If there’s an unauthorized charge made on your credit card account, no money is taken from you. There’s no immediate

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, credit card company, debit card, Electronic Fund Transfer, transaction

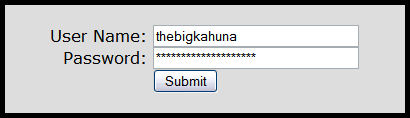

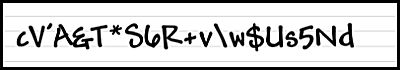

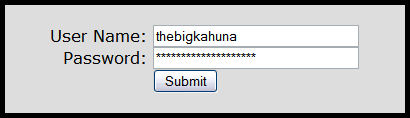

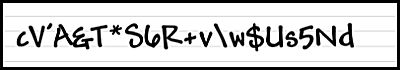

Users need to take personal responsibility for their passwords, people tend to stick with simple, easy to remember passwords, but

Posted in Best Practices for Merchants Tagged with: bank, Security

End Of Life (EOL) terminals are terminals that are no longer produced by the manufacturer, but are still commonly in

Posted in Best Practices for Merchants Tagged with: Android Pay, Apple Pay, contactless readers, EMV, Equinox, hypercom, merchant, nfc, point of sale, terminal

Loyalty programs continue to change and evolve, with the new and more powerful technology available today, rewarding customers is becoming

Posted in Best Practices for Merchants, Gift & Loyalty Card Processing Tagged with: Apple Pay, data, Google Pay, Loyalty Rewards Programs, mobile payment, mobile wallet

Every merchants, small, medium or large, should put in some effort to protect their sensitive data. Many breaches of data could

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: data, data breaches, merchants

Adoption of EMV technology in the U.S is important, because it provides protection against losses from counterfeit cards. EMV, or

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: card issuer, chip cards, debit cards, EMV, magnetic stripe, merchants, microchip, Mobile Payments, nfc, payment networks, point of sale, POS, terminal slot

We’ve covered a lot about EMV, but what about improving security for online and Card-Not-Present transactions? That’s where 3-D Secure

Posted in Best Practices for Merchants, e-commerce & m-commerce, Internet Payment Gateway Tagged with: 3-D Secure, amex, card holder, card present, card-not-present, chargebacks, Chip and PIN, credit card, ecommerce, EMV, fraud, jcb, magnetic strip, MasterCard, merchant, online payment, payment gateway, pin code, visa

If you’re a merchant accepting credit cards, you’re probably aware that things are changing. As of October 1st, 2015, merchants

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: bank cards, chip cards, credit cards, data, EMV, financial institutions, magnetic stripes, merchant, mobile payment, PIN, POS terminal, processor, retail business, terminal slot

Small merchants don’t consider themselves at risk for a cyberattack. But Cybercriminals thrive on data about employees, customers, bank accounts

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: bank accounts, banks, chip card, credit card, data, EMV, magnetic strip, merchants, payment cards, payment systems, processors

With the EMV liability shift that takes effect in October 2015, how much you’ll be affected depends on how you

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Point of Sale Tagged with: banks, Card Not Present Transaction, card-present transactions, chip cards, cnp, credit card, debit cards, EMV, merchant, payment gateway, payments, POS, terminal