October 18th, 2018 by Admin

As your business grows, your time seems to shrink. Here are some tips that can help you manage your time better.

Create a Plan

Creating a plan will always lead to a successful day. Organization will allow you to have a much more balanced day and better quality of life while running your business. Be sure to write down all the tasks you need to get done. Having them written down will give you a better idea of how much you have to do and what needs to get done.

Have a Calendar

Along with a list of all of your tasks, a calendar will help you figure out what else is happening throughout the day. Do you have meetings to go to, people to talk? A calendar will be your best friend for better time management. It will also help you block out time to get your to-do list done.

Prioritize

Now that you have your list and your list, it is time you prioritize and figure out what needs to get done first. A common mistake is to go down your to-do list as you wrote it and that is not efficient. Figure out your “Must’s”; “Should’s” and “can wait’s” so you can get the best out of your day. You will realize that many tasks are not as important for your productivity as you might think.

Delegate

Now that you see what you must do first, do you need to do it yourself? Perhaps some tasks do not require all of your attention. That is when delegating will be your greatest ally for time management. That run to the store for supplies can be done by your employee or family (if you run your business from home).

Learn to say no

Along with running and managing a business, there will be things that, while you would love to do, are not necessary for you to do. Learn to say no in a polite way and you will find yourself more organized and meeting deadlines faster. Sure, you might have a few disappointed people at first, but they will realize that you are working on being efficient for them and you and it will add value to your service.

Track your time spent

Do you feel you are spending way too much time on a task or job? Perhaps it is time you start tracking your time. This is an excellent tool for freelancers who find themselves working day and night. Tools like TopTracker can keep you accountable and give you perspective on how much time you are truly working. It will help you learn and adjust if necessary.

Eliminate Time Wasters

There are plenty of time wasters at the office! That e-mail didn’t need to be checked so many times, and that note could have waited for later. No, you do not need to check Facebook before work. Setting boundaries will allow you to become much more productive and have more time to do tasks like this after you have completed your list.

Always plan to be early

When it comes to meetings, calls or events, always plan to arrive early, this will help you prepare for unseen events like traffic jams or car problems. Practicing this habit will help you be on time and have less stress.

Take Small Breaks

To get all of your tasks done, you must take breaks. Taking breaks will allow your mind to rest for a few minutes and can help you become a lot more productive. Be sure to use your calendar so you can schedule some break time every day.

Focus

Lastly, focus. Know that the tasks needed need to get done in a timely matter. Be sure you focus and avoid any distractions while getting it all done. Focusing will help you be done with all tasks sooner than you think.

We hope these steps can help you get more out of your day and you can be in control of your time better.

Posted in Small Business Improvement Tagged with: business, business goals, calendar, data, delegate, efficiency, entrepreneur, entrepreneurship, freelancer, leaderhip, manage, plan, planner, planning, professionalism, smartphone, technique, time management, tools, track time

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

June 27th, 2017 by Elma Jane

E-commerce has been growing, and now the overall market is starting to take notice; thanks to advances in online payment processing and electronic payment technology, as well as the willingness of almost all merchants to accept credit cards online.

E-commerce ecosystem are set to double and will account for a rising share of overall card payments. In addition to increased internet and smartphone penetration; more e-commerce merchants and an increase in the use of digital wallets.

Cardholders globally are becoming more confident in the security of the e-commerce channel, with the expected implementation of 3D-Secure 2.0 and increased use of sophisticated anti-fraud systems in many markets it gives consumer assurance that payment cards are safe to use for e-commerce purchases.

Trends indicate that e-commerce is the wave of the future for shoppers. But digital shopping is just one piece of the broader payments ecosystem.

For Electronic Payment Set Up Call Now! 888-996-2273

Let’s Get Started National Transaction.Com

Posted in Best Practices for Merchants Tagged with: card payments, credit cards, Digital wallets, e-commerce, electronic payment, merchants, online, payment, Security, smartphone

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

November 28th, 2016 by Elma Jane

Payment acceptance is key to making more money.

Let’s talk about your money, and how to make more of it. Today money is taking on a new form. It’s digital, it’s electronic and it’s everywhere and anywhere 24/7/365.

