Category: Best Practices for Merchants

November 3rd, 2015 by Elma Jane

While EMV represents a significant improvement in the way credit/debit card fraud is detected and prevented, some have confused EMV’s capabilities with the concepts of data security and PCI compliance.

Does EMV override PCI?

The answer is NO, EMV technology does not satisfy any PCI requirements, nor does it reduce PCI scope.

- EMV is counterfeit card fraud protection – it makes it more difficult to make use of stolen card data.

- EMV is not encryption – EMV does not encrypt the Primary Account Number (PAN) and therefore the card data must still be protected according to PCI guidelines.

- EMV only works for card present transactions.

If your business accepts credit or debit cards in a physical store or other face-to-face setting, you will need to implement the EMV technology and PCI standards. If you upgrade your terminals for EMV, consider adding point-to-point encryption (P2PE) capabilities to reduce PCI scope and protect data end to end. In addition, using tokens after authorization can prevent the card data from being used, should it be stolen.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security Tagged with: card data, card fraud, card present, counterfeit card, credit, data security, debit card, EMV, emv technology, fraud, p2pe, PAN, PCI, PCI Compliance, point-to-point encryption, Primary Account Number, terminals, tokens

November 3rd, 2015 by Elma Jane

Dear National Transaction Corporation IT Department,

It is with great pleasure that I write about our wonderful experience with National Transaction Corporation and more specifically with John Barbieri and the e-invoicing product. The tool will streamline our payment processing and make our booking process as a tour operation company exponentially more client friendly. We have already used the system to successfully receive payment from prospective clients literally days after sending them a proposal, instead of waiting weeks for them to fill out, sign and fax in a credit card authorization form. John tailored the system to be fully branded from our company colors to adding custom fields to fit our business needs. I would highly recommend the e-invoicing system for any business looking to streamling their credit card processing and invoicing system.

Warmest regards,

Marco A. Marano

CEO, CountryBred

Posted in Best Practices for Merchants, Travel Agency Agents

November 2nd, 2015 by Elma Jane

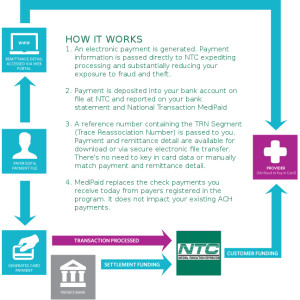

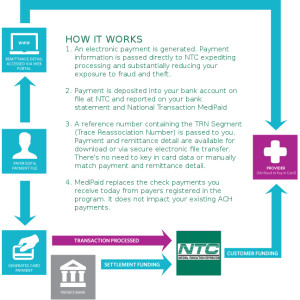

Delivering Paperless, Next-Day Deposits for Health Insurance Payments.

NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance payments. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: checking account, credit card, electronic payments, health insurance, healthcare provider's, medical insurance, MediPaid, merchant accounts, payments, provider's

November 2nd, 2015 by Elma Jane

Apple’s mobile payment and digital wallet service will become available for American Express Card Members in Canada and Australia this year, with Spain, Singapore and Hong Kong to follow suit next year.

Card Members in these markets will be able to seamlessly add their small business, eligible consumer and corporate American Express Cards and pay on the go with their iPhone, iPad or Apple Watch devices in stores where American Express and contactless payments are accepted. They will also be able to pay using their iPad or iPhone in participating merchant apps.

Card Members paying with Apple Pay will continue to take advantage of the protection and customer service that American Express is known for. They will also receive real-time notifications and details for their purchases, as well as enjoy seamless connection to the Amex Mobile app for better account monitoring, servicing and access to rewards and offers.

Posted in Best Practices for Merchants Tagged with: Card Members, contactless payments, Digital Wallet, merchant, mobile payment

October 30th, 2015 by Elma Jane

National Transaction Corporation is the preferred Credit Card Processing Agent for many National Travel Agencies & Associations. We are the preferred merchant account service provider for ASTA, OSSN, ARTA, HBTA,Vacation.com, Travel Leaders, Trams and many more. We are also affiliated with JaxFax, Travel weekly, TRO / Travel Research Online and other travel agency associations in the travel agent industry.

Benefits of our Merchant Account Services for Travel Agencies.

