August 25th, 2017 by Elma Jane

A travel merchant account helps you manage all your transactions. It also allows you to integrate into your booking software; plus, there are more features that you get to process payments in a secure environment.

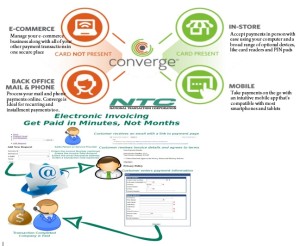

Virtual Merchant Payment Terminal

This is a web-based system that allows you to view processed payments in real-time. You can access it using any web browser, and the transactions are conducted over a secure and encrypted connection.

Customers get receipts for their payments via email once the transaction is complete. You can also handle installments and recurring payments online. It also accepts different payment methods, including gift cards, electronic checks, and credit and debit cards.

Loyalty Programs

With a travel merchant account, you are able to reward your loyal travel customers. You can personalize your loyalty program for customers basing on their behavior. A loyalty program can offer free products or discounts on certain tour or travel packages.

Also, you can make gift cards part of your program. With these cards, you can simply load them with any dollar amount and present them to your customers. Plus, they’re re-loadable and offer a great way of advertising. These programs can go a long way in boosting your customer’s loyalty.

Trams & Sabre Integration

If you’re using Sabre Travel Network for agency services, you can easily integrate your account into Sabre to improve your travel options. This integration allows you to provide convenient payment methods for customers searching for cruise lines, hotel properties, car rental services, and airlines.

Also, for those using Trams for accounting and reporting, NTC travel merchant account lets you make a simple integration. In the long run, you are able to focus on growing your travel agency and offer quality services to your clients.

Mobile Processing

Accepts payments fast and on-the-go with mobile processing solutions that are PCI compliant. With this service, you only need to use a mobile device card reader to swipe cards.

Mobile payment processing allows you to use your own iOS or Android device with a free mobile app which you can integrate with your account to manage transactions.

Offering a convenient and smooth payment methods to your clients is one of the ways to grow your business. National Transaction Corporation merchant account, offers secured travel payment processing services e-Pay, to process your payments; with no delays and at a very competitive rates.

Also, you can accept payments from anywhere and get 100 percent funding. Faster deposits for bookings, which can occur as quick as the next business day.

To speak to our travel payment consultant, call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: card reader, credit, debit cards, electronic checks, Gift Cards, Loyalty Programs, mobile, payment processing, payments, PCI, swipe, terminal, transactions, travel agency, Travel Merchant, virtual merchant

April 17th, 2017 by Elma Jane

Intelligent Use Of Big Data

In understanding Big Data for Merchants, NTC provided a general overview of how online merchants can use Big Data. Think about this application of big data as adopting a more intelligent use of data.

Keeping customers happy is the key to the travel industry, but customer satisfaction can be hard to gauge in a timely manner. Big data analytics gives these businesses the ability to collect customer data, apply analytics and immediately identify potential problems before it’s too late.

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex.

One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as a CRM and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter.

A business could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions.

In a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

A Virtual Merchant can capture email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected.

As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants. Application of big data is a more intelligent use of data.

You know WHO, WHAT, WHEN, AND WHERE a purchase took place.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: data, database, merchants, mobile, online, point of sale, virtual merchant, website

January 24th, 2017 by Elma Jane

How to set up a travel merchant account?

First, you need to find a Merchant Service Provider.

Put together your business profile so you can start applying for a merchant account.

There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should set up your account.

Some of the questions are:

Is your business seasonal?

For Travel Agencies or Tour Operators, it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

How do you intend to accept payments?

Different business models require different methods of accepting payments.

If you’re doing face to face transaction and have a physical location then you need a credit card terminal.

If you process checks, then you need Electronic Check and ACH Transfers.