Payment acceptance is key to making more money. You don’t make more money by not accepting a transaction, and making the experience convenient and safe to your customer can bring loyalty.

Let’s break down a transaction.

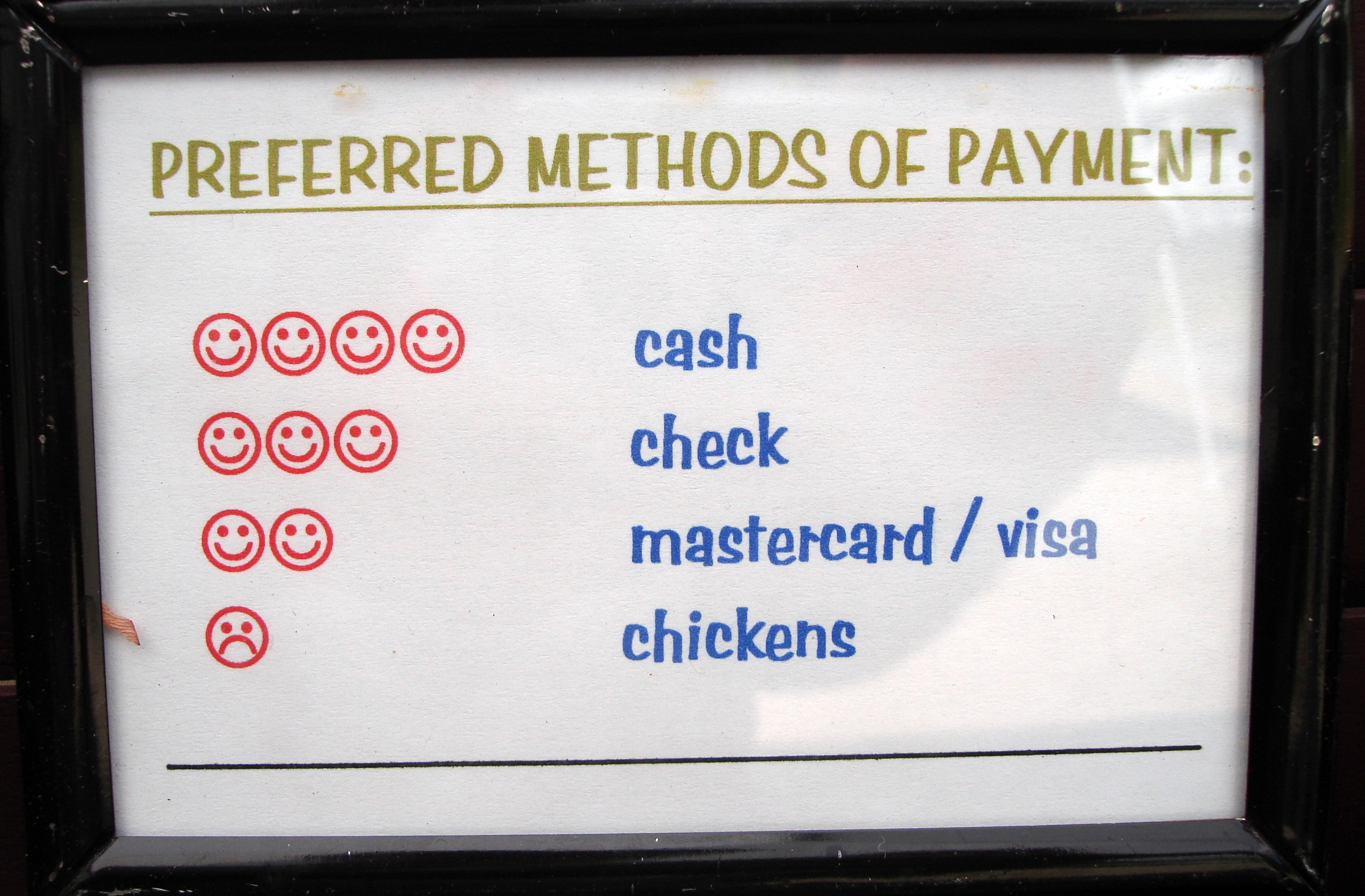