Competitive credit card processing rates & fees for travel agents

Faster deposits (as quick as 24 hrs from transaction)

No holds on funding

Trams Credit Card Merchant Account Integration

Sabre Red Merchant Account Integration

Booking Software Processing Integration

Lower Processing Rates & Fees

Swiped Rates for face to face credit card processing

ecommerce for shopping cart credit card processing

National Transaction Corporation has a proven track record with many of the Largest Travel Agency Associations in the U.S. and Canada. In fact for several of those, we are the preferred credit card processing merchant account services provider for their members. We can take your business to the next level with integration into Trams, Sabre, Sabre Red or off the shelf accounting programs like QuickBooks and Peachtree Accounting.

We are more than happy to provide you with a free merchant account rate review and go over your current credit card processing details and show you how we can save you money and get deposits even faster. We also offer industry leading technical support around the clock, you call, we answer. Simple as that. We can assist errant transactions, chargebacks, terminal messages and much more. Find out why National Transaction Corporation is the preferred merchant account services provider for travel agents & agencies.

Call us now and put us to the test. 888-472-7112

American Society of Travel Agents, Vacation.com, ASTA, Trams, Virtuoso, Travel Leaders, Association of Retail Travel Agents, Specialty Travel Agent Association, Cruise Holidays Credit Card Processing.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: chargebacks, credit card, credit card processing, ecommerce, merchant account, Merchant Account Services, National Travel Agencies, shopping cart, travel agencies, travel agency, travel agent

October 29th, 2015 by Elma Jane

What is Identity Theft?

Identity theft and identity fraud are terms used to refer to all types of crimes in which someone wrongfully obtains and uses another person’s personal data.

Basic categories of identity theft:

Account Takeover Fraud – is one of the two basic forms of financial identity theft, it occurs when a fraudster obtains and uses a victim’s personal information to take control of existing bank or credit card accounts and carries out unauthorized transactions right at a point of sale or access individual accounts online. Victims are often the first to detect account takeover when they discover charges on monthly statements they did not authorize or funds depleted from existing accounts.

Business or commercial identity theft – entails using a business’ name to obtain credit or even billing a business’ clients for products and services. Business identity theft can go on for years undetected.

Criminal identity theft – occurs when an imposter gives another person’s name and personal information such as drivers’ license, date of birth, or Social Security Number to a law enforcement officer during an investigation or upon arrest.

Identity cloning – some people use identity theft and identity cloning interchangeably, but definitely are not the same thing. True identity clones pretends to be you, they want to assume your identity. They want to become YOU.

Medical identity theft – occurs when someone steals your personal information (like name, Social Security Number or MediCare Number) to obtain medical care in your name. Medical identity theft can damage your credit rating.

New Account Fraud – means using another’s personal identifying information to obtain products and services. New credit card accounts is the most prevalent form of new account fraud. Because the thief is likely to use a different mailing address, the victim never sees the bill for the new account. When this type of fraud involves a credit card, once the new plastic is issued, the criminal turns it into cash very quickly. Victims may also be denied credit as a result of applying for loans.

Posted in Best Practices for Merchants Tagged with: bank, credit, credit card, data, fraud, medical, Medicare, point of sale, transactions

October 29th, 2015 by Elma Jane

Computer viruses are a big nightmare that can disrupt your PC’s performance, they are designed to corrupt your machine.

Here are the most dangerous computer viruses of all time:

Code Red – taking advantage of the Microsoft Internet Information Server’s flaw, Code Red spread on the network servers in 2001, it didn’t need you to open an email attachment or execute a file; it just required an active Internet connection with which it ruined the Web page that you opened by displaying a text Hacked by Chinese! This virus devastated nearly $2.6 billion dollars by hitting almost one million PCs in less than a week’s time, the virus brought down over 400,000 servers that included the White House Web server as well.

ILOVEYOU – virus managed to wreck PCs all across the world. Infecting almost 10% of the world’s PCs connected to the Internet, the virus caused a total damage of around $10 billion. The virus apparently got transmitted via email Love-Letter-For-You.TXT.vbs. The moment someone opened the file, the virus emailed itself to the first 50 contacts available in the PC’s Windows address book.

