October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

Cash When You Need it by Not Holding Funds

In our second installment, we talked about NTC’s newest solution, NTC ePay. This third and final reason in this series will go over how NTC keeps your cash flow going.

Due to the history of travel businesses, many travel agencies are given a travel merchant account with monthly credit card processing volume caps. This means merchants are only permitted to handle a specific number of credit card transactions per month. Once that limit amount is reached, the merchant can no longer take credit cards for purchases that month. This keeps a business, especially an e-commerce merchant that relies on credit card payments, from operating effectively.

Imagine the impact on your travel agency when you no longer have to worry about having your cash flow stopped. We work very hard to eliminate holds and reserves on all our travel accounts.

Now imagine you getting approved for large volume.

You will agree that those two factors will have a huge positive impact on your business growth.

Most merchant providers usually hold funds from travel agents, because historical data shows that consumers are much more likely to dispute and chargeback travel agency transactions because of a change in their travel plans.

You may be wondering, why do we not hold your funds?

Well simply said, because we understand your business. NTC has been doing business with travel professionals like you for over 20 years and we understand that holding funds creates a huge hassle for your operation. We understand that cash flow is essential to your continued success.

With NTC travel agents can feel confident that they will maintain cash flow to help their business operate smoothly and efficiently without interruptions.

Why do travel merchants flag large transactions?

Many travel merchants many times run thousands of dollars worth of transactions and their processor tells them they’re going to simply hold the transaction and not pay the merchant.

We understand how critical it is to have funds available because many agents have shared how with other merchant providers, their cash flow has come to a complete halt at times.

Remember that when you choose a travel payment processor, you must be sure to choose one with experience in working with travel agencies like NTC.

At NTC, we assist you in developing and implementing your fraud prevention procedures, so that you can be proactive in identifying and correcting potential weak spots in your processing cycle.

Over these past three blog articles, we have shared the three main reasons why travel agents like you prefer National Transaction Corporation. Now we want to hear from you as to which of these three reasons is most important for your travel agency business. We’d love to read your comments below.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Merchant Services Account, nationaltransaction.com, Travel Agency Agents Tagged with: credit cards, e-commerce, electronic payment, merchant account, travel

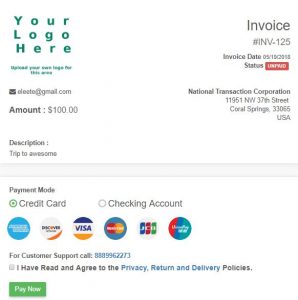

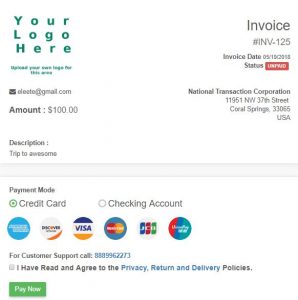

Travel Agents prefer NTC ePay because they get paid faster with their very own “Buy Now” button or simply by requesting payments by email!

Last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTC ePay helps your travel agency.

Last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTC ePay helps your travel agency.

NTC ePay offers travel agents the most innovative technology because it is fast, mobile friendly and easy to use.

Whether you use Quickbooks, Peachtree or any other accounting application, you can enter the invoice number into the ePay application for reconciliation, and you can customize your pricing to any amount you choose. Your agency can create invoice and payment links that can be posted to your website or any social media website for payment.

Don’t you like it when everything seems to work together, making your day a lot easier? Technology is something that can get your daily workflow to go smoothly, and NTC ePay works for you. If you need a customized solution to go with your workflow, NTC can make most anything a reality for your business workflow.

National Transaction Corporation is one of the few travel payment processing companies that can directly integrate with both TRAMS and SABRE. You can perform your bookings like you always have but have the payment flow the way you need it to. We also integrate with many booking engines and shopping carts allowing you many options that are not available by host agencies.

NTC ePay is simple, secure and sets up in just minutes. It’s a web application, so you can use it on any device you already own: your desktop, laptop, tablet or phone. It lets you add inventory items or use the quick send feature for simplified invoicing.

