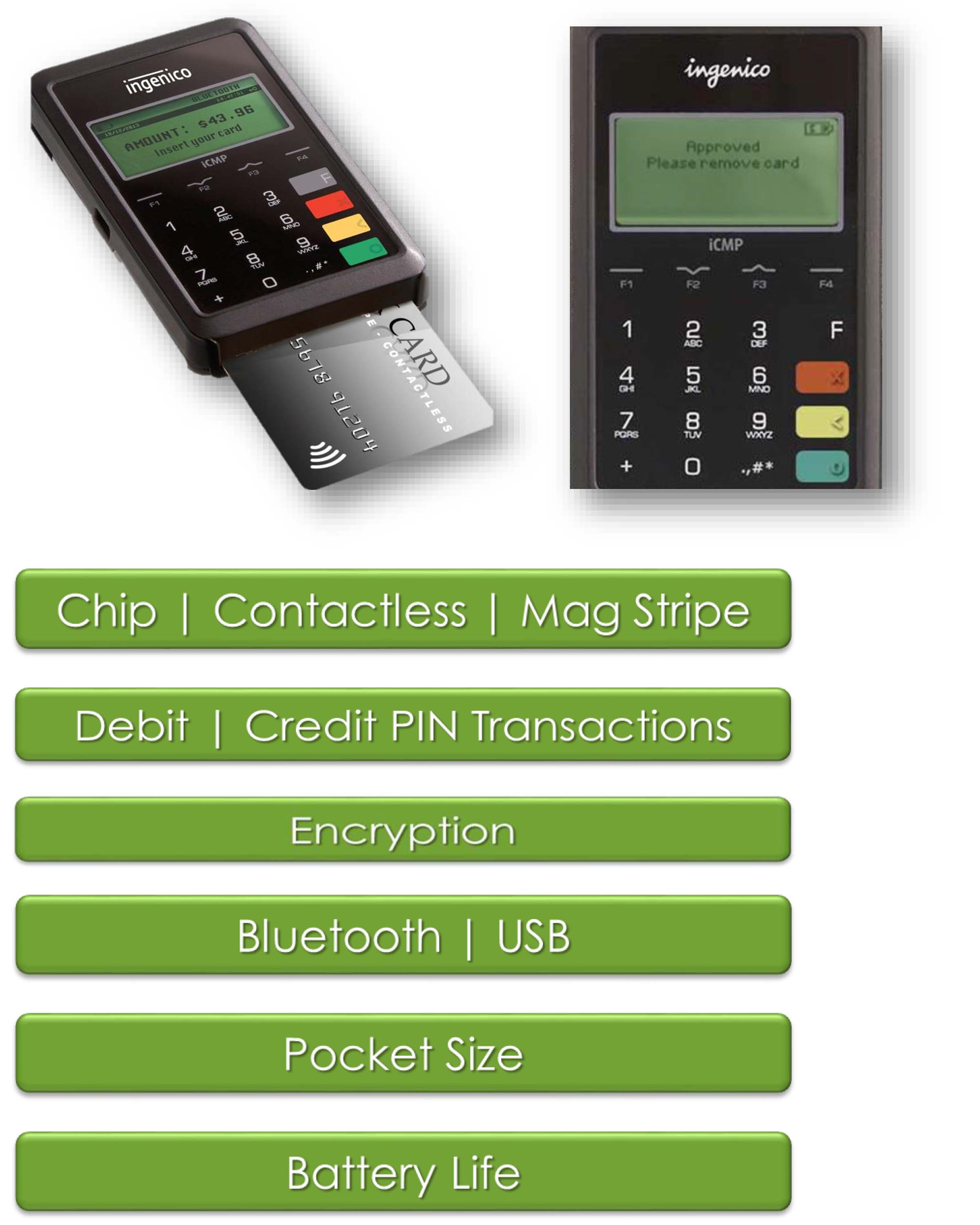

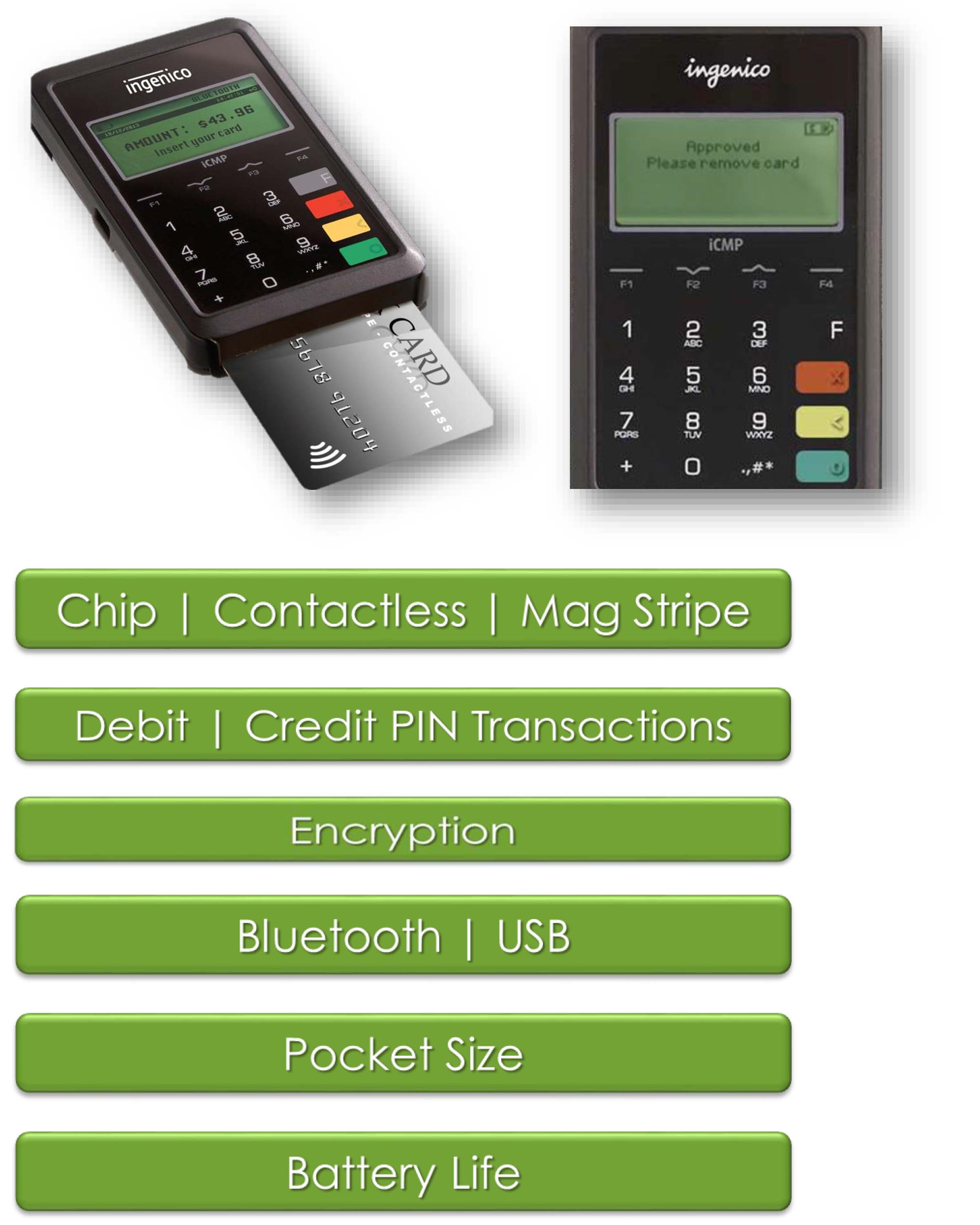

You can offer your customers preferred payment method with the next generation point-of-sales terminals, an all-in-one credit card processing experience: which not only support Near Field Communication (NFC) contactless payment transactions such as Apple Pay but chip cards and the traditional magnetic stripe cards; and manual entry transactions as well.

Contactless payment transactions are happening now. NTC are here to help.

Posted in Best Practices for Merchants Tagged with: chip cards, contactless payment, credit card processing, customers, magnetic stripe cards, Near Field Communication, nfc, payment, point-of-sales, terminals, transactions

April 27th, 2016 by Elma Jane

Near field communication is a contactless communication protocol between devices like (smartphones, tablets, smartwatches or even credit cards themselves) with a nearby NFC-enabled terminal by simply authorizing your device with a passcode or fingerprint authentication.

Both merchants and customers benefit from near field communication technology, by integrating credit cards, train tickets, and coupons all into one device. Faster payment transaction times and fewer physical cards to carry around.

If your smartphone has an integrated NFC chip, you can use a mobile wallet app like Apple Pay, Android Pay and Samsung Pay for items at retailers that support NFC transactions. Just load up your credit cards on your mobile device and wave or tap your device near an NFC compatible terminal to pay, no card swiping required.

As the technology keeps growing, more NFC compatible smartphones will be available and more businesses will offer NFC card readers for customer’s convenience.

Apple Pay, integrated into the newest generation of Apple mobile devices and incorporates NFC technology. If it becomes widely used by many iPhone users, perhaps merchants will be encouraged to more quickly adopt NFC technology.