Melissa – built by David L, Melissa became the breaking news on March 26, 1999, was spread in the form of an email attachment by the name list.doc. FBI arrested David L and slapped him with a fine of $5000 for creating the wildest virus of its time.

My Doom – hit the malware world in 2004. Infecting somewhere around two million PCs. It transmitted itself via email, a receiver would first consider a bounced error message that read Mail Transaction Failed. This mass mailer worm caused a damage of almost $38 billion.

Sasser – Sasser was a Windows worm that was discovered in 2004, it would slow down and crash the PC, making it even hard to reset without cutting the power. Millions of PCs being infected and crucial, significant infrastructure affected. The worm played on a buffer overflow susceptibility in Local Security Authority Subsystem Service (LSASS) that monitors the safety policy of local accounts causing crashes to the PC, resulting in over a million infections. This included critical infrastructures, such as new agencies, hospitals, airlines, and public transportation.

Posted in Best Practices for Merchants

October 27th, 2015 by Elma Jane

If there’s an unauthorized charge made on your credit card account, no money is taken from you. There’s no immediate financial hit while you straighten things out. But if someone gets hold of your debit card information, your bank account will be drained depending on the nature of the transaction.

Differences between a credit card and a debit card:

Debit cards fall under a different federal law than credit cards. Regulation E, the Electronic Fund Transfer Act, says after two days, you could be liable for up to $50. After 2 days liability jumps to 500.00. Beyond 60 days, you could be liable for all unauthorized transactions. Otherwise, federal rules are on the bank’s side. Beyond 60 days, there’s likelihood you’ll never see your money again.

Federal law protects you from unauthorized charges made with your credit card number rather than with the actual card. In the event the credit card is in a thief’s hands, you’ll be liable, but only for a maximum of $50, provided you report the problem to the credit card company. However, in many cases a zero liability policy may kick in.

There are many things that can go wrong. Best solution is to pay close attention to your statements, online or via a mobile app, frequently. Report if there’s a malicious transaction.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, credit card company, debit card, Electronic Fund Transfer, transaction

October 27th, 2015 by Elma Jane

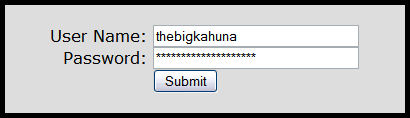

Users need to take personal responsibility for their passwords, people tend to stick with simple, easy to remember passwords, but these are the passwords that are easy to hack.

There are many ways that a hacker can get into your online account.

Force attack is one way to gain access to information, and is generally done when a hacker writes a special code to log into a site using specific usernames and passwords.

Hacker instructs the code to try thousands of different username and password combinations on the target site, such as your bank.

Hacker usually focuses on websites that are not known for security and if you are like most people, the same password and username you use on your favorite site is the same you use at your bank is not a good idea.

What makes this easier? Your computer stores cookies, which have information on your login credentials, in a neat, orderly unencrypted folder on the cache of your web browser. As soon as this is accessed, it can be used to get into online accounts.

How to Improve Your Passwords

Consider using a password manager to keep track of all of your account credentials. This way, you won’t have to worry about remembering all of the symbols and letters.

Have a different username and password combination for every account.

Substitute numbers for letters, such as @ for O.

Test your password strength with an online tester, but make sure it is from a reputable source.

Throw in a random capital letter.

Don’t learn a hard lesson when it comes to your passwords, update your log in credentials and have a safer tomorrow.

Posted in Best Practices for Merchants Tagged with: bank, Security

October 26th, 2015 by Elma Jane

End Of Life (EOL) terminals are terminals that are no longer produced by the manufacturer, but are still commonly in use today, some of these terminals may be considered obsolete.

If you’re a merchant having trouble with your Hypercom/Equinox 4200 series terminals and they have stopped working or you’re receiving an error message such as Security Error please call your service provider to discuss available options. This is an industry-wide outage that potentially affects all Hypercom/Equinox users.

Now’s a great time to upgrade If you haven’t already, you will need to adopt point-of-sale devices with NFC/contactless readers where you can accept Apple Pay, Android Pay and other contactless device in your business. National Transaction Terminals are EMV/NFC/Contactless readers capable! Give us a call now! at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: Android Pay, Apple Pay, contactless readers, EMV, Equinox, hypercom, merchant, nfc, point of sale, terminal