Our ePay product was designed from the ground up with your security in mind. Even though we encrypt data back and forth to the payment gateway, we also use the gateway to handle the cardholder’s input. NTC’s cutting-edge technology doesn’t store credit card data, nor does it transmit that data. What that means to you is that the liability is 100% on the bank and not you – the merchant – as is typically the case. The application is written and hosted on our own servers, so you can set up and be in the ecommerce business within minutes.

By the way, there are also many customizations available to you with NTC ePay which can be set up very easily by your users. Inquire with your specific process and we will meet your specific needs in the travel payment scope.

Now when you run a social media campaign you can leverage our NTC ePay technology to help you increase sales. Use our ePay links to post vacation packages or special sales and have customers pay by two clicks.

Next week we will share the third reason in this series why National Transaction Corporation is the preferred choice for travel agents like you.

Remember, when you need a safe and technologically advanced gateway to manage all your travel agency payments, look no further than NTC.

Feel free to call us now at 888-996-2273, if you are ready to start using NTC ePay today.

Posted in Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, nationaltransaction.com, Travel Agency Agents Tagged with: card-not-present, credit card, customers, e-commerce, electronic payment, merchant account, Mobile Payments, payments, Security, transactions, travel

Over the next three weeks we will explore on this blog some of the reasons why National Transaction Corporation is the preferred choice for travel agents.

The Travel industry is one of the world’s largest industries with a global economic contribution of over 7.6 trillion U.S. dollars in 2016. (Statista)

At NTC we recognize that travel agency payment processing has some unique hurdles to overcome, but we are leveraging our innovation because we want our travel agency partners to explore how our solutions transcend the challenges that travel agents face.

Secure processing is one of the reasons why National Transaction is the preferred choice for travel agents

National Transaction Corporation has Secure Merchant Payment Processing – Because when your customers know their data is safe, they keep coming back!

You’ve heard of the many data breaches within major corporations that have occurred in just the last few years, when customers’ confidential credit card information is stolen and businesses lose a small fortune in repairing the problem. The cost of such a security breach goes far beyond that, however; once a business has lost the trust of its customers, 60% of those cardholders will go elsewhere for their purchases and services, according to studies on the problem.

Imagine if this happened to your travel agency merchant account? It could be disastrous, especially because agencies tend to deal with high-dollar sales from a moderately-sized pool of customers – so every client counts.

NTC knows that you, like us, care about your customers, and we want your travel agency to be seen as a trustworthy place to book a dream vacation. The first step is for your business to be PCI-DSS compliant.

PCI-DSS (Payment Card Industry-Digital Security Standards) requirements were put in place by the credit card associations to deal with the increasing problem of identity theft and data loss. The requirements vary according to the types and the number of payment transactions your agency goes through, but you can be sure that NTC will help you stay compliant with the latest security standards.

In the event of a data breach, we are here to eliminate the negative impact it can have on your company. NTC may be able to help you with the fines, assessments, and other costs from the networks, and we will consult with you on how to proceed to protect your agency and your reputation.

As you know, data security is as much a concern for the business owner as it is for the cardholder – your customer. When your clients know that their data is safe with you, they will keep coming back to your agency to book their next great trip!

If you cannot wait to read blog number two out of this three part series, feel free to call NTC now at 888-996-2273 to find out the best options for your travel agency!

Posted in Credit card Processing, Credit Card Security, Travel Agency Agents Tagged with: cardholder, data, fraud, merchant account, payments, Security, transaction, travel, visa

April 23rd, 2018 by Admin

Have you ever had issues with your credit card processing service only to get turned around and around by the rep on the phone? You hang up feeling frustrated, angry, and without any answers.

Have you ever had issues with your credit card processing service only to get turned around and around by the rep on the phone? You hang up feeling frustrated, angry, and without any answers.

Sometimes it’s a small problem, but what happens when they “misplace” your money, or there’s a problem with your account and you can’t receive any payments – and no amount of calling, emailing, or “chatting” seems to help you resolve anything?