Many major banks and credit cards are supporting NFC technology, issuing new cards with embedded NFC chips. This means that you may be able to tap or wave your card at the terminal instead of swiping, no phone required, in the next few years.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: cards, contactless, credit cards, customers, merchants, mobile wallet, Near Field Communication, nfc, payment, Smartphones, tablets, terminal, transaction

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 25th, 2016 by Elma Jane

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 23rd, 2016 by Elma Jane

Cardless ATM’s Could Help Push Mobile Wallet Adoption

The mobile wallet will be the payment method in five to 10 years.

Cardless ATM transactions is a great way to introduce smartphones as payments devices. It could help with the adoption of mobile payments and wallets. Mobile Smart Phones will become the piece of plastic and cards will be a thing of the past…

A multinational banking corporation intends to use (NFC) near-field communication for its service. It will let customers leverage NFC technology on their smartphones to authenticate at the bank’s ATM without a debit card.

An NFC cardless ATM transactions could be compatible with Apple Pay which uses NFC technology.

Benefits:

Speedier ATM cash withdrawal takes about 15 seconds without the debit card compared with 60 to 90 seconds with a debit card, whether it’s a chip or magnetic-stripe transaction.

Safer ATM transaction. No physical connection between the phone and ATM, skimming device to intercept the transaction is gone.

The barcode represents the time of day and what terminal the transaction is taking place at. Everything is tokenized.

Cardless ATM transactions are interesting and an appropriate evolution.

Posted in Best Practices for Merchants, Near Field Communication, Smartphone Tagged with: banking, cards, debit card, Mobile Payments, mobile wallet, Near Field Communication, nfc, payments, transactions