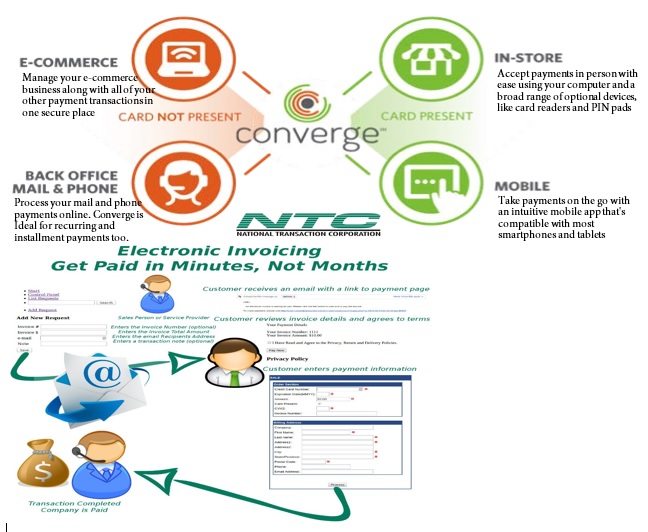

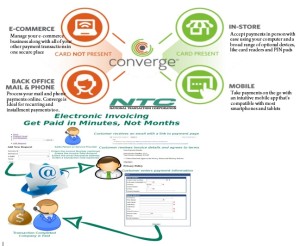

For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

How much volume do you plan on processing?

Merchant account providers are going to want to know how much sales volume you plan on processing per month.

If you’re new in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation.

if you’ve been in the business – you’ll already have this number ready.

What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call at 888-996-2273 or use our contact form.

Posted in Best Practices for Merchants Tagged with: ach, credit card, e-commerce, E-Pay, Electronic Check, merchant account, merchant service provider, mobile, payments, shopping carts, terminal, transaction, travel, virtual merchant