There’s a better alternative to credit card payment processing, a company that’s been around for a long time, and is backed by one of the biggest banks in the country: National Transaction Corporation. And we have live, knowledgeable, friendly people waiting to pick up your calls and help you with your questions – no runaround, no excuses, no delays.

That’s the NTC way: Help when you need it, on a human level.

You may have had to make a lot of phone calls about chargebacks if you are using one of the more familiar service providers like PayPal and Square. Chargebacks are a primary cause of business owners’ complaints with these companies, because these services will usually side with the cardholder in the event of a dispute as they arbitrate the chargeback themselves.

NTC does business fairly and sensibly. When you process your credit card sales through NTC, you will be dealing with Visa or other credit card companies directly.

When you work with those other service providers, you may be worried about where your money might end up – especially if you’ve read all the nightmarish complaints that business owners like you have posted on trusted sites like the Better Business Bureau and Consumer Affairs.

Imagine you’re making a money transfer, and the cash seems to disappear? You call and you write and you chat, but no one has anything helpful to offer you and you wonder just where your money went, and what will happen to it now.

NTC knows that’s not how you build trust with your customers. We pride ourselves on our outstanding customer support, ease of use of our services, and the confidence and integrity that comes from being backed by one of the biggest banks in the country, US Bank.

National Transaction Corporation aims to make growing your business easier and more profitable by tailoring our services to your specific needs. We do this because we like you to establish a long-term partnership with us.

Now whether you are a florist, a restaurant, or any other kind of merchant, remember to look beyond just the advertised rate when looking for the best credit card payment processing service provider.

If after reading this article and you would like to speak to one of our live customer service representatives, simply call NTC today at 888-996-2273.

Posted in Credit card Processing Tagged with: consumers, credit card, customer, customers, electronic payment, merchant account, Security

March 15th, 2017 by Elma Jane

Payment Options

Technology continues to evolve, offering multiple billing and payment methods increases satisfaction by improving customer experience.

Customers will continue to move toward digital life, like embracing different forms of online billing and ways to accept payments.

Creating convenient ways to accept payments and having more options can reduce the time it takes your business to get paid.

Accept debit and credit card payments online; to offer this feature you need to get a merchant account.

Options for accepting payments:

Electronic Check Service (ECS) – convert paper checks to electronic transactions, with NTC’s ECS. Converting paper checks to electronic transactions eliminates many of the risks and costs, adding money to your bottom line.

Mobile Payments – the opportunity to increase revenue through mobile payments is huge. Many consumers find that mobile bill pay makes shopping easier, more convenient and saves time. Converge Mobile Solution lets you accept card payments using smartphone or tablet. The app works with most Apple and Android mobile devices.

Online Payment Gateway – offering customers an online payment form enables them to pay you easily and allows you to accept payments by credit card, debit card or echeck.

Electronic Invoicing (NTC ePay) – send your customers an invoice by email and get paid in minutes. Electronic Invoicing gives your customer the ability to pay their bills and receive a receipt in seconds by email.

Learn more about accepting electronic payments with NTC or sign up with us.

No setup or cancellation fees, there’s no risk! call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, echeck, ECS, Electronic invoicing, electronic transactions, merchant account, mobile, online, payment, payment gateway

February 16th, 2017 by Elma Jane

Chargeback Cycle

A chargeback is also known as a reversal; a credit card transaction that is reversed to a merchant because of the customer or customer’s bank disputes charges. Other reasons include fraud, credit card processing errors, authorization issues and non-fulfillment of copy requests. There’s an assigned reason code for every chargeback. Reason codes may vary by VISA and MasterCard.

How does the chargeback cycle work?

1. A customer files a complaint to card-issuing bank.

2. The bank sends disputed transaction (chargeback) to acquirer.

3. Acquirer receives chargeback and resolves it or forwards to the merchant for documentation.

4. Merchant accepts chargeback or addresses issues and resubmits to Acquirer.

5. Acquirer represents the chargeback to the issues once acquirer agrees the merchant has properly addressed it.

6. The issuer resolves the dispute by reposting to the cardholder’s account.

7. The cardholder receives dispute information and may be rebilled or credited.

Every merchant that offers credit card processing to its customers should be concerned about chargebacks to their merchant account.

