May 19th, 2014 by Elma Jane

Keeping your business’s finances in order doesn’t have to take all day. Bookkeeping is a necessary for small business owners, but it’s a time-consuming chore.

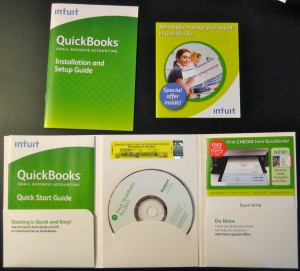

If you use QuickBooks for payroll, inventory or keeping track of sales, there are several timesaving shortcuts you can utilize to make bookkeeping easier.

Time-saving tips for getting the most out of QuickBooks in the least amount of time. Help you spend more time building your business and less time using QuickBooks.

Download data whenever possible. Even after factoring in initial setup time, downloading banking and credit card activity directly into QuickBooks is a huge time saver. Doing this will minimize the chance of human error and enable you to record activity faster than if you did it manually.

Make the Find feature your friend. Using the Find feature is the most efficient way to locate a particular invoice in QuickBooks. Those who usually open the form and click Previous until the form appears on the screen know how tedious this process can be. The Find tool will search for almost any transaction-level data, depending on your filters.

Memorize transactions. QuickBooks has the capability to memorize recurring transactions (invoices, bills, checks, etc.) and set them for automatic posts daily, weekly, monthly, quarterly and annually, eliminating the need to enter the same transaction into the software every month.

Use accounts payable aging. Use this feature for a snapshot on who you owe money to and manage your cash flow more efficiently.

Use accounts-receivable aging. Use this feature for a snapshot of information on who owes you money, how much you are owed and how long the individual has owed you.

Use classes. Classes can be very helpful to track income and expenses by department, location, separate properties or other meaningful breakdowns of your business.

Use QuickBooks on the go with remote access. Remote-access methods include QuickBooks Online, desktop sharing and QuickBooks hosting on the cloud, which allows you to take the program on the go and make changes no matter where you are.

Posted in Best Practices for Merchants Tagged with: accounts, accounts payable, banking, banking and credit card, bills, Bookkeeping, card, cash flow, checks, cloud, credit, data, desktop, desktop sharing, finances, hosting, income and expenses, invoices, online, program, QuickBooks, Remote-access, software, transaction

December 2nd, 2013 by Elma Jane

U.S. Bank has announced the U.S. Bank Contour Card – saying that the new card gives customers the convenience of a debit card, the control of a bank account and the freedom of cash. Giving customers innovative options to manage their finances. The Contour Card is the latest example. It’s a great tool to manage expenses by giving you the power to budget your money across multiple prepaid cards under the same account. Customers can use Contour as their primary payment card, but it is also a good fit for anyone who wants a new way to manage money.

Contour gives control over your spending in so many ways. From tracking your spending to transferring money between accounts, Contour gives customers the ability to manage it all from one location through their personal My Contour Dashboard.

Cardholders can open up to five additional card accounts that can be linked to their primary account. Cardholders can use Contour anywhere Visa Debit cards are accepted, get free cash withdrawals at any U.S. Bank or MoneyPass ATMs, and direct deposit paychecks to their accounts at no additional charge.

Posted in Financial Services Tagged with: account, ATMs, budget, card, cardholders, debit card, deposit, finances, money, MoneyPass, paychecks, prepaid, tracking, tranferring, U.S. Bank, US Bank, visa, withdrawals