September 9th, 2016 by Elma Jane

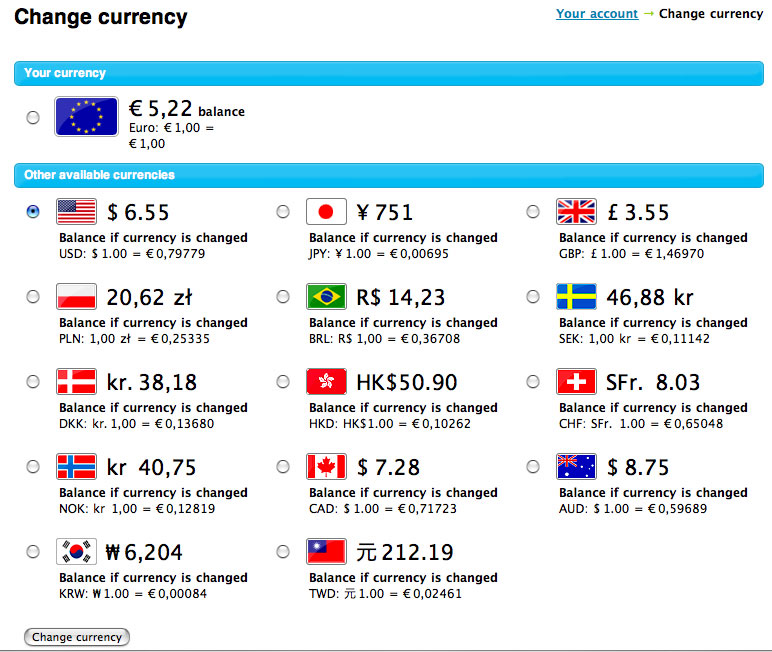

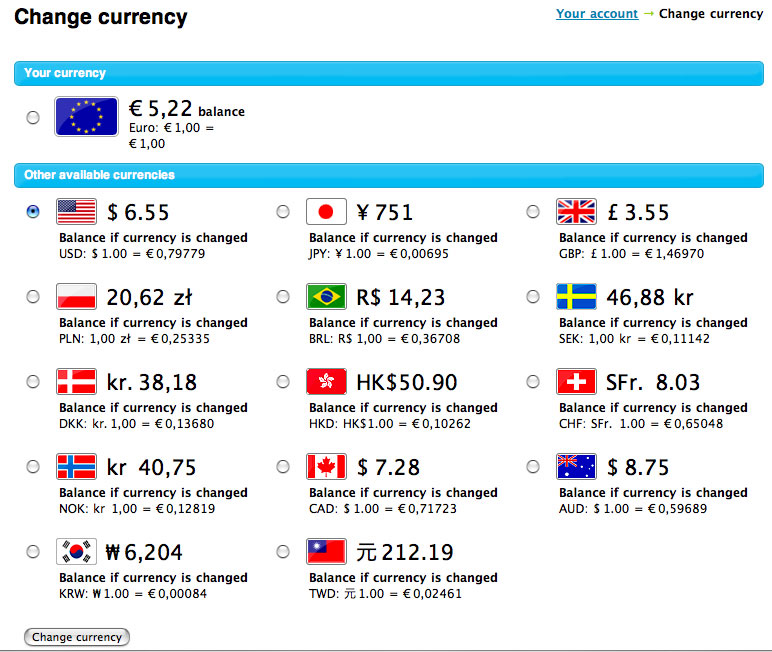

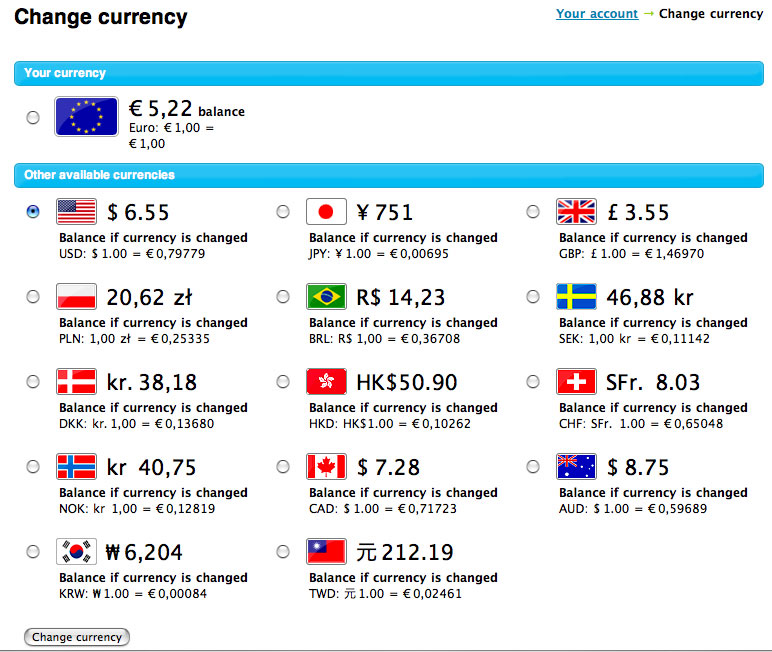

Multi Currency Conversion (MCC):

- In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

- Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

- Conversion occurs between the point of sale and settlement.

- E-commerce only and no merchant rebate.

- Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC):

- Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

- Conversion occurs at the point of sale and five supported currencies less than MCC.

- Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

- Price listed in merchant’s currency conversion.

- For Retail, Restaurant, MOTO and E-commerce.

- Supported by terminals, via Warp and Virtual Merchant.

For more information give us a call at 888-996-2273 or visit our website: www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order Tagged with: customer, e-commerce, merchant, moto, Multi Currency Conversion, point of sale, terminals, transactions, virtual merchant

August 11th, 2016 by Elma Jane

CURRENCY CONVERSION

Multi Currency Conversion (MCC):

In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

Conversion occurs between the point of sale and settlement.

E-commerce only and no merchant rebate.

Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC): Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

Conversion occurs at the point of sale and five supported currencies less than MCC.

Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

Price listed in merchant’s currency conversion.

For Retail, Restaurant, MOTO and E-commerce.