Lower your risk of chargebacks by following the tips below:

Verify card logos, credit card numbers, identification, customer signature and check the expiration date.

Call for voice authorization if the card stripe doesn’t work or if the terminal is down or cannot authorize.

Authorize every transaction.

Be sure your customers are familiar with your return or exchange policy.

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, merchant, merchant account, transaction

January 31st, 2017 by Elma Jane

Selecting a Payment Provider

Selecting electronic payments provider for your business is critical. NTC believes that the process starts with an honest assessment of your business and the types of credit card processing options it requires. (Retail or e-commerce, Card Present or Card-Not-Present)

Card present transaction is the most common type of account. Card-Not-Present (CNP) is a different type of account if you run a MOTO (mail order telephone order) or Internet operation.

Here are some points to keep in mind in selecting your electronic payments provider:

Referrals from fellow business owners and checking out payment providers online.

Evaluate products and services as well as cost to determine which electronic payments provider offers the biggest savings for your business.

Make sure the deals you’re considering include all the features and services you need and none that you won’t use.

Keep upgrade options in mind.

Look for 24/365 support and discuss customer service support.

Read the fine print in your contract.

The merchant account provider’s reputation is important, so find out how long they’ve been in business and their reputation in the industry.

NTC has over 20 years’ of Bankcard History. Helping businesses of all sizes for over 25 years in the industry. Call us now 888-996-2273 and tell us all about your business needs and requirements and we’ll put together a package of products and services that will best serve your credit card processing needs. There are a variety of solutions, so it’s important to focus in on those that directly address your needs.

Posted in Best Practices for Merchants Tagged with: cnp, credit card, customer, e-commerce, electronic payments, internet, merchant account, online, payment provider, payments, retail, transaction

January 30th, 2017 by Elma Jane

U.S. Based Payment Processing Account?

How do you get a U.S.-based payment processing account when you are based outside of the country?

Here are several steps you need to take before applying a U.S. payment processing account:

The first thing you need to do is get incorporated.

Get an office – typically comes as a part of the package offered by the company that is doing your incorporation. Opt for real physical presence, rather than just a mailing address.

Get a U.S. representative – that representative is not only a name to use in the incorporation paperwork and in your office rental agreement. The U.S. representative person will be acting on behalf of your company in the U.S. This person will need to have a U.S. social security number (SSN) and will be the one who signs your credit card processing agreement.

If you are unable or unwilling to find one, you will not be able to get approved for a domestic payment processing account and will have to settle for an offshore one.

Lastly get a business checking account.

Only U.S.- based businesses are eligible for U.S. payment processing accounts, talk to a Payment Specialist 888-996-2273.

Posted in Best Practices for Merchants Tagged with: credit card, merchant account, payment, Security

January 24th, 2017 by Elma Jane

How to set up a travel merchant account?

First, you need to find a Merchant Service Provider.

Put together your business profile so you can start applying for a merchant account.

There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should set up your account.

Some of the questions are:

Is your business seasonal?

For Travel Agencies or Tour Operators, it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

How do you intend to accept payments?

Different business models require different methods of accepting payments.

If you’re doing face to face transaction and have a physical location then you need a credit card terminal.

If you process checks, then you need Electronic Check and ACH Transfers.

For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

How much volume do you plan on processing?

Merchant account providers are going to want to know how much sales volume you plan on processing per month.

If you’re new in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation.

if you’ve been in the business – you’ll already have this number ready.

What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call at 888-996-2273 or use our contact form.

Posted in Best Practices for Merchants Tagged with: ach, credit card, e-commerce, E-Pay, Electronic Check, merchant account, merchant service provider, mobile, payments, shopping carts, terminal, transaction, travel, virtual merchant