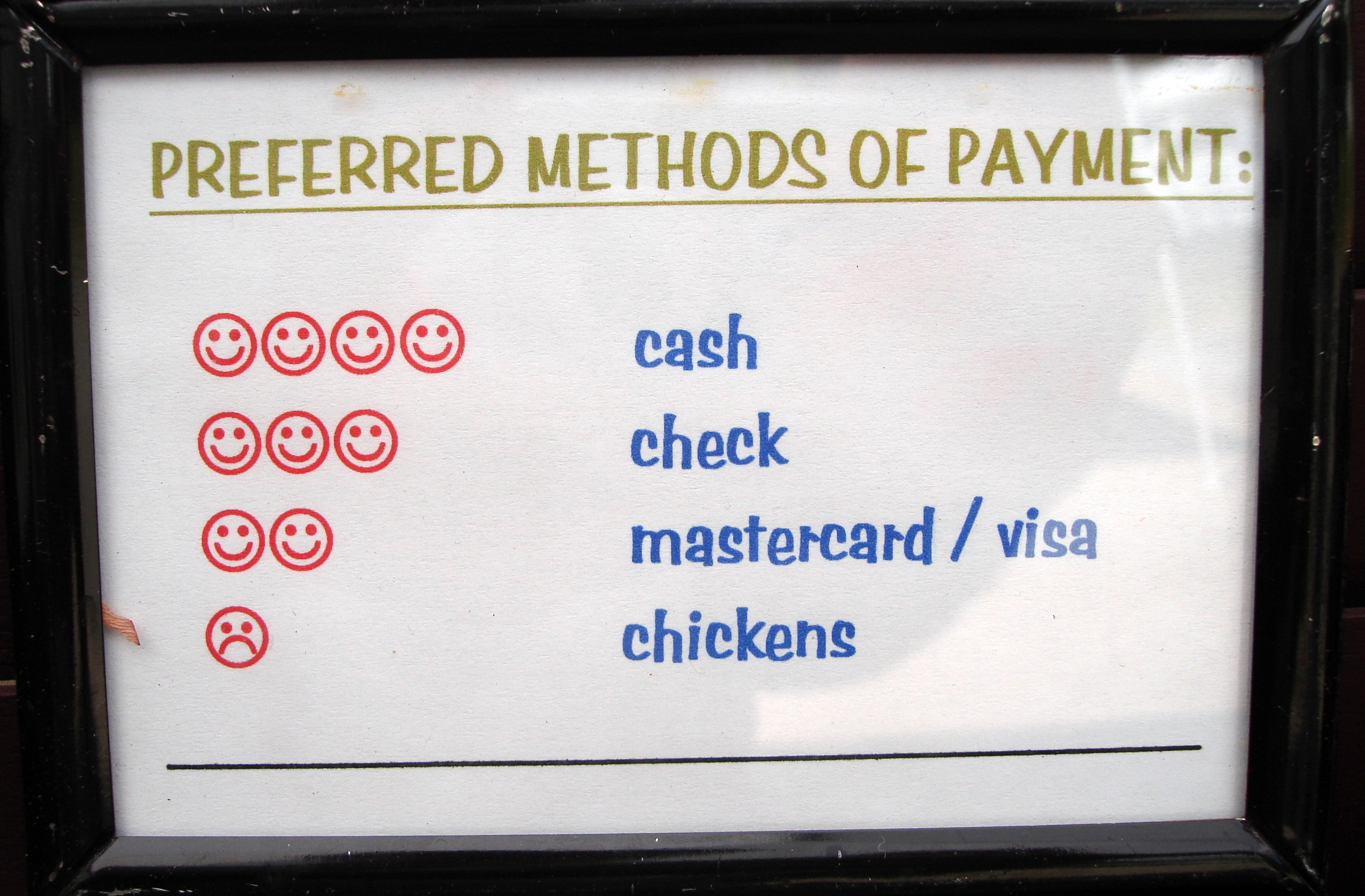

Cash, but that would mean that the customer has to be in front of you. You could take checks, those are safe to mail, but then you don’t have your money until you drive to the bank and cash or deposit the check.