Supported by terminals, via Warp and Virtual Merchant.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Point of Sale Tagged with: currency, customer, DCC, Dynamic Currency Conversion, e-commerce, Internet Secure, MCC, merchant, moto, Multi Currency Conversion, point of sale, retail, terminals, transactions, virtual merchant

April 15th, 2016 by Elma Jane

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant

November 13th, 2015 by Elma Jane

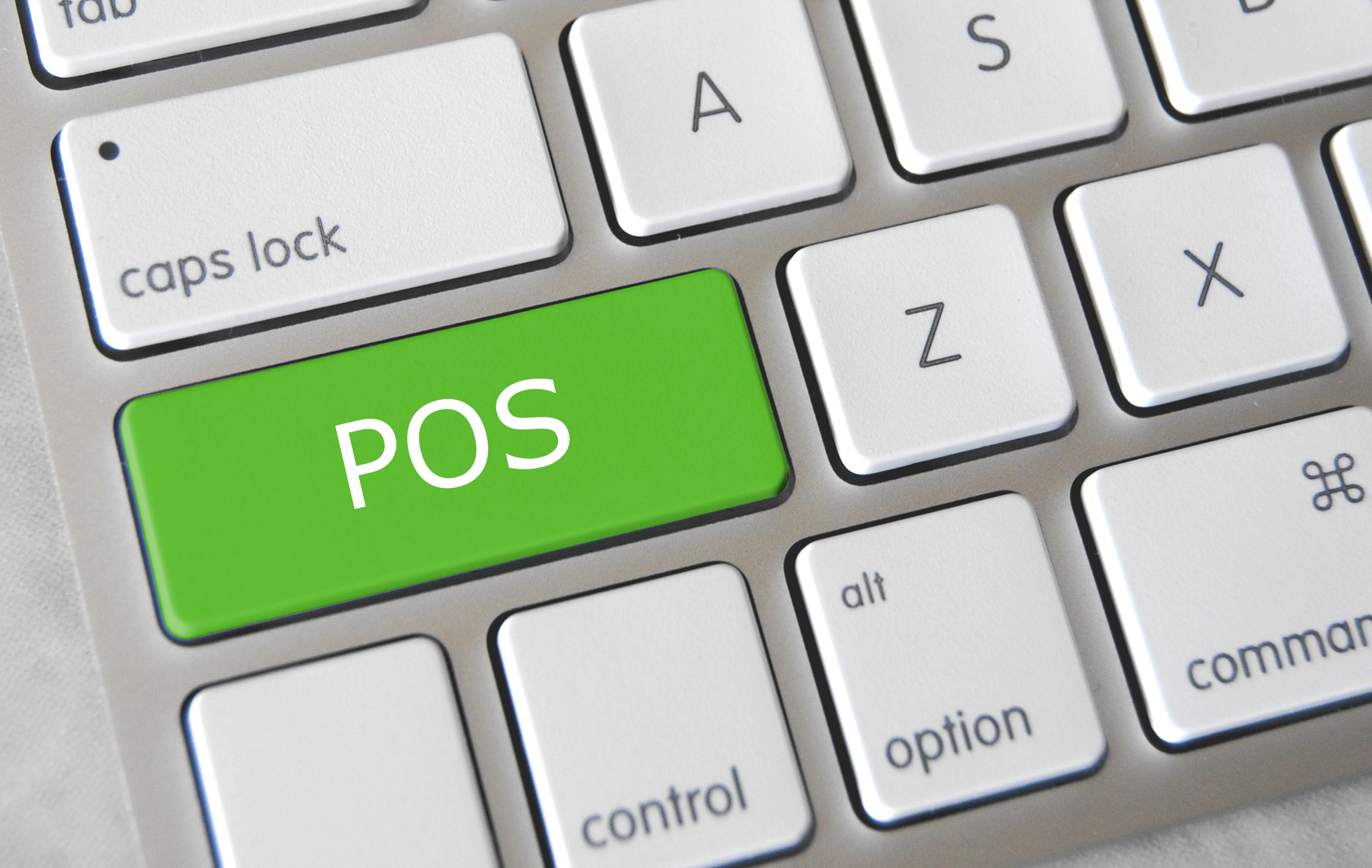

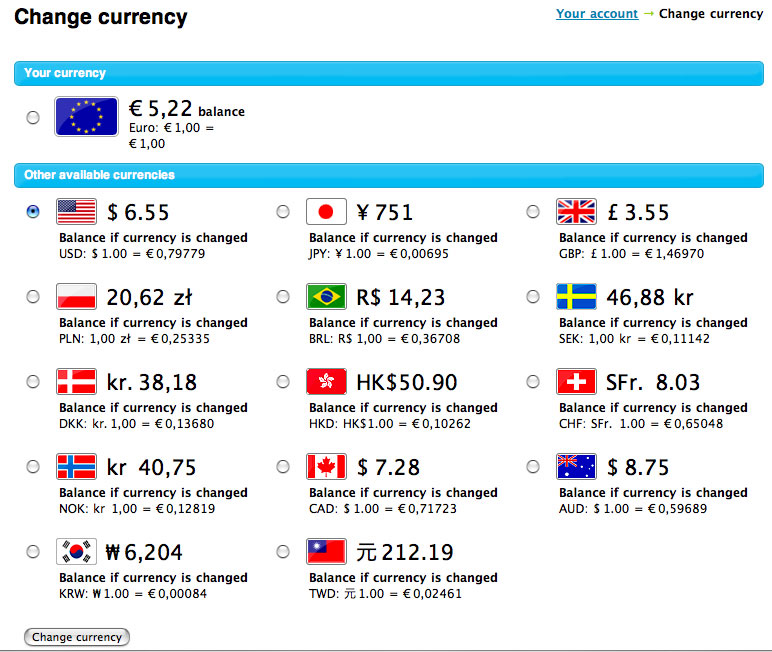

It’s important for merchants to understand the basic of how a credit card terminal works. It is the channel through which the process flows and the merchants can choose the right one for their processing needs, whether they use a point-of-sale (POS) countertop model, a cardreader that attaches to a smartphone or mobile device, a sleek handheld version for wireless processing or a virtual terminal for e-commerce transactions.

A credit card terminal’s function is to retrieve the account data stored on the payment card’s EMV microchip or a magnetic stripe and pass it along to the payment processing company (also known as merchant account provider).

For card-not-present (CNP) – mail order, telephone order and online transactions – the merchant enters the information manually using a keypad on the terminal, or the e-commerce shopper enters it on the website’s payment page. The back half of the process remains the same.

The actual data transmission goes from the terminal through a phoneline or Internet connection to a Payment Processing Company, which routes it to the bank that issued the credit card for authorization.

In card-present transactions where the card and cardholder are physically present, the card is connected to the reader housed in the POS terminal. The data is captured and transmitted electronically to the merchant account provider, who handles the authorization process with the issuing bank and credit card networks.

A POS retail terminal with a phone or Internet connection works best in a traditional retail setting that deals exclusively in card present transactions. For a business with a mobile sales, a mobile credit card processing option like Virtual Merchant Converge Mobile relies on a downloadable app to transform a smartphone or tablet into a credit card terminal equipped with a USB cardreader.

Wireless Terminals are compact, allowing you to accept credit cards in the field without relying on a phone connection. If you process debit cards, you’ll need a PIN pad in addition to your terminal so cardholders can enter their personal identification number to complete the sale.

Selecting the right terminal for your credit card processing needs depends largely on the type of business you run and the sorts of transactions you process. Terminals are highly specialized and provide different services. At National Transaction we offer a broad range of terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC/Contactless payment transactions at your business. An informed business decision benefits your bottom line. Start accepting credit cards today with National Transaction.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Point of Sale Tagged with: Android Pay, Apple Pay, card-not-present, card-present transactions, cardholder, cardreader, cnp, contactless payment, Converge Mobile, credit card, credit card networks, credit card terminal, debit cards, e-commerce, EMV, magnetic stripe, mail order, merchant account provider, merchants, microchip, mobile credit card processing, mobile device, Near Field Communication, nfc, online transactions, payment processing company, PIN pad, point of sale, POS, POS terminal, smartphone, telephone order, virtual merchant, virtual terminal, wireless processing

October 12th, 2015 by Elma Jane

Setting up a merchant account.

- First find a Merchant Service Provider.

- Then setup your Business Profile.

Put together your business profile so you can start applying for a merchant account. There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should setup your account.

Some of the questions are:

- Is your business seasonal? For Travel Company it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

- How do you intend to accept payments? Different business models require different methods of accepting payments. If you’re doing face to face transaction and have physical location then you need a credit card terminal. If you process checks, then you need Electronic Check and ACH Transfers. For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

- How much volume do you plan on processing? Merchant account providers are going to want to know how much sales volume you plan on processing per month. New in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation. Been in the business – you’ll already have this number ready.

- What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call now at 888-996-2273 or go to www.nationaltransaction.com to know more about our services.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: ach, Converge, credit card terminal, e-commerce, Electronic Check, merchant account, merchant service provider, NTC e-Pay, payments, Travel Company, virtual merchant

September 22nd, 2015 by Elma Jane

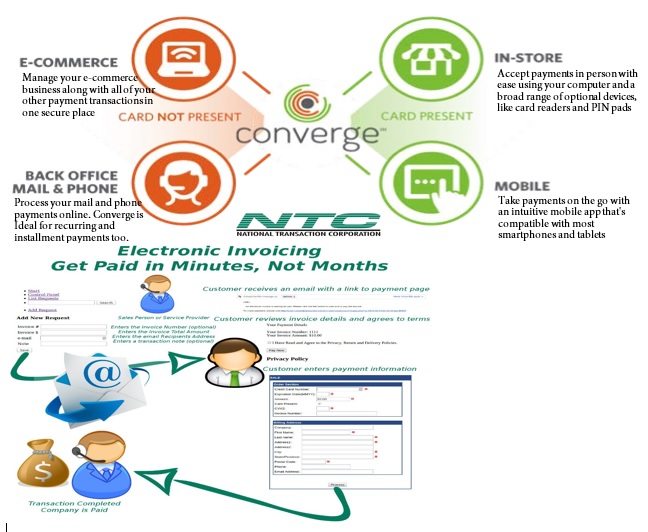

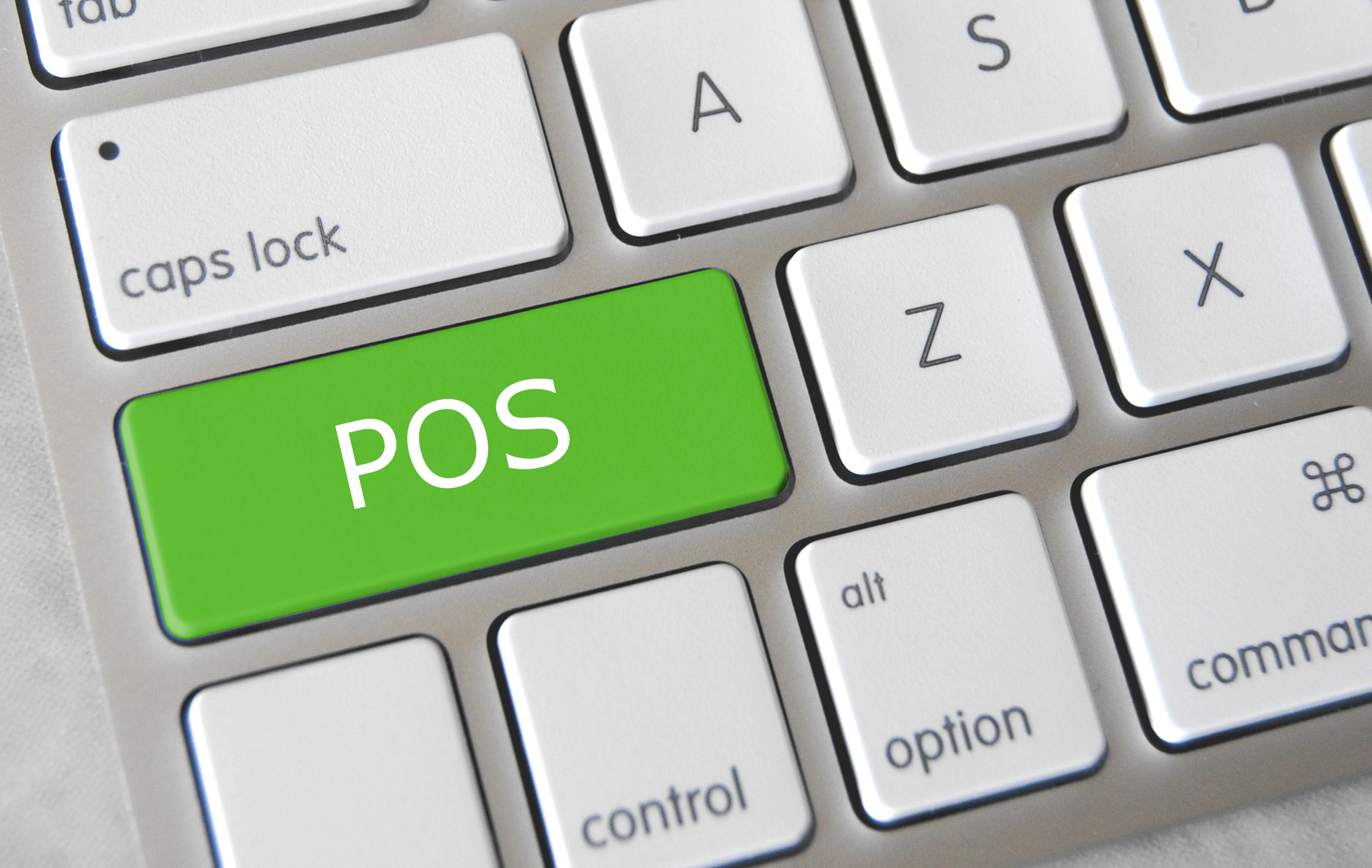

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

September 10th, 2014 by Elma Jane

Merchant go into business to make a sale. They go to great length to advertise their business and then they make a sale and don’t track it… They don’t track the very customer they went into business to attract…That seems crazy…But now more companies are embracing the practice of collecting email addresses at the point of sale (POS) and they’re doing so with increasing regularity. An example, when customers are at the cash register, many brick-and-mortar stores now offer to email them receipts

Confidently collect email addresses at POS:

Your email service provider should be able to implement a text-to-join acquisition program for you that executes quickly and can be built specifically to mitigate the risks around POS data collection.