So how do we easily and securely transfer funds for a transaction? The answer lies in digital or electronic payments. Accepting credit cards, debit cards, ebt cards or even gift & loyalty cards and electronic checks. These provide secure and convenient ways to complete transactions for your customers. If you want to make more money, make it easy for customers to spend it while making it faster for you to receive it. That’s where a merchant account comes in.

A merchant account allows you to deposit funds directly into your bank account in as little as a few hours. Whether the customer swipes their card into your smartphone, calls it in over the phone or keys it into your web site, just having a merchant account can be a huge advantage over competitors.

It allows you to conduct transactions in more ways than cash or checks alone. Transactions are recorded automatically and can easily be reconciled for both customer and merchant. Most importantly it widens the opportunities to conduct sales to the widest customer audience possible.

No matter what you sell or how you sell it, the sale is only complete once the funds are transferred from one party to the other.

It’s important to recognize your missed opportunities. Could accepting electronic payments help increase your revenue stream? We’re here to help you make more money, let us show you the many ways we can do just that. Let’s talk, 888-996-CARD (2273)

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Mail Order Telephone Order, Mobile Payments, Travel Agency Agents Tagged with: credit cards, customer, debit cards, ebt cards, electronic checks, electronic payments, gift & loyalty cards, merchant account, payment, smartphone, transaction

November 22nd, 2016 by Elma Jane

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

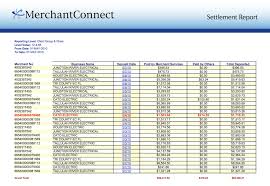

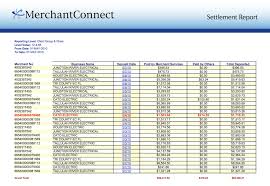

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

September 12th, 2016 by Elma Jane

Ingenico RP457c card reader is now available at NTC for $75.00 plus encryption and shipping!

NTC are pleased to announced the launch of Converge Mobile 1.3, which includes support for the new Ingenico RP457c.

An all-in-one card reader that accepts:

- Mag stripe

- chip card

- contactless payments including mobile wallets

Customers can utilize audio jack to connect the device to their either smartphone, tablet or connect via Bluetooth.

In addition to the converge Mobile portfolio, Ingenico RP457c is a lower price point for customers who are cost sensitive. It offers the same payment flexibility as the iCMP.

Both RP457c’s and iCMP devices also offer encryption technology, adding another layer of security to help protect card data at the point of entry and throughout the payment lifecycle.

One key difference is that iCMP is a PIN pad that supports chip & PIN as well as debit PIN transactions, while the PR457c is a card reader only; therefore chip and signature and signature debit are supported on this device.

For your electronic payment needs or to purchase the device give us a call now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card data, card reader, Chip & PIN, chip and signature, contactless payments, customers, mobile wallets, payment, PIN pad, Security, signature debit, smartphone, transactions

February 25th, 2016 by Elma Jane

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

December 7th, 2015 by Elma Jane

Most payments will probably be made with apps in phones or smartwatches in less than a decade from now, using NFC, biometrics or other mechanisms that don’t involve swiping or using plastic cards.

If your mobile device has an integrated NFC chip, you can use a mobile wallet app like Apple Pay and Android Pay to pay for items that support NFC transactions at a retail store. Simply wave your device near an NFC compatible terminal to pay, no card swiping required.

Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

In some countries, it’s easy for consumers to get credit cards with imbedded NFC chips. This means that you may be able to wave your card at the terminal instead of swiping, no phone required. In America, though, because NFC hasn’t caught on until recently, analysts expect that NFC via smartphone and smartwatch services such as Apple Pay and Android Pay will dominate contactless transactions in the next few years.

Just as credit cards replaced cash, credit cards will be replaced by digital payments which will continue to rely on the credit infrastructure but will obscure the plastic card itself.

As consumers, we love to see better products. When it comes to payments, we need Standards and Reliability.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: biometrics, cards, contactless transactions, credit cards, digital payments, mobile wallet, nfc, NFC chip, payments, smartphone, terminal