Instead of relying on sales associates to accurately input email addresses, your customers can use SMS to text their email addresses to your short code.

Customers receive an immediate SMS reply message letting them know to check their email for their receipt.

A mobile-optimized receipt is immediately emailed to the address.

This can be followed by an email inviting customers to join your company’s email program. Offering a purchase discount can increase opt-ins. New joiners can be sent an age verification email, if relevant.

Your welcome email, including discount coupon, is sent and the relationship starts off on the right foot.

Increasing your confidence about POS email address collection, a text-to-join program can increase your acquisition rates. It can engage those customers who prefer to provide their information privately via their mobile devices. It can help protect companies against potential blacklisting because of typos and confirmed opt-ins. It can even reduce overhead costs by saving sales associates valuable time. Understanding these important email address collection issues and adopting the prescribed best practices are critical to ensuring customers have a safe, positive and valuable experience with your company at the point of sale and beyond.

Virtual Merchant can collect data too, and as a provider we can help merchant use that data. We are committed to providing appropriate protection for the information that is collected from customers who visit the website and use the Virtual Merchant payment system. Policy Privacy is updated from time to time.The website is provided to our customers as a business service and use of the site is limited to customers only.

If the merchant never makes a sale before 10 why do they open at 9 ?? This is only one small example on how collecting data first and then analyzing that data can shape businesses and find money you may be throwing away ….

Posted in Best Practices for Merchants, Mobile Point of Sale, Point of Sale Tagged with: brick and mortar, business, cash, cash register, customers, data, discount, discount coupon, email, merchant, mobile, Mobile Devices, payment, payment system, point of sale, policy, POS, provider, purchase, Rates, receipts, sale, service, sms, store's, virtual